Israel’s hotel sector was fairly stable in 2016—but HVS’ latest report, Trends and Opportunities: Israel Hotel Market Overview, notes that the country has “significant potential for future growth due to a rise in incoming tourism and expansion in the sharing economy.”

Despite the “volatile geopolitical situation” in Israel and its neighboring states, hotel occupancy in 2016 averaged 67 percent, with average rates and RevPAR remaining steady at $202 and $136.

By the Numbers

Mirroring the positive trend in visitation, the total number of accommodated bed nights increased by 2 percent in 2016, primarily driven by the international market. Overall, all areas under review recorded an increase with the exception of the Dead Sea.

With more than 6.8 million bed nights recorded in 2106, Eilat accounts for approximately 30 percent of total bed nights in Israel. Jerusalem and Tel Aviv come second and third, with 3.5 million (16 percent of the total) and 3 million (14 percent of the total), respectively. Resort destinations like Eilat and the Dead Sea are more heavily reliant on the domestic market, which represents 90 percent and 80 percent of total bed nights in these locations, respectively. The international market shows a clear preference for Jerusalem and Tel Aviv as both cities accommodate more than 5 5 percent of the total international bed nights.

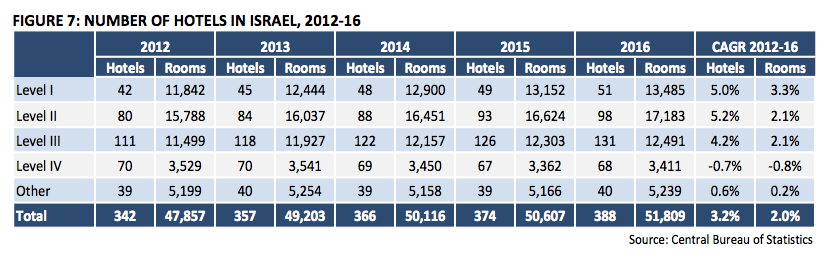

The average hotel size—in terms of room count—has decreased slightly from approximately 140 in 2012 to 134 in 2016, although significant differences exist throughout the country, depending on the level and the location. Hotels in resort destinations like Eilat and the Dead Sea are much larger with an average room count of 220 and 270, respectively, while properties in cities like Jerusalem and Tel Aviv are smaller with an average room count of 124 and 107, respectively.

Top Markets

Hotel performance still varies from one region to another, and with relatively high room rates the country is still expensive to visit compared with other Mediterranean destinations.

Israel’s regions also have a pronounced divide between international and domestic markets, with resorts such as Eilat and the Dead Sea more reliant on the domestic market, while Jerusalem and Tel Aviv remain the favourite destinations for international visitors.

Changing the Game

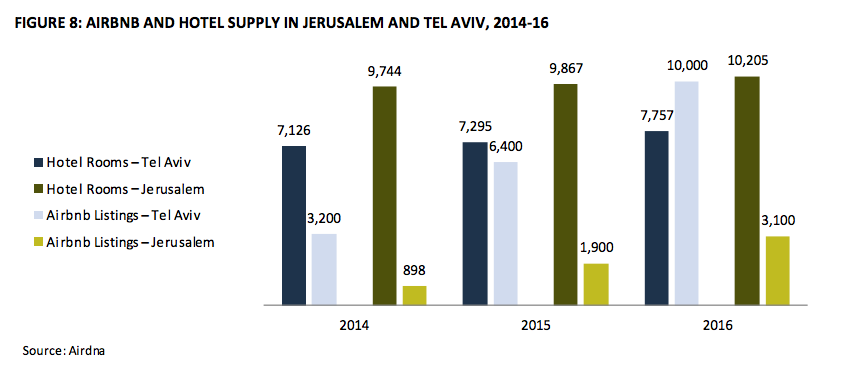

The industry is facing some challenges, however. Notably, the growth of alternative accommodation in Israel, such as Airbnb, could become a game-changer for both locals and international visitors.

While overall hotel supply has grown moderately in recent years with 46 hotels and almost 4,000 new rooms entering the market since 2012, the concept of the sharing economy has been gaining in popularity and has led to the emergence of alternative types of accommodation, and distribution channels such as Airbnb have become a game-changer for both locals and travelers. Despite significant efforts from the Israel Hotel Association, legislation around this type of rental in Israel remains almost nonexistent, while cities like New York, London or Berlin have implemented stricter regulations.

The number of listings increase year-on-year at a much higher pace than hotels, although the report noted that Airbnb started from a much lower base. Tel Aviv and Jerusalem are by far the cities with the largest Airbnb offer with more than 10,00 and 3,000 active listings, respectively, compared to 800 in Eilat or Haifa.

Looking Ahead

“There is potentially room for further growth in the budget segment, which would attract different types of travelers who can already benefit from lower air fares,” HVS analyst Lionel Schauder, co-author of the report, said in a statement. “This would have the effect of reducing overall average rates making the destination more affordable.”

With the number of airlines adding flights and the country’s hotel pipeline remaining strong, there remains real potential for substantial tourism growth, particularly if security concerns in the region can be overcome.

“The first half of 2017 reached a record in terms of tourist arrivals with an increase of 26 percent over the same period last year,” co-author Russell Kett, chairman, HVS London, said. “The 3 million arrivals mark could conceivably be reached for the first time in the country’s history by the end of the year.”