NEW YORK — Marriott International is officially the largest hotel company in the world, and it's in a position to get even bigger.

Last year, the company experienced the strongest period of room singings and openings growth in its history, with over 880 hotel deals under its belt and more than 136,000 additional guestrooms now under long term management and franchise agreements.

This fact was at the forefront of a presentation hosted by Tony Capuano, Marriott’s EVP and global chief development officer, who made the case that the company’s ability to scale hotel growth for its brands is one of its greatest assets on offer to the newly acquired Starwood Hotels & Resorts. Simply by combining the two companies, reaching almost 1.2-million rooms in its system, Marriott now is nearly 45 percent larger than its nearest competitor (Hilton, for those wondering, at 792,000 rooms).

As if that wasn’t enough, the growth is accelerating. Marriott has a pipeline 27 percent larger than the next closest company, and it went from being present in 87 countries and territories during 2015 to 122 by the end of 2016, more than doubling its rooms in the Asia Pacific region and the Middle East.

“New rooms are one of the most important drivers of Marriott’s shareholder value,” Capuano said. “More importantly, not all rooms are created equal.”

What Capuano means to say is that a guestroom located in Midtown Manhattan is not of the same value as one in Boise, Idaho. Expanding on this strategy, Capuano said for Marriott to hit its development goals for the future the company needs to build on the moment it has experienced over the past three years, while simultaneously focusing on properties and tiers that have a higher overall quality. In order to fully blast off in 2017 Marriott is looking to five different sources for growth:

1. Accelerating Starwood

According to Capuano, Marriott sees major growth opportunities in Starwood’s three-tiered collection of brands: The Luxury Collection, Autograph Collection Hotels and the Tribute Portfolio. Specifically, he said the Autograph Collection and Tribute Portfolio have the opportunity to open 50 hotels over the next two years.

“With Marriott’s distribution and marketing program, as well as fewer and more flexible brand standards, we believe we will accelerate growth for these brands,” Capuano said.

He also highlighted St. Regis as an underrepresented brand in many top global markets, particularly when compared to its biggest competitor, The Ritz-Carlton. For example, while Ritz-Carlton is a leader in luxury hotel development with 93 hotels open worldwide and 41 in its signed pipeline, St. Regis currently operates only 38 hotels and has 22 in its pipeline worldwide. Marriott currently has plans to grow St. Regis by roughly 10 new deals per year.

Marriott also wants to play off of the continued success of Starwood’s Aloft brand by making it more scaleable. Capuano said that while Aloft’s current makeup of 116 open hotels and 150 in the pipeline is admirable, Marriott wants to push the brand to be more in line with the growth enjoyed by its Courtyard brand, which is currently at 1,100 hotels worldwide.

“We aren’t trying to grow Aloft from a dead stop,” he said. “Aloft is a great brand with strong growth momentum. Starwood’s development team signed 120 Aloft deals over the past two years, an acceleration over the 108 deals signed during the past four years.”

Similarly, Marriott has plans to build Starwood’s budding Element brand alongside its own Residence Inn model. Element has 23 hotels open and 73 in its pipeline, and Capuano said future goals include a greater emphasis on room product and food & beverage enhancements, as well as better use of public spaces and a reduced cost to build in order to attract investors.

2. Established Brand Growth

In an earlier presentation, Marriott International’s chief commercial officer, Stephanie Linnartz, discussed the company’s future growth strategy for its Sheraton brand. Capuano built off of this to discuss the growth of Marriott’s eight other established brands that represent more than 70 percent of the company’s global distribution, as well as 55 percent of its global pipeline. While growth of these brands has accelerated over the past three years, Capuano said there is more work to be done.

“These brands saw an increase of 76 percent in deal volume with over the prior three years,” he said. “These brands are growing in established markets such as Paris and Shanghai, as well as emerging markets like Poland where we signed four new deals last year.”

3. International Select Service Expansion

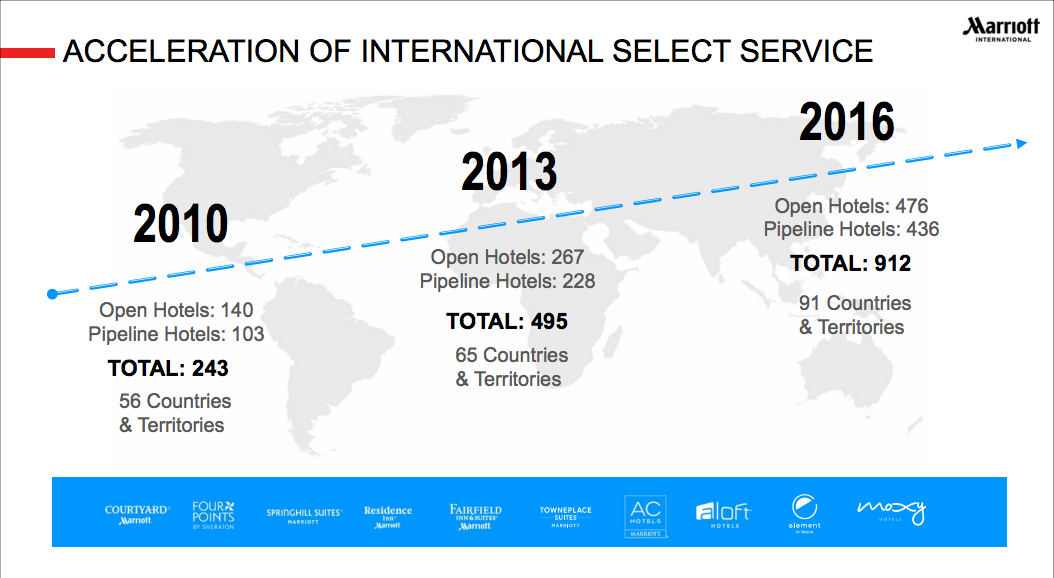

According to Capuano, the international select service segment is currently seen as Marriott’s biggest growth opportunity, and he let the numbers tell the story.

In 2010, there were 243 hotels open or under development within Marriott’s select-service brands internationally, found across 56 countries and territories. Just six years later, Marriott expanded to a total of 912 properties open or under development (a mostly even mix of 476 open and 436 in its pipeline), located across 91 countries and territories.

“From an owner and franchisee perspective, attractive operating margins are driving developer interest internationally,” Capuano said. “We are on pace to double our current pipeline.”

4. Conversions

It’s customary for construction to slow and conversions to gain momentum during the tail end of a cycle, and Capuano said the time is now to start thinking about conversions. The company’s Luxury Collection, Autograph Collection, Tribute Portfolio, Delta Hotels and Four Points brands are earmarked to make big moves during this period.

“The conversions outlook is excellent in Asia Pacific, with 25 deals signed there last year,” Capuano said. “Twelve of these hotels are already open, with the remaining 13 set to open later this year.”

5. Mergers & Acquisitions

While Capuano admitted that Marriott currently has its hands full maximizing the use of its current acquisition, Starwood, the company still has its eyes out for future opportunities.

The company’s decision to acquire companies such as AC Hotels and Protea have paid off in dividends, with the Protea buy resulting in Marriott becoming the largest hotel company in Africa and Delta settling Marriott as the largest full-service lodging company in Canada. The AC Hotels transaction improved Marriott’s standing in Europe by 24 percent, and its purchase of Gaylord Hotels are helping the company better position itself within the convention hotel segment.

After seeing the numbers it’s clear that Marriott has its tentacles spread wide across the industry, and despite the complicated nature of the Starwood acquisition Capuano has further reason to be excited for the future.

“We met our forecasts from 2010 to 2012, and we are well on our way to meeting projections from 2014 as well,” he said. “Given 2014 to 2016 was the highest period of growth in history for us, we expect to open between 285,000 and 3000,000 gross rooms from 2017 to 2019.”