Despite New York City’s lagging revenue per available room, Lodging Econometrics’ third-quarter report on the market’s hotel development is a testament to owners’ confidence in the ROI that New York City can deliver. While the city’s hotel pipeline remains strong, some sections of the city are seeing higher project numbers than others while certain segments are also experiencing greater growth than others.

Here, Lodging Econometrics' VP Bruce Ford tells HOTEL MANAGEMENT what these third-quarter results mean for New York City’s hotel industry going forward.

HOTEL MANAGEMENT: How will the increase in supply continue to affect RevPar and ADR?

Ford: New York City has been seeing new supply additions for the past four years. It’s a market that didn’t really stop constructing hotels when we had a downturn; the pipeline was among the first to really pick up, which is a direct result of being a high rate and high ADR market. Those are the first markets to be attractive to investors.

Now, with more rooms available for sale in New York City than there have been in the past, performance will continue to be below the industry for the foreseeable future. New supply continues to open in the city and most of it is in Midtown and extends down to the southern tip of Manhattan. North of the Waldorf-Astoria, there’s very little development.

HM: Why is growth in the luxury segment sluggish while there is a proliferation of product in the upper-midscale and upscale segments? Is this indicative of NYC overall hotel product turning a corner?

Ford: Currently, there are no big, luxury projects in the works and there haven’t been since the Baccarat Hotel. It takes a long time to get through a pipeline to build a luxury hotel and the luxury market in New York City is also fairly mature. Also, for a period, developers who have been looking to redevelop a building in New York City have seen condos and apartments as the way to go, particularly at the higher end of the market and that’s been the way it’s been going.

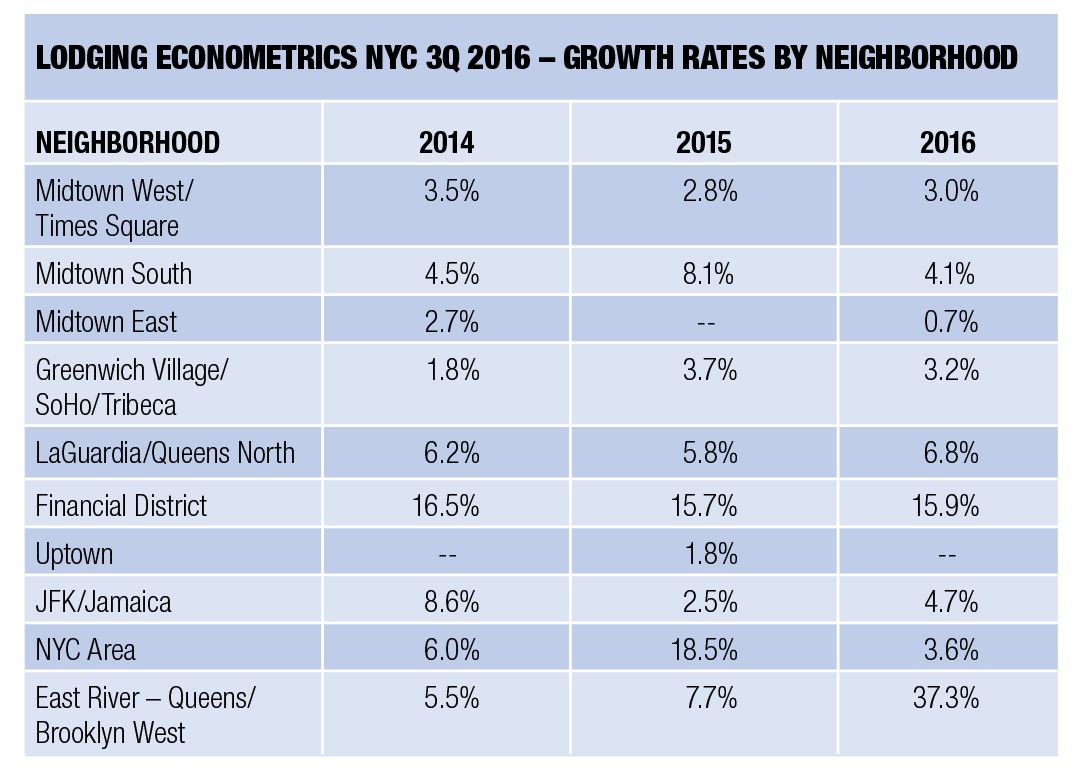

HM: What New York City neighborhoods are currently hot for hotel development? To what do you attribute the growing numbers of hotels in these areas as well as the lack thereof?

Ford: The new redevelopment of Manhattan is all about Hudson Yards and what will be a number of new buildings, new design, a new look and feel across several city blocks where there’s never been anything previously. That’s the high point of what we’re talking about in terms of new neighborhoods. Hudson Yards development is the biggest story in terms of the number of square feet and it will change the city substantially. Already, the addition of a subway line, which accelerated some development in the area, has changed the configuration of that neighborhood. Currently, we’re tracking six hotel projects in Hudson Yards.

In Queens, the changes that are going on at the airports is making a significant difference in how hotel developers view the areas around JFK and LaGuardia. Now we’re seeing new hotel construction happening around these airports for the first time in 20 years. We’re going to see an increase of about 20 percent in room inventory there over a period of the next four to five years. There are also quite a few projects happening in Long Island City, where a 176-room Aloft recently opened. Several new projects for that area have yet to start or are planned to start next year.

Brooklyn currently has just under 40 active projects. The theory about Brooklyn is that years ago you would stay in New Jersey and take the path in if you were looking for a hotel that was a little less expensive. Today, Brooklyn is where you go as options have opened up for commercial development there and so we’re seeing expansion. There have been announcements for brands like La Quinta, Even Hotels, Sleep Inn and Comfort Inn in Brooklyn because they make more economic sense there. A wave of trendy boutique hotels may have initially come into Brooklyn, but I think that’s staying more toward upper-midscale and midscale brands now.

HM: Do you foresee the NYC hotel market becoming oversaturated in the next several years? Do you think it is already?

Ford: You have an operating performance downturn in New York City and that’s been happening for the better part of nine months and it’s going to continue for the next several quarters, largely because—while there’s been new supply opening for the last few years that’s been absorbed—there’s now another wave of new construction and openings that have set the city’s hotels back to absorbing more new supply. So the expectations are that [hotel performance in] New York City isn’t going to become wildly negative. But it’s just not going to be positive for an extended period of time in terms of operating performance growth. The widening of branded supply in the midscale and upper-midscale categories will substantially change the existing supply metrics for the long term. I don’t believe that new supply will significantly dampen the market in New York, but I do believe that supply is going through a renovation and rebirth cycle and select service is a reality in urban centers—a phenomena that started in New York City and is now spreading across the world.

HM: What do you forecast for the 30 unbranded hotel projects currently under construction in New York?

BF: From a percentage standpoint, 30 is pretty high as it relates to the rest of the country. But I would say that a good number of them will end up being branded, although that’s hard to predict today.