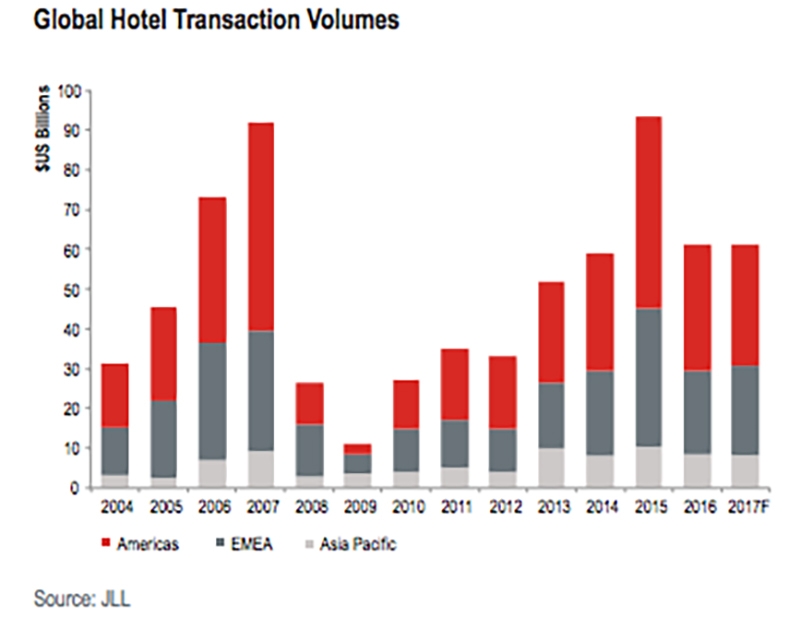

Last month, HOTEL MANAGEMENT reported a rocky outlook for European hotel investment in 2017 and earlier this month, speakers at this year’s International Hotel Investment Forum shared a weakened optimism for global lodging investment during the next 12 months. But in January, JLL released its "Hotel Investment Outlook 2017," announcing the firm’s total global expectation for hotel real estate transactions in 2017 to reach the same levels recorded in 2016: $60 billion.

According to the report, transactions are forecast to take place in conjunction with portfolio restructurings that will occur as funds reach the end of their hold periods. Growth is predicted for the Europe, Middle East and Africa regions, from approximately $20.5 billion in 2016 to $22.5 billion in 2017; the Americas and Asia Pacific are expected to remain stagnant at $31 billion and $8.5 billion, respectively. Here, three professionals from different segments of the industry provide a snapshot of what they see coming down the pike for 2017 in their region of expertise.

The Middle East

As Tom Engel, principal of Boston-based hotel advisory firm TR Engel Group, tells it, the declining price of oil over the past few years has had a ripple affect throughout the Gulf States. Engel, whose company also has offices in Doha, Qatar, explained that the drop in oil revenues is leading to decreased subsidies throughout the region and increased commodities costs, and room supply has also increased, resulting in a slowdown in occupancy and revenue per available room.

Although resort products, which are increasingly popular with European leisure travelers to the region, are key to the Gulf States’ economic diversification, local development authorities—the major investors in new lodging product—are diverting their reduced revenues elsewhere. “The bottom line is that there’s been a noticeable slowdown in room development, largely because of what’s been happening in the market in the last 36 months and because of the reduction in national revenues associated with oil prices that’s been part of that,” Engel said, adding that he also hasn’t seen substantial amounts of non-Gulf capital behind the region’s hotel development.

Latin America

The New Year kicked off with the business slowdown that’s customary of South America’s summer. But Arturo García Rosa, president and founder of the South American Hotel & Tourism Investment Conference and president of RHC Latin America, said that also came with consternation over the new U.S. administration and potential implications to trade deals across the region. But as no changes have yet been made, it’s back to business as usual with U.S. hotel companies continuing to express interest in South American markets, particularly Peru, Colombia and Chile. “There are still high expectations for Argentina and we suspect that more overseas investment will start going into the country in the second half of the year,” García Rosa said.

Investors are also still paying attention to Cuba, where SAHIC will host the country’s first hotel investment conference in May. “There are great expectations for Cuba and since the new U.S. administration hasn’t made any changes to the new relationship between the two countries, U.S. hotel companies are still expressing interest in bringing their brands to that market,” he said.

SAHIC Cuba announces Copa Airlines as carrier sponsor of Hotel Investment Conference in Havana https://t.co/NV9xqbgC5S

— Travel Khan (@TravelKhan) February 20, 2017

However, he also pointed out that the prospects for investment in Brazil this year are less than sanguine as the country’s political class is still embroiled in scandals after President Dilma Rousseff was impeached last year and her successor, Michel Temer, was accused of corruption. “Brazil is still in crisis and the scandals have produced more fear for businesses in the country,” he said.

Asia

"Centrally located in Jakarta, this hotel (@alilajakarta) offers easy access to the major points… https://t.co/9lt5vvpbyX

— Alila (@AlilaHotels) March 12, 2017

For hotel management company Two Roads Hospitality, this part of the world is hot right now. The group currently has 10 hotels in the region under its Alila brand with another six set to open in Cambodia, Sri Lanka, Malaysia, Indonesia and China and according to CEO Jamie Sabatier, there are also plans to bring Two Roads' other brands, Destination Hotels, Joie de Vivre, Thompson Hotels and Tommie, to the region.

“We’re still seeing significant demand for new projects that will resonate with guests in the region and there’s also still plenty of capital for the right projects to get built,” he said, adding that historically, many Asian markets have been very brand focused, but demand is growing for more independent, lifestyle and boutique hotels.

But Sabatier also acknowledges that supply has been growing in Asia for quite some time and so at this point, new projects need points of differentiation otherwise they risk being swept to the sidelines. “It’s hard to generalize relative to any one market, but overall I think projects that are more marginal in nature are probably going to have a tougher time getting traction because of the new supply,” he said.