EMEA's pipeline presents quite the puzzle: While the number of hotel rooms under construction is up year-over-year, the number of deals signed for the longer-term is down in both Europe and Africa.

Europe’s Pipeline

Europe had a rough year, what with an ongoing refugee crisis putting pressure on local governments and communities, terrorism changing where people travel and headline-making votes in the UK and Italy. That could be why STR’s December 2016 Pipeline Report for Europe shows a 4-percent decrease in rooms under contract compared with December 2015, with 155,434 rooms in 1,017 projects under contract in Europe.

But when we look at the number of rooms under construction the forecast is somewhat better: In December, Europe had 68,777 rooms in 442 projects under construction, and based on number of rooms, that is a 13.1-percent increase in year-over-year comparisons.

Hotel investors and operators still seem to have confidence in Italy, with hopes that the pressing need to shore up the country’s banking sector may mean that issues around non-performing loans could see more supply come into the market.

In the post-Brexit UK, investors may see better rates for hospitality projects and higher occupancy rates as international and domestic travelers take advantage of the depreciated pound. Hospitality sector specialists at Colliers International are predicting that the UK regional hotels market will be supported by low interest rates, solid trading, "acquisitive domestic buyers" and an increasing flow of international capital this year.

Still, Europe's future is uncertain at best, with ongoing terrorism concerns affecting travel trends and hotel profitability. If people stop visiting cities or countries in the wake of terror attacks, hotel pipelines could start drying up.

Middle East & Africa

STR’s December 2016 Pipeline Report for the MEA region, meanwhile, shows 158,441 rooms in 555 projects under contract in the Middle East and 57,626 rooms in 309 projects under contract in Africa.

The under-contract total in the Middle East represents a 7.2-percent increase in rooms under contract compared with December 2015. Specifically in the in-construction phase, the Middle East has 84,519 rooms in 264 hotels. Based on number of rooms, that is a 4.3 percent increase in year-over-year comparisons—which could easily be attributed to Dubai’s initiatives to bring in more hotels ahead of the 2020 Expo.

At the beginning of 2015, Dubai had approximately 94,000 hotel rooms available, according to the GCC Hospitality & Leisure-Recreation 2016 report. In early November, that number had jumped to 100,000 rooms. And by the time the Dubai Expo gets underway in October 2020, the Emirate is expected to have 164,000 rooms available.

But that’s still almost four years away, and right now, Dubai is not quite on top of the pipeline. Makkah, Saudi Arabia, has claimed that honor, with 23,060 rooms in 14 projects under construction. Dubai, the only other market to report more than 10,000 rooms in construction, has 20,451 rooms in 69 projects.

Africa, meanwhile, isn’t faring as well in the under-contract department, where the total number of rooms has dropped by 5.1-percent compared with December 2015. For the in-construction phase, though, Africa reported 29,546 rooms in 160 hotels. Based on number of rooms, that is a 6.3-percent increase in year-over-year comparisons.

Chain Scale Segments

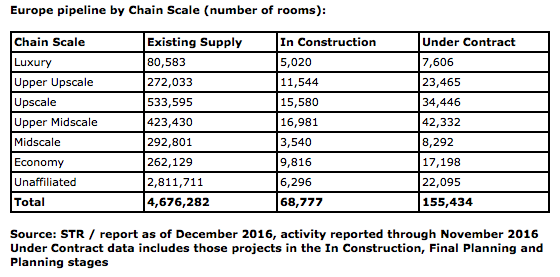

Among chain scale segments in Europe, the upper midscale segment accounted for the largest portion of rooms under contract (27.2 percent with 42,332 rooms) and in construction (24.7 percent with 16,981 rooms). Upscale (22.7 percent with 15,580 rooms) was the only other segment to represent 20 percent or more of rooms in construction.

STR’s under contract data includes projects in the In Construction, Final Planning and Planning stages but does not include projects in the Unconfirmed stage.