HVS’ new study of Myanmar’s potential for hotel investment paints a fascinating picture of a destination not only coming into its own in terms of tourism, but leveraging its appeal for international visitors as a means to improve its economy.

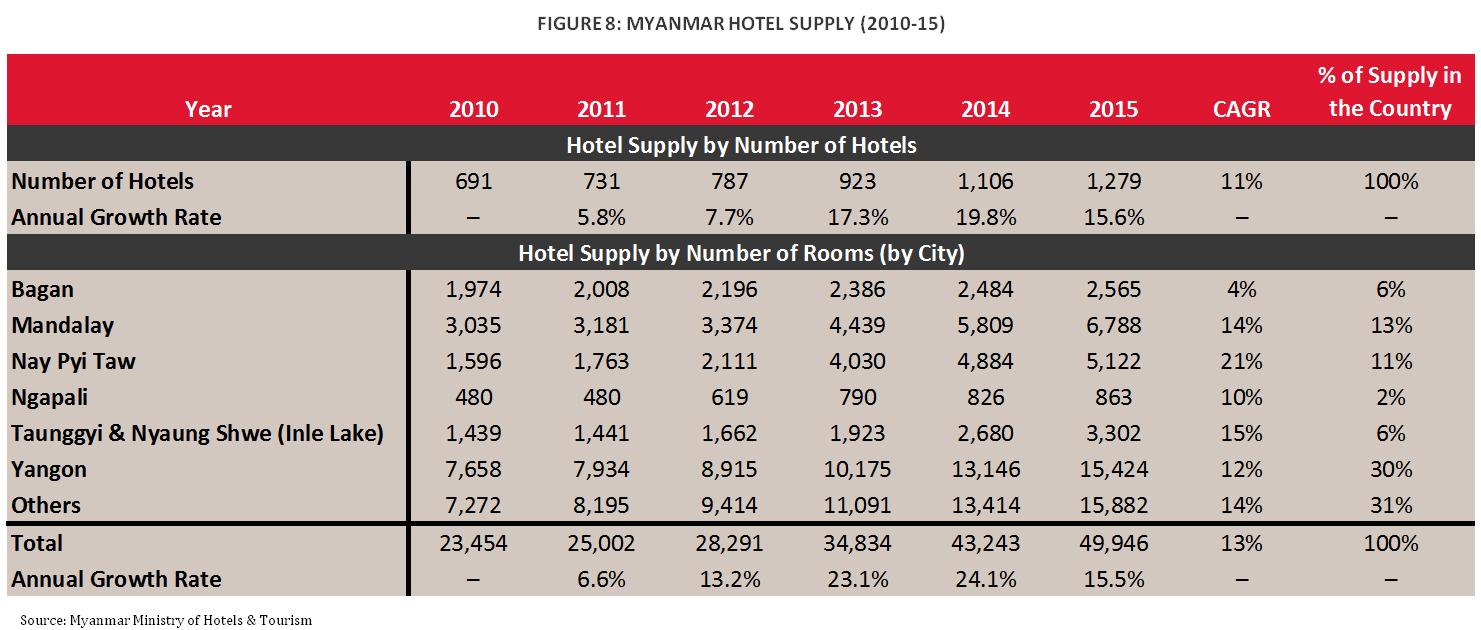

As of last year, Myanmar had a total of 1,279 registered hotels with a total of 49,946 rooms. The country’s largest city, Yangon, has 30 percent of the country’s room count, driven largely by business travel. Mandalay comes next at 13 percent with a strong leisure presence, and Nay Pyi Taw has 11 percent, driven “solely by government-related demand,” according to the report.

From 2014 to 2015, total number of hotel rooms increased by 15.5 percent, adding over 6,700 rooms across the country. In particular, the Inle Lake area (Taunggyi & Nyaung Shwe) recorded the largest combined year-on-year growth of 23.2 percent in room inventory, driven by the increased Leisure demand in the area, while Yangon and Mandalay’s room inventory growth rates trail slightly behind at 17 percent.

With infrastructure improvements already completed and solid growth across a range of metrics in the past few years, Myanmar is ripe for investment. Here are five reasons why you should be considering Myanmar.

1. Tourism numbers are on the rise. According to the Myanmar Tourism Master Plan, 2013-2020, published by the Ministry of Hotels and Tourism, the country had set ambitious goals to receive 7.48 million annual international tourists by the year 2020. In line with this aggressive growth, the total tourism receipt is expected to increase from $534 million in 2012 to $10.18 billion in 2020. Local industry players predict a target arrival number of two to three million.

In 2015, total tourist arrivals to Myanmar reached approximately 4.68 million with 28 percent of tourists entering through airports and 72 percent through border gateways. Compared to 2014, total tourism arrivals grew by 52 percent in 2015. This was contributed by a 15-percent growth in airport arrivals and a 73-percent growth in border gateways. Due to the small base arrival numbers, growth rates in arrivals have maintained at a double-digits pace for the past four years. Overall, Myanmar has benefited from strong growth in tourist arrivals with a compound annual growth rate of 34-percent from 2010 to 2015.

2. A better airport means inbound traffic is likely to keep growing. There are currently 28 international airlines and 11 domestic airlines servicing Yangon International Airport, the main air hub in Myanmar. Total airport arrival (from all airports) reached 1.3 million in 2015 and has achieved a CAGR of 27 percent in the 2010-2015 period.

With Yangon International Airport’s new terminal opened in March 2016 and further plans to transform Bagan Airport into an international one in November 2016, both these airports will serve more international routes that will help to support future increase in arrivals. (Still, the report notes “limiting factors” such as political instability, high traveling expenditure and infrastructure constraints that may put constraints on the accelerated growth.)

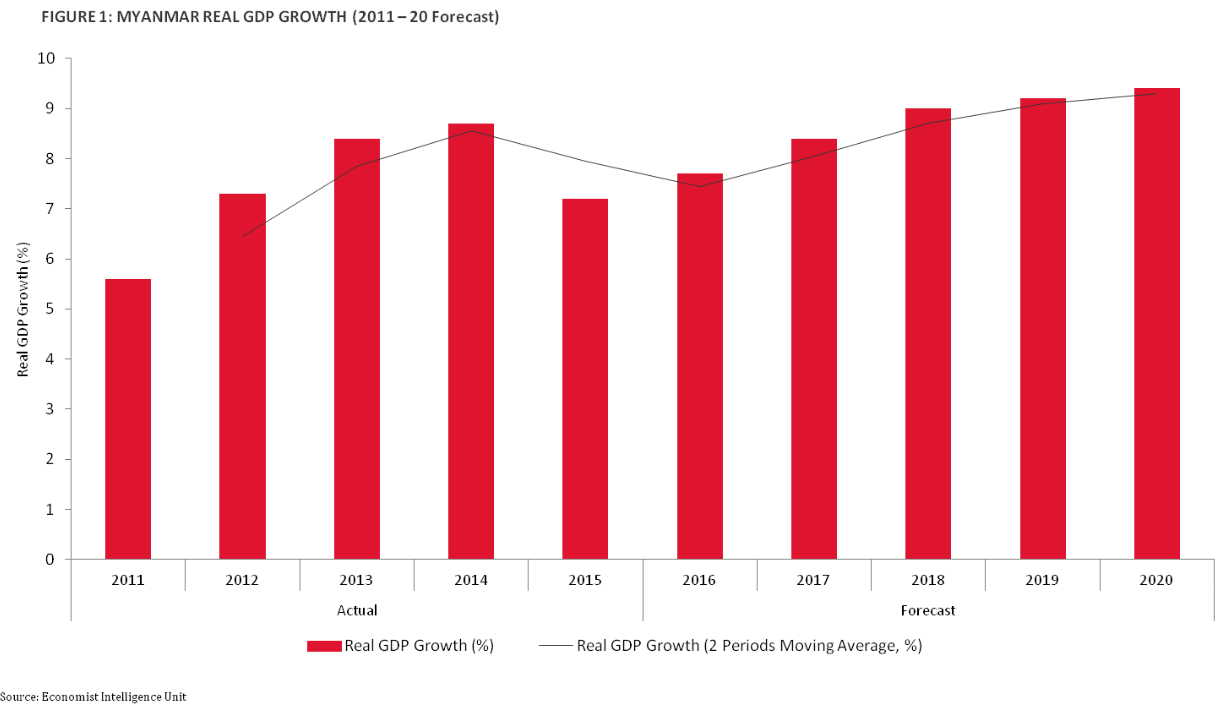

3. The country’s economy is getting better. Myanmar’s economy has seen impressive growth in the past few years. The Economist Intelligence Unit‘s May 2016 Forecast for Myanmar estimates a GDP growth of 6.8 percent in 2015 and 7.7 percent in 2016. Significant economic growth is forecasted in 2016/17 to 2020/21, which will be spurred by large projects funded by foreign investors. As regulatory and legal reforms are introduced, foreign investments will continue to increase in this developing nation.

4. Visitors are spending more. In 2015, Myanmar received a total of approximately US$2.1 billion in tourism expenditure. As compared to the previous year, total tourism expenditure increased by 19 percent with a six-year CAGR of 42 percent. In line with strong annual growth rates, a significant increase in the average expenditure per person per day was also seen over the past six years, with the average spent increasing from $102 in 2010 to $171 in 2015. In the same time period, the average length of stay increased from 7 days to approximately 9 days. It should be noted that this average length of stay figure most likely excludes day trippers from border arrivals.

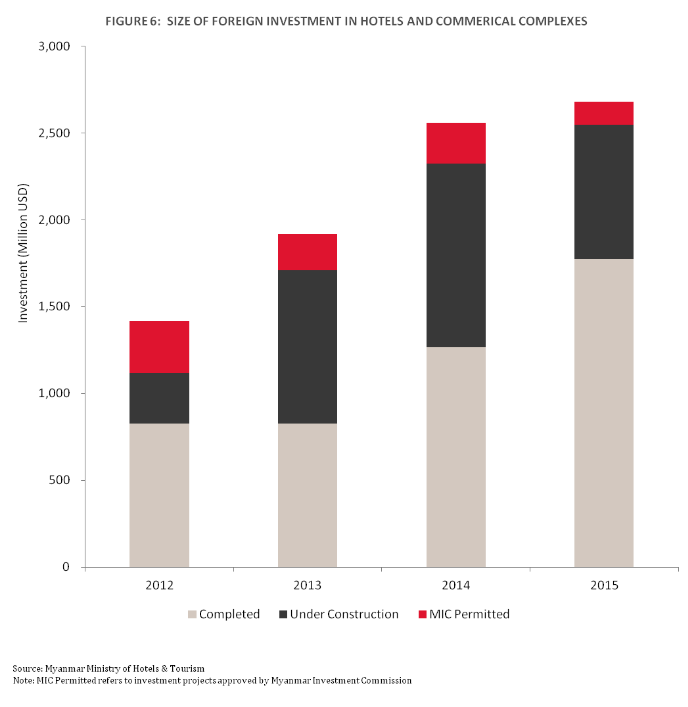

5. Investors are already there—but there’s room for more. In 2015, an influx of approximately $2.6 billion of foreign investment was made for the development of hotel and tourism-related commercial complexes, mostly routed from Singapore, a fellow member of the Association of Southeast Asian Nations (ASEAN).. This amounted to a total of 9,132 rooms across 48 projects, of which 69 percent were complete, 25 percent were under construction, and 5 percent had received approval from Myanmar Investment Commission.

5. Investors are already there—but there’s room for more. In 2015, an influx of approximately $2.6 billion of foreign investment was made for the development of hotel and tourism-related commercial complexes, mostly routed from Singapore, a fellow member of the Association of Southeast Asian Nations (ASEAN).. This amounted to a total of 9,132 rooms across 48 projects, of which 69 percent were complete, 25 percent were under construction, and 5 percent had received approval from Myanmar Investment Commission.

Compared to 2014, growth in the number of foreign invested rooms dropped by 3 percent while the total amount of investment increased by 5 percent which leads to an increase of average investment per room by 8 percent in 2015. Even though investment is still increasing, the growth rate has slowed down as compared to the previous periods.

The slowdown in foreign direct investment in 2015 may be largely attributed to the investor caution ahead of the 2015 presidential elections, political transitions, flooding, and ongoing structural constraints etc. However, in the long run, greater FDI into the tourism industry is required to provide the necessary structural capacity to support future tourism growth. HVS expects that private investments will pick up in 2016/17 depending on the economic and political reforms in Myanmar with the transfer of political reforms in Myanmar with the transfer of power.

The report also notes that majority of the hotel rooms across the country fall into the budget to mid-scale segment and are unbranded, run by local owners and operators. As such, the quality of the hotels may not be standardized across the country. Most internationally branded hotels are located in Yangon and Nay Pyi Taw to cater to commercial demand and government requirements. There is limited presence of branded hotels in the leisure destinations as these markets have only recently opened up and gained recognition among international travelers.

But as we noted earlier this year, brands are already looking for opportunities in Myanmar. Kempinski, Amara, Centara, Dusit, Melia, Shangri-La, Tangram, Hilton and Best Western are just a few of the brands that have invested in Myanmar. The Sheraton Yangon, the chain’s first in the country, is expected to open next year while Marriott is looking for partners, according to comments by Asia-Pacific president Simon Cooper.