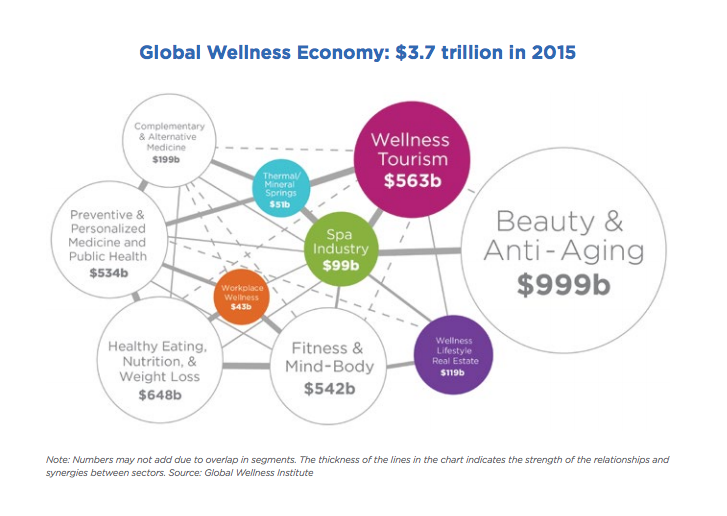

The Global Wellness Institute has released a new report on recent growth and trends in 10 global wellness areas, portrayed in the diagram below. The study not only examined the growth of wellness tourism, but included insights into what kinds of properties are attracting wellness-focused travelers—vital knowledge for hoteliers looking to cash in on this ever-growing demographic.

Here are four key takeaways from the report.

1. The Value of Wellness

The wellness economy now represents more than 5 percent of global economic output and is almost half the size of all global health expenditures, which reached $7.6 trillion in 2014.2 From 2013-2015, the wellness economy grew by 10.6 percent, while the global economy shrank by -3.6 percent in U.S. dollar terms. Globally, the wellness industry is now worth $3.72 trillion.

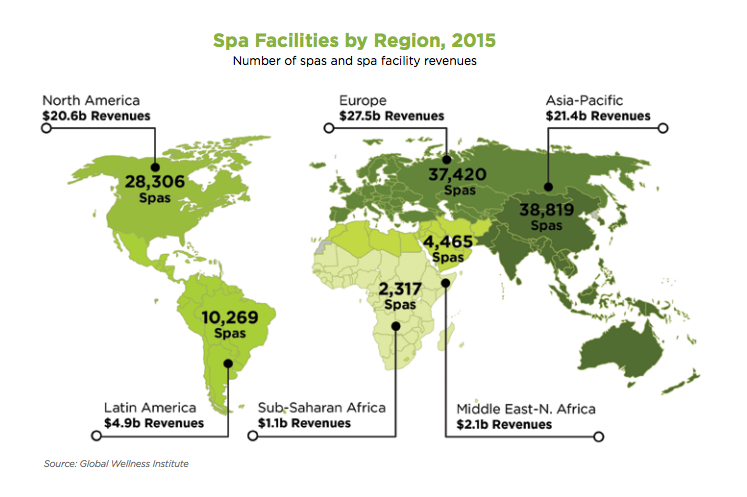

As of 2015, there are 121,595 spas worldwide—a compound annual growth rate of 7 percent from 2013 alone.

Travelers made 691 million wellness trips in 2015, 104.4 million more trips than in 2013. Wellness trips account for 6.5 percent of all tourism trips, but represent 15.6 percent of total tourism expenditures. This is because wellness travelers are high-yield tourists, spending much more per trip than non-wellness travelers.

2. Mineral Springs are Hot

Notably for hoteliers, the thermal/mineral springs industry is poised for rising investment and growth. These include businesses that focus on the therapeutic uses of waters with special properties. “We estimate that there are now 27,507 facilities built around thermal/mineral springs, located in 109 countries, and earning $51 billion in revenues in 2015 (compared to $50 billion in 2013).” The Institute said that establishments with these facilities have seen solid growth in both attendance and revenues. “The countries with the largest thermal/mineral springs industries—especially in Europe and Japan—saw major currency depreciation against the U.S. dollar from 2013-2015, and so the revenue growth rates in these countries were much higher in local currency than in U.S. dollars. For example, global industry revenues grew by 10 percent annually in euros as compared to 1 percent annually in U.S. dollars.”

Just over a quarter of all thermal/mineral springs establishments offer value-added spa services (including massage, facials, hydrotherapy, other treatments) alongside their bathing offerings. “These tend to be more developed facilities with a wider range of offerings; therefore, they earn higher revenues than those facilities with bathing only, and they account for nearly two-thirds of the industry’s revenues.”

3. Know Your Target Demographic

The bulk of wellness tourism is done by “secondary wellness” tourists (those who seek wellness experiences during their travel), which account for 89 percent of wellness tourism trips and have been growing faster than primary wellness trips since 2013. Most wellness tourism is done by domestic tourists (both primary and secondary), driven by short-haul and weekend trips, and accounting for 83 percent of all wellness trips. However, international wellness tourism growth has outpaced domestic wellness tourism growth from 2013-2015.

4. Know the Wellness "Hotspots"

Wellness tourism is heavily concentrated in the key markets of North America, Europe, and Asia Pacific. Europe is the destination of the largest number of wellness trips, while North America leads in wellness tourism expenditures. Since 2013, Asia made the most gains in both the number of wellness trips and wellness tourism expenditures, continuing a trend that is propelled by a rising middle class, increasing intra-Asia tourism, and a growing consumer interest in wellness. While most of the top markets have continued to grow, many emerging markets have climbed steadily in the rankings since 2013, including China, Brazil, Mexico, Vietnam, Indonesia, Malaysia, Chile, Argentina, and South Africa.

Info courtesy of the “Global Wellness Institute, Global Wellness Economy Monitor, January 2017.”