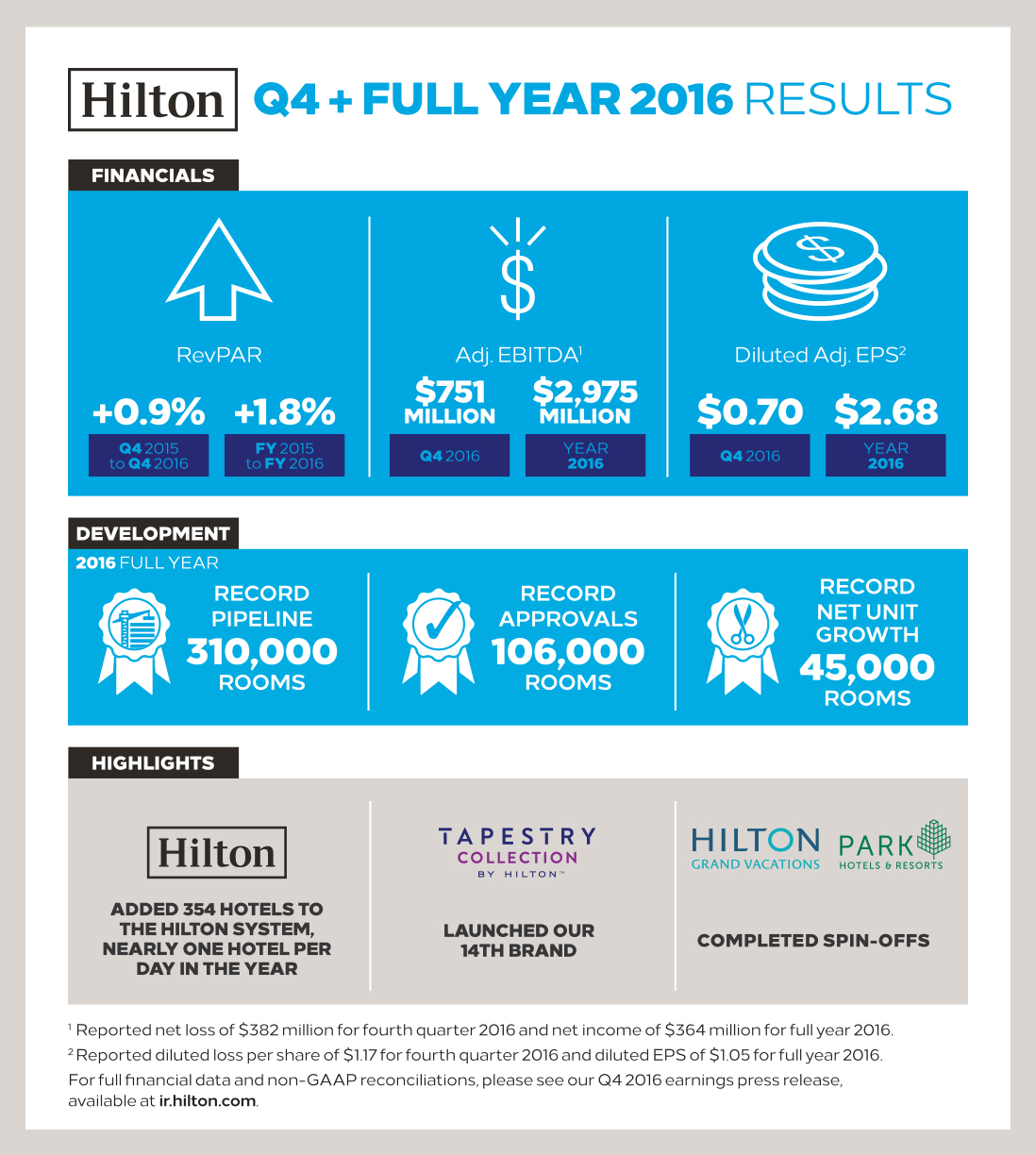

In spite of a frenetic 2016 that included the spin-off of Park Hotels & Resorts and Hilton Grand Vacations, an historic election and shifting global politics, Hilton managed to achieve some significant growth across several metrics.

"For the quarter and full year, performance met our expectations,” Hilton President & CEO Christopher Nassetta said in a statement. “We also continued to increase our development activity this quarter and surpassed development records this year, approving 106,000 new rooms and opening nearly one hotel per day, contributing to net unit growth of over 45,000 rooms. With completion of the spin-offs, Hilton is a fee-based, capital-efficient and resilient business, with meaningful cash flow that we intend to be very disciplined in returning to stockholders."

Among the company’s milestones for the year, Hilton:

- Approved 29,000 new rooms for development during the fourth quarter, bringing total approvals to a record 106,000 rooms for the full year;

- Grew its development pipeline by 16 percent from 2015 to 1,968 hotels, consisting of 310,000 rooms, 50 percent of which are under construction;

- Grew its room count by 45,000 rooms, representing a 6.6-percent growth in managed and franchised rooms;

- and added 354 hotels to its system in 2016, opening nearly one hotel per day over the course of the year.

#Hilton CEO Chris Nassetta: New brands need to appeal to millennials, who will make up 1/2 of travel population in 10 years.

— HOTEL MANAGEMENT (@HotelMgmtMag) February 15, 2017

Hilton opened 105 hotels with 15,700 rooms, of which more than 22 percent were conversions from non-Hilton brands, and achieved net unit growth of 15,100 rooms during the fourth quarter of 2016. During the full year, Hilton opened 354 hotels with 51,500 rooms, and achieved net unit growth of more than 45,000 rooms.

As of the end of the year, Hilton's rooms pipeline totaled approximately 310,000 rooms at 1,968 hotels throughout 96 countries and territories, including 32 countries and territories where Hilton does not currently have any open hotels. More than 159,000 rooms, or more than half of the pipeline, were located outside of the U.S., and more than 157,000 of the rooms in Hilton's pipeline were under construction.

Be sure to check out Hotel ROI, a series of one-day conferences focused on how to leverage a hotel asset for maximum returns.

Region by Region

In the Americas, outside the U.S., Hilton's fourth quarter RevPAR grew 2.5 percent versus the prior year due to strength in Canada, where RevPAR increased more than 5 percent driven by solid group performance.

Zika concerns continued to hinder growth in the Caribbean, while economic contraction continued to drive declines in Brazil. For the full-year, RevPAR increased 4.2 percent. "For full-year 2017, we expect RevPAR growth in the region to be at the higher end of our guidance range," Hilton’s EVP and CFO Kevin Jacobs said.

RevPAR in Europe grew 2.2 percent in the quarter, surpassing expectations due to solid leisure transient performance across the UK and Ireland during the holiday period. Additionally, results in Continental Europe were aided by increased demand from the Middle East and easier year-over-year comps, following terror attacks in Israel. "Unfortunately, terror attacks and geopolitical instability continued to plague Turkey, where performance declined 16 percent versus the prior year," Jacobs said. For full-year 2016, RevPAR for the European region increased 1.1 percent. For full-year 2017, we expect RevPAR growth to be at the mid to high-end of our range.

RevPAR in the Middle East and Africa declined 5.7 percent in the quarter, driven by new supply in the UAE, coupled with lower demand levels. Continued political unrest in certain African markets further weighed on results. In 2016, RevPAR in the region decreased 1.5 percent. For full-year 2017, our RevPAR growth forecast is flat to slightly positive. In the Asia Pacific region, RevPAR increased 1.5 percent in the quarter, largely due to strength in China, mitigating softer group performance in Japan and demand declines in Thailand following the death of the King.

RevPAR growth in China increased approximately 5 percent during the quarter, driven by the China national holiday campaign and the China winter campaign, which helps compensate for shortfalls from the recent implementation of nationwide service charges. "For the full-year, RevPAR growth in the Asia Pacific region increased 3.5 percent," Jacobs said. "For full-year 2017, we expect RevPAR growth in the mid single-digits, with RevPAR in China up in the 3 percent to 4 percent range."

Brand Strength

The year-old Tru by Hilton brand got approvals for 35 more hotels in the fourth quarter for a total of 179 hotels in the pipeline as of Dec. 31, 2016. As of Jan. 31, 2017, Tru had nearly 400 hotels in the pipeline or in various stages of approval.

In January 2017, Hilton launched its 14th brand, Tapestry Collection by Hilton, which is meant for independent hotels in the growing upscale segment. As of Jan. 31, 2017, Tapestry Collection by Hilton had more than 40 deals in process. The first Tapestry is expected to open by the third quarter of 2017.

Hilton's new brands include 800 hotels with 90,000 rooms open or in the pipeline, Nassetta said. The company's Home2 Suites extended-stay brand has a full 350 properties in the pipeline, making in the second-largest brand in development across the country.

Millennials, more than most generations, value experiences. "Thankfully, travel is one of those experiences." - #Hilton CEO Chris Nassetta

— HOTEL MANAGEMENT (@HotelMgmtMag) February 15, 2017

"These brands are all meant to target the growing millennial demographic, which could make up as much as half of the travel population within a decade," Nassetta said. "That’s why, in terms of brand launches, we're doing what we do. The Home2, Tru and Tapestry brands will appeal to a broad range, but the lower price points will get younger travelers into the system and build loyalty. Some of our products, even at the lower end of the price scale, were too expensive for millennials." This generation, he added, prefers to spend money on experiences rather than tangible things. "Thankfully, travel is one of those experiences."

Looking Ahead

For 2017, Hilton expects its systemwide revenue per available room to increase between 1 percent and 3 percent on a comparable and currency-neutral basis compared to 2016. Net income from continuing operations is projected to be between $555 million and $592 million, and net unit growth is expected to be approximately 50,000 rooms to 55,000 rooms. This growth, Nassetta said, will likely be supported "almost entirely" by a third-party capital. "We also forecast another year of robust signings, totaling over 100,000 rooms."

$HLT FY 16: Net unit growth was 45K rooms, representing a 7% growth in managed and franchised rooms https://t.co/ytmJvIhMox pic.twitter.com/nMI6PbfbsT

— Hilton (@HiltonNewsroom) February 15, 2017

Nassetta does not expect President Trump’s suggested travel ban to have a severe impact on the company’s profits, if the ban is successfully implemented. “International business, system-wide, in the U.S. is a relatively modest component of our business,” he said, noting that even before the executive order was signed, international business at Hilton hotels was down between 2.5 and 3 percent. “That had a lot to do with strengthening of the dollar,” he said. “Some markets showed growth—like Asia Pacific to the U.S.—but other markets, including Canada, saw a dropoff. This year, my sense is you will see pressure on international business, but that pressure will be driven by the strengthening of the dollar.”

The U.S. dollar has grown stronger over the last 90 days, Nassetta noted, which is not good for international inbound business. In any case, he said, the company has not seen much of an impact in its business since the order was signed several weeks ago. “Nothing in any way material has come from it at this point."