Listening to Tyler Morse, the founder and CEO of New York-based hotel owner and operator MCR Development, speak, you quickly realize that among a room of hotel industry experts, he's one of the smartest. He's certainly one of the most frank, skillfully undiplomatic—telling audiences what he really thinks about relevant issues and trends. Maybe it's a trait he picked up from outspoken industry luminary Barry Sternlicht: Fresh out of Harvard Business School, Morse was Sternlicht's right-hand man at Starwood Hotels & Resorts Worldwide.

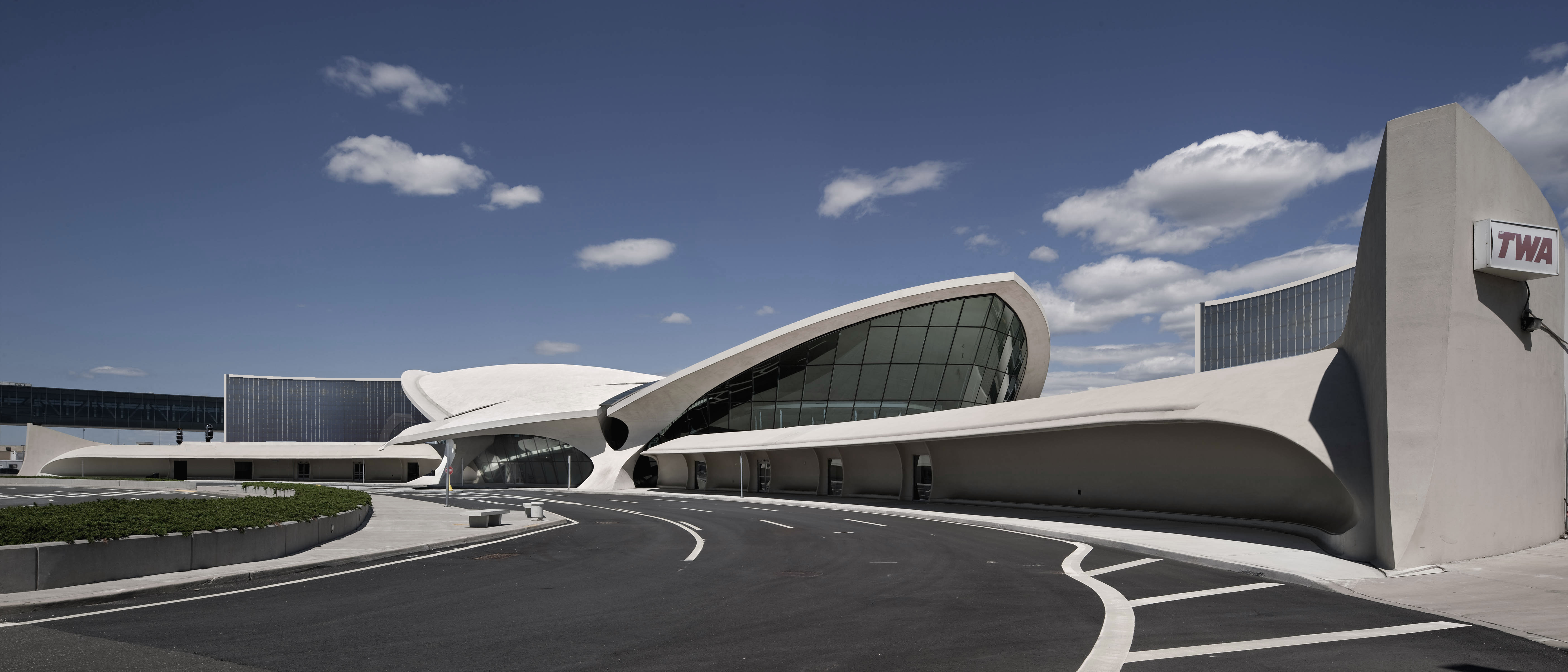

Candidness is what we found when we sat down with Morse for a discussion of all things hotel. With a portfolio of 90, mostly-branded hotels, MCR is a top-10 hotel owner-operator in the U.S. And while MCR's portfolio is predominantly composed of Courtyards and Hamptons, it's MCR's one independent hotel—The High Line in Manhattan—and its forthcoming project at the TWA Flight Center at JFK Airport, which gather the bulk of attention.

Here, he talks about the real estate cycle, the multi-faceted nature of hotels, where interest rates are headed, REITs, his love for the Residence Inn and Hampton Inn brands, how Airbnb is headed to become just another OTA and why many hoteliers can't see the forest for the trees.

What separates you from other hotel owners and developers? If we call you the smartest guy in the room, what does that mean to you?

Morse: It's a combination: We work really hard; we do our homework; we use data to make decisions and to think about trends and where things are going. We don't just accept the status quo. I like to joke that the hotel business is the second-oldest business in the world. It's such an entrenched business that a lot of people say, 'Yeah, no, this is the way it always has been. This is the way it's always going to be.' They're averse to change. We try to keep pushing the ball forward, but using data.

Expand on that notion.

Morse: The hotel business uses an anachronistic concept of revenue per occupied room for all of its outlets. Whether it's spas, restaurants, gyms, bars. Through analytics, we found—and if you push people on this at most hotels, they'll acknowledge this—but somewhere between 3 percent and 8 percent of an outlet's revenue comes from in-house guests. Talking about a revenue per occupied room is really a nonsensical measure because a very small percentage of your revenue in that outlet comes from guests. The balance of it comes from the local community, from a variety of other sources but not just the people in the building.

Can you share a success story?

Morse: We bought a hotel in downtown Baltimore, and the parking garage made $11,000 of NOI. After we restructured the parking agreement, we now make $275,000 of NOI from it. It's not always just the rooms business in the hotel. Hotels are multi-faceted animals.

The consensus is that the hotel industry real estate cycle is past its peak. What is your current strategy?

Morse: We're still buying. We like the long-term demographics of the hotel business and are not in this for quick flips. When you talk about we're past the peak, it's the peak of the real estate cycle. I generally agree with that concept, but the long-term demographics of the travel and tourism trade are still going up. That's when you got to go market by market. New York City, San Francisco, Miami and Nashville are wildly overbuilt now. A lot of cities have seen very little new supply. If you dig into the data, in the last six years new supply has grown at 1 percent or below. As a country, that's not very much.

The top 10 gateway markets are the most volatile. They get a preponderance of the new supply because of the institutional investment focus. Whereas some secondary and tertiary markets can see little to no new supply and have great demand. We focus on places that have better supply demand imbalances toward the demand side.

As an investor, you track lending rates, interest rate hikes, etc. What are your expectations?

Morse: I think we'll see a 25-basis-point increase in December. I think we'll see two increases in 2017 for another 50 basis points. That's 75 basis points over the next 18 months or so. It's just not material. If the investment works, then 75 basis points doesn't matter.

Are you a highly leveraged buyer?

Morse: We are not highly leveraged at all. The hotel business is extraordinarily volatile and the fastest way to get hurt in the hotel business is by using a lot of leverage. We have never borrowed from mezzanine lenders. We have never borrowed from specialty lending shops. We've never used CMBS debt. We continue that way. We borrow from balance-sheet lenders at low LTVs.

When do you start to worry as an investor?

Morse: We're not worried at all because the investment thesis behind our investments is not economy-driven. I don't like making investments where you have to speculate on the number of Chinese inbound tourist visas that are issued by the Shanghai Consulate. That's a macro thesis that is very hard to predict.

Hotels are the riskiest asset class. If you wanted to get in the business as an investor, why not office or multi-family? Why hotels?

Morse: Hotels are an incredibly dynamic business. The office business is not nearly as dynamic. In hotels, you can add value through asset management, branding, operations, financing strategies. Whereas the office business is: you build it, you lease it up, you're done. Multi-family is very similar. There are not as many levers to pull to add value. Now, that's what also makes the hotel business so volatile, because all those levers that you can pull to add value, if you pull them the wrong direction, they can move against you.

Chinese cross-border investment: Has that impacted you at all?

Morse: At the end of the day, the Chinese are smart to invest in high-yielding assets. If they put the proper debt structure on them, it'll be a great investment for them. If they over-lever them with high-interest-rate debt, and there's a mild demand shock, that's going to be a problem for them. The industry is better off if there are multi-national buyers and institutional buyers participating and making money.

What's your take on REITs? Will they continue to sell assets and buy back stock?

Morse: They're going to continue to invest selectively. You see most of the REITs pruning their portfolios and changing the asset mix. RLJ has gone more gateway cities; Summit has gotten rid of some of its older, more tired assets; Xenia is getting rid of select-service in favor of full-service. Everybody is kind of changing the mix, but I think most have kind of executed against their mix strategies and I think you'll see them buying one-off, two-off assets here and there. Hopefully they buy them with asset management strategies.

MCR's portfolio is heavily-branded, select-service properties: Why that mix?

Morse: We love select-service largely because of the margins, and we love extended stay because it straight-lines your Thursdays and Sundays, and does away with some of your lower-demand and shoulder days.

Brand wise, I think the highest return on invested capital in the hotel industry is Residence Inn by Marriott and Hampton Inn. There are about 88 brands in the hotel business and Residence Inn and Hampton have the highest return on investment by a country mile. They both have extraordinarily high customer loyalty and have great margins. If we think about the value proposition, we charge roughly $125 a night and for that $125, you get free parking, free breakfast, free dinner, free Wi-Fi.

The High Line Hotel in New York stands out as your one independent hotel. What's the story there?

Morse: It was an opportunistic investment. We assessed the local demand drivers, the asset-management strategies and it's a very unique product. In these big gateway cities, the need for a brand is less. If you have a hotel in White Marsh, Md., you really need that Marriott flag. In high-demand markets, like San Francisco, Miami, New York, the need for a brand is less. We chose not to flag [The High Line] and it turned out to be a great decision because we didn't have to pay the fees to the brands and we were able to generate sufficient demand.

Steve Joyce on the Choice Hotels' Q3 call said that the full-service suburban hotel is dead. Do you agree?

Morse: I don't think you'll see any more development of those. They're too expensive to build. The group meeting space is very hard to be competitive because every city's CVB continues to build big convention centers with public taxpayer money, but it has terrible return on investment but ends up being a competitor. If you build one, now you're competing against the city and the city has a lower cost of capital than you.

What would you say then is the overall value of a brand—especially in the distribution landscape?

Morse: You're seeing the hotel business move toward an oligopoly, which is where most mature businesses move to. It took the hotel business a little longer than it probably should have to get to this stage. There are basically three major U.S. air carriers, and now there are three major U.S. hotel companies. It's not surprising that it got here.

On OTAs, I say push harder against them. OTAs don't spend money on real estate, on fire and life safety systems. They just take a vig on our sales. In bad economies, the pendulum swings back to the OTAs. We're in a pretty good economy right now, and I think the brands should push back hard against the OTAs and negotiate better deals because, at the end of the day, we have the inventory.

As a hotel investor, and also an operator, does Airbnb worry you?

Morse: I'm not worried about Airbnb and think it will morph into just another OTA. You saw a big win against Airbnb in New York City and it's effectively been eradicated from the city via the $7,500 fine if you post your apartment. There are roughly five notable OTAs right now and it'll become the sixth.

The thing about Airbnb is it's for an extraordinarily price-sensitive customer. No business travelers that I'm aware of use Airbnb. IBM is not signing up a big deal with Airbnb, because IBM can't control the experience.