Executives at commercial real estate services firm CBRE Hotels are bullish that the hospitality industry will remain on the crest of its current wave of success for some time to come. Via a webcast presentation of the company’s Hotel Sector Update and Forecast for first quarter 2016, CBRE Hotels’ senior managing directors Mark Woodworth and Kevin Mallory and EVP Mark Owens prognosticated high levels of industry growth to continue through 2017 and likely beyond.

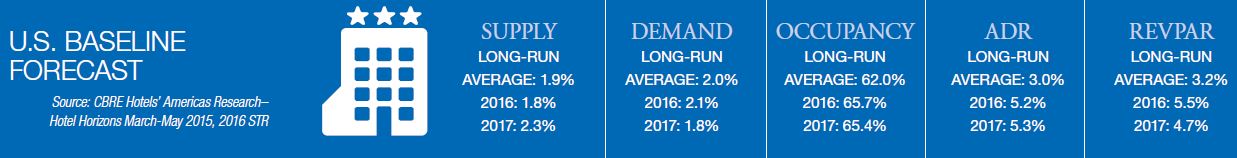

According to the forecast, average daily rate is expected to continue its upward trajectory, with a long-run average of 3 percent between 2013, when ADR grew 3.8 percent over the previous year, and 2017, when ADR is projected to rise 5.3 percent. CBRE also anticipates occupancy is just starting to peak; the forecasted year-end 2016 occupancy level is 65.7 percent, 20 basis points greater than 2015’s record occupancy level.

“We believe domestic lodging is performing at peak levels and we believe it will stay at an elevated level of performance in the near- to mid-term,” Woodworth said.

Macroeconomic picture

The report credits full employment and strong income growth as the economic engine driving occupancy and ADR. “Expect occupancy to stay positive as demand growth will continue to accelerate and outpace supply for the balance of the year, nationally,” Woodworth said. “Solid fundamentals in the form of income and employment are supporting demand growth principally in the lodging industry.” But he also pointed out that the benefits of a prosperous U.S. job market are not without hindrances for the hotel business. “More people with jobs brings greater income levels, but the lower level of unemployed workers makes work more expensive and as unemployment declines, hotel labor costs go up,” he said. “Pressure on this major expense category continues to persist.”

The forecast also reveals additional macroeconomic factors affecting the hotel industry, including the strong U.S. dollar impacting international inbound travel to major gateway cities such as New York, Miami, Los Angeles and San Francisco and the drop in oil prices. “If low oil prices stay around through the summer—on a positive note—we can expect another favorable year for leisure markets, particularly those in the South and along the West Coast,” Woodworth said.

He also noted that Airbnb’s growth is starting to have an effect on traditional hotel performance in New York, Miami and L.A., further expounding that for every five hotel rooms in New York City, there’s an Airbnb unit, and in the top 10 U.S. cities, it’s a 10-to-one ratio. On the national level, there are approximately 3.5 Airbnb units for every 100 hotel rooms. “The greater the [revenue per available room], the greater the number of Airbnb units,” Woodworth further elaborated. “When the economic incentive is present, owners will avail themselves of the Airbnb platform. The more expensive Airbnb is relative to traditional hotels, the lower the competition.” He added that it’s typically more leisure-oriented markets where Airbnb tends to be more expensive.

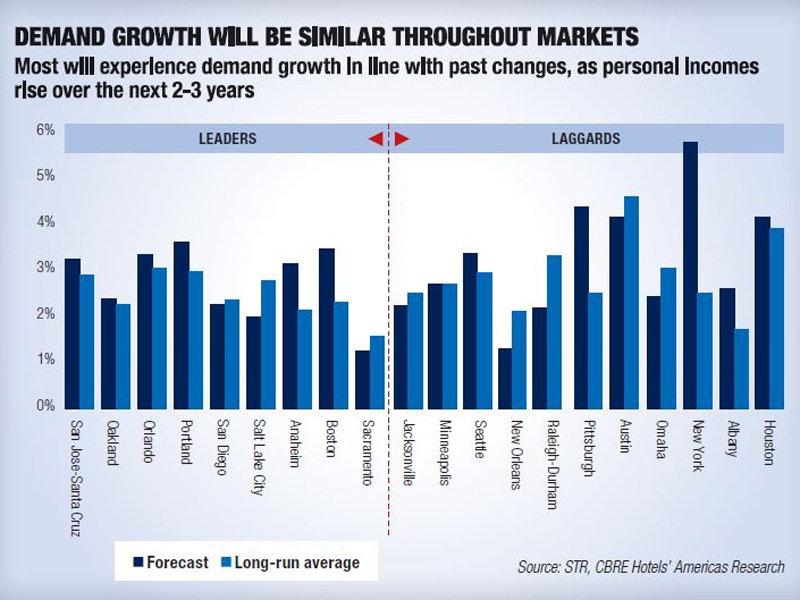

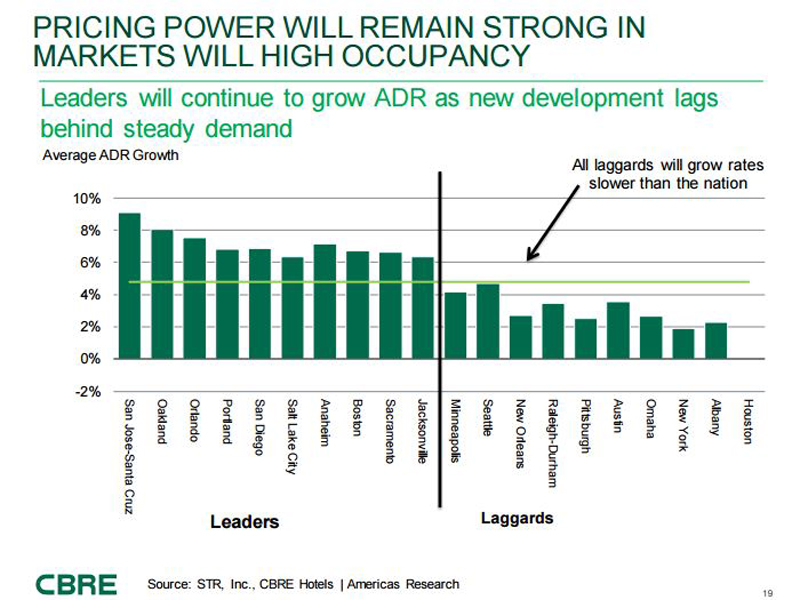

Nevertheless, CBRE is forecasting a favorable economic climate for most U.S. markets, given that many are expected to realize income growth above the national average of 3.5 percent and personal income ranks as a lead indicator for hotel performance, at least in so far as it can drive demand. But supply is also playing a part in the success or lack thereof that makes for leading and lagging markets. According to Woodworth, those markets expected to lag in RevPAR growth over the next two years are expected to realize a supply growth beyond the long-run average and while demand growth in many lagging markets is expected to exceed that in leading markets, the increases will not be enough to absorb the level of supply coming into those cities. “Those markets that are experiencing above average supply-chain increases will experience weaker performances in the mid-term,” he said. Conversely, Woodworth said that Tier 2 and 3 markets benefited from a solid first quarter this year due to strong occupancy and rate growth that resulted from a lack of supply as well as minimal demand headwinds.

Transactions outlook

Broadly positive, CBRE’s outlook for the transactions market is one of a disparate performance compared with previous years when real estate investment trusts and commercial mortgage-backed securities played a greater role than they are currently. “Broader capital markets are in a period of volatility,” said Owens, who went on to also say that CBRE has seen transactions volumes decrease and REITs sidelined because of net asset values and trading prices as well as a shift away from CMBS, which will be subject to regulatory changes by year end. “Buyers and sellers are exercising more caution beyond where they were last year …and concerns in China and oil have also led to some dynamics through the industry,” Owens said. “Debt markets are also experiencing similar trends.”

But from CBRE’s perspective, it would appear the transaction market—from a domestic perspective—is going though a transition period as it shifts from REITs and CMBS to foreign capital, bank debt and life insurance companies, some of which are again originating hotel loans after 15 years out of the game, Owens attested. “Multiple life companies are getting back into the hospitality debt space and a number of European lenders who haven’t issued debut in the U.S. for hospitality are coming into the space,” Mallory said. “A number of Asian businesses are also setting up debt capital for hotels in the U.S.” He added that Asia accounts for 34 percent of investment into U.S. markets and that while Chinese insurance companies like Anbang and Sunshine are subject to regulatory scrutiny for foreign investment, China state-owned enterprises and large conglomerates are not. “In short, China will continue to play a growing role …as outbound capital debts in China indicate an expectation that controls will be lifted near mid-year,” Mallory said.

Owens has an equally sanguine perspective on foreign investment, noting “the U.S. is still a safe harbor for foreign capital to flow into.” He further expects more rate hikes by the Fed to prove advantageous to fundamentals on the debt side of the equation and additionally indicates that bank loans are still available at competitive pricing. “A lot of our clients are concerned about the availability of capital, but we don’t see it from our seat,” Owens said. “There’s still an abundance of capital available, much of it from sources who haven’t been active in the last five to 10 years and are now coming back.”