The first three months of 2016 saw a notable shift in the U.K.'s hotel scene: For the first time in four years, the market saw a decline in revenue per available room. As HVS notes, this drop supports the theory that the peak of the hotel property market may have been reached.

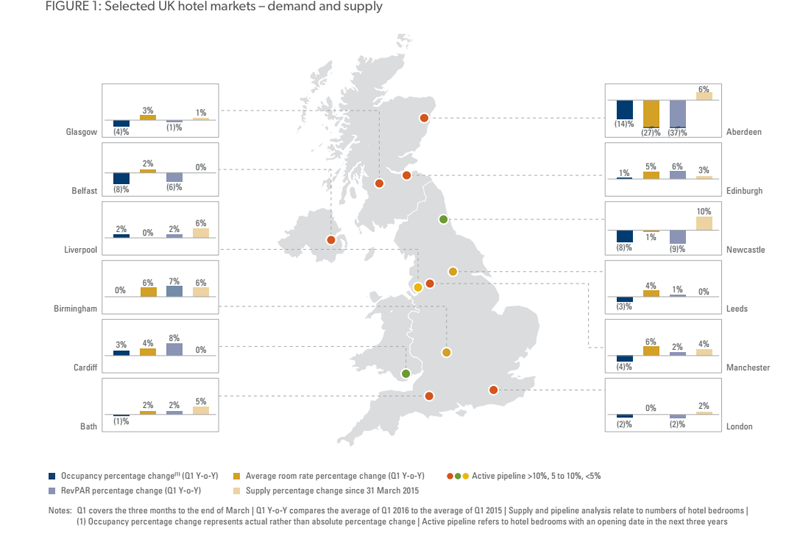

According to the latest Hotel Bulletin: Q1 2016, published by HVS, AlixPartners and AM:PM, a poor start to the year for hotels in Aberdeen, Scotland, saw RevPAR fall by 37 percent year-on-year, skewing overall results across the 12 cities analyzed. Even excluding Aberdeen’s results, the overall market grew by only 1 percent, its lowest increase since the first quarter of 2012.

Hotels in London, meanwhile, saw RevPAR drop 2 percent over the quarter, the fifth consecutive quarter of flat or declining figures for the city.

"These figures give us a strong indication that the peak of the U.K.’s hotel occupancy market has been reached and the growth we are seeing now is rate driven rather than occupancy driven," HVS chairman Russell Kett said in a statement. "For the moment, there continues to be strong interest in hotel investment in most parts of the U.K., which could continue into 2017, but investors are currently delaying decisions because of uncertainty fueled by a combination of terrorism concerns, the forthcoming Brexit vote, China’s economic situation and the U.S. elections.

"There is a risk that some operators will cut rates in an attempt to stimulate demand, forcing competitors to follow suit. Once room rates fall across the hotel sector, the likelihood is that values will soften. This is a big concern for London’s hoteliers, particularly with the large number of bedrooms due to open in the next 12 months unless demand starts to pick up again," Kett said.

According to the Bulletin, the best performing city in Q1 was Cardiff, Wales, with an average RevPAR increase of 8 percent, which HVS credits to the World Half Marathon Championships in March. The fact that demand has not been constrained by new supply means that Cardiff has been in the top three best performing cities over the past year. Since December 2011, HVS claims that only 18 new rooms have opened in the city. (Perhaps somewhat ironically, Colliers International dubbed Cardiff the top investment city in the U.K. just weeks ago due to its low active pipeline, low build costs and strong hotel performance over the past three years.)

London's Numbers

HVS' numbers match STR’s preliminary March 2016 data for London, which indicate negative year-over-year performance.

Based on daily data from March, London reported the following in year-over-year comparisons:

- an increase in supply (+2.5 percent) and a decrease in demand (-0.6 percent);

- a 3.1-percent decrease in occupancy to 76.1 percent;

- a 1.8-percent decrease in average daily rate to £131.04; and

- a 4.8-percent decrease in RevPAR to £99.78.

According to STR analysts, London’s weak performance in March can be attributed to supply growth outpacing nearly flat demand. Another factor in the occupancy decrease is the ongoing threat of terrorism throughout Europe, particularly after the March 22 attack in Brussels, Belgium. Immediately following the attack, Eurostar suspended services between London and Brussels, and flights to and from Brussels and the U.K. also were canceled.