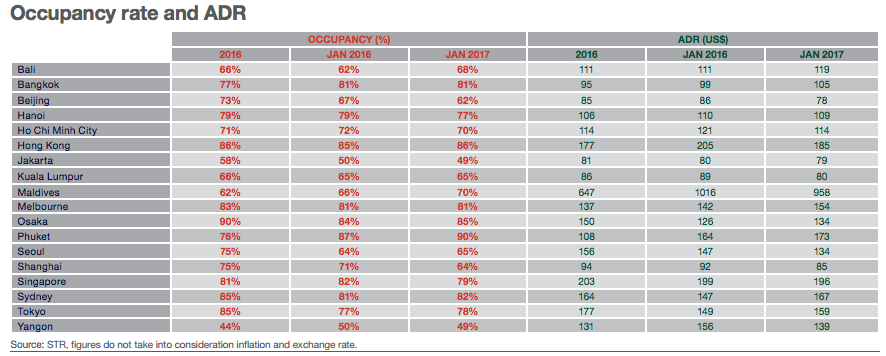

New research from Savills indicates that although the aggregate of Asia Pacific had hotel occupancy declines in 2016, most markets are combatting the drops by raising rates, a strategy that likely will continue through the better part of 2017.

“Even though APAC witnessed a moderate decline in occupancy as a whole during 2016, a majority of regional markets have responded with strong rate growth. ADR will likely remain the primary driver behind performance in the APAC hotel sector this year," Savills noted in its first half of 2017 APAC sentiment survey.

The below table illustrates the point:

Here's a market-by-market look:

Sydney

According to Savills survey, the Sydney hotel market began 2017 in a strong position and is poised for further growth in 1H/2017. Total arrival numbers for both international and domestic travellers are expected to remain strong and stable. Sydney is anticipated to further boost MICE and general corporate demand in the city with the opening of the International Convention Centre. In Sydney’s Central Business District, a limited 3.8-percent increase in hotel supply is unlikely to cause much disruption to the market. As the overall market occupancy currently stands at 85 percent, there is potential for hotels in key locations to further improve their average daily rates (ADRs). The stability of this mature and well-placed market will continue to draw investor interest.

Shanghai

In China, Shanghai is expected to outdo Beijing as the key commercial and leisure hub. In June 2016, the Chinese government implemented a value added tax at 6 percent, which had an impact on operator profit margins in calculating the base management and incentive fees. However, changes to VAT have not had a major effect on overall hotel performance.

2017 got off to a soft start with Chinese New Year at the end of January, which affected overall commercial demand during the first month. However, looking forward, there is still room for growth in the first half of 2017. While the Shanghai market has 22,071 rooms in the pipeline over the next few years, new openings in 2017 are concentrated in the luxury segment, with their impact expected to be felt in 2018. Demand from business and MICE travellers is increasing, and leisure demand remains strong. Looking ahead, the market should experience a growth in both occupancy and ADRs.

Ho Chi Minh City

Respondents were cautiously optimistic about Ho Chi Minh City with the belief that ADRs would remain stable over the coming months. Some were more positive in forecasting a mild increase in occupancy for 1H/2017. “HCMC set a new record in 2016 with 5.2 million international arrivals and there is currently nothing to indicate that this growth trend will not continue in 2017. However, more than 3,000 new rooms are expected to enter the market over the next three years, which will put a cap on room rates and occupancy growth," Savills noted.

Osaka

Despite growing arrival numbers, the Osaka hotel market has seen some weakening in performance since 2016. Due to the accelerated growth in hotel supply and ADRs in the past few years, Osaka is expected to experience a re-adjustment in hotel performance as current price levels are perceived to be unsustainable. In addition, the rise in alternative short-term rental accommodation has also diverted price sensitive demand away from hotels, leading to a weakening in occupancy levels. While the overall market for tourism is still experiencing healthy growth, Savills expects hotels to report lower performance levels in 1H/2017.

Alternative accommodations are also a growing concern. According to Savills, in 2016, Japan received 24 million inbound visitors, 3.7 million of whom stayed at short-term rental properties. This represents more than 15 percent of inbound visitors using alternative accommodation instead of hotels. One of the main reasons: a price surge of hotel accommodations in recent years.

Jakarta

Most interviewees told Savills that they believed there would be a mild or significant decrease in occupancy and ADR in Jakarta. Corporate demand has been stagnant and may negatively affect occupancy over 1H/2017. Another respondent believed that there was “no positive sentiment about visitor arrivals” as visitor numbers are “impacted by the oil and gas business down turn.” Excess supply of inventory was the main concern for occupancy.

For international travellers, terrorist attacks nearly 14 months ago in January 2016 still linger, although regional non-leisure travellers are less concerned. One local hotel chain told Savills, “Luxury in particular is struggling, while budget is stable.” The same hotel chain also commented that RevPAR for their Jakarta hotel portfolio was down 6 percent for year-to-date February 2017.

Yangon

Many interviewees expressed concern about upcoming supply levels, but believed occupancy will be stable during 1H/2017. Many openings have been postponed due to construction delays and licencing issues. Further visitor arrivals growth is expected this year, but this has not converted to better performance indicators, “it seems [visitor arrivals] expectations were too high.”

New airport capacity should eventually increase hotel demand, as long as new supply is manageable. It is likely that ADR decline will continue. Demand for large properties is likely to be generated by local events, launches, symposiums and conferences. Local demand for food and beverage has been strong, as guests are happy to pay more for quality experiences– “locals fi ll up our buffets on weekend nights…same with weddings and other social events, as long as we provide a modern and better environment [than what is available elsewhere in the market]."

Savills' market sentiment survey was collected via in-person interviews and surveys with hospitality consultants, corporate-level executives and local market experts and aimed to provide a forward-looking snapshot of occupancy and average daily rate across 18 major cities in the Asia Pacific region.