They did it again. On Wednesday, the Federal Reserve raised short-term interest rates by 25 basis points, the first in what many expect will be two more rate hikes this year.

When the Fed last raised the rate in December, hotel industry analysts we spoke with did not express too much worry over its short- and long-term impact. Has that changed now with the latest bump? Maybe, just a little bit, for borrowers and owners, and maybe much more for lenders.

"If the U.S. economy continues to grow at its current pace, we will likely see two to three more quarter point rate increases this year and that means hotel values will decline," said JP Ford, SVP of New England Hotel Realty.

The size of the rate increases is not the worry. Sure, borrowing rates will tick up, but it shouldn't preclude owners from tapping debt for projects. "We have not seen this recent rise in interest rates having any effect on the availability of capital for real-estate loans," said David Sonnenblick, co-founder and principal of Sonnenblick-Eichner Company. "There is still a tremendous amount of capital available from both Wall Street conduits and on-book lenders. Borrowers need to remember that we are still in a very attractive interest-rate environment. Real-estate loans today are pricing less than they were 10 years ago, when we thought we were in the most attractive interest-rate environment possible."

The concern, instead, is over a hotelier's ability to continue to churn out and grow net operating income, according to Ford.

"These likely rate increases are rather benign when scattered over the next nine to 10 months, and provided they continue to be quarter point bumps," he said. "Even so, a hotel owner unable to grow revenue and NOI, and in a location subject to new supply increases, may want to consider a sale of his asset(s), because his value may have peaked."

Ryan Meliker, managing director of equity research, REITs and lodging at financial services firm Canaccord Genuity, is of similar thought: keeping NOI growing at a brisk rate is a hotelier's panacea to rising interest rates.

"One rate hike in isolation means little; however, it is clear that the Fed is moving toward rate increases. The result of this trend is such that interest rates are trending upward (not a big surprise) and cap rates on assets where leverage is typically used also move higher—though not necessarily to the same magnitude," said Ryan Meliker, managing director of equity research, REITs and lodging at financial services firm Canaccord Genuity.

"When the economy is improving and investors have confidence in that improvement, risk premia are reduced and cap rates don’t rise as fast as interest rates—though they may still tick up. Just because cap rates are moving higher, that does not mean that values are coming down either. If NOI increases can move at a similar pace to cap rates, asset values can be unchanged. Usually, as seems to be the case now, the Fed is raising rates because they feel good about the economy, hence the narrowing in risk premium. But most importantly, hotels are very economically sensitive, so its likely that NOI growth can offset cap rate increases, keeping asset values consistent and potentially causing them to rise."

The recent spate of interest rate hikes does, according to Meliker, impact the potential rate of return on a given project. "Cost of capital advantages begin to shift," he said, citing private equity groups that rely on debt to boost returns. "Highly leveraged platforms, like private equity, tend to lose an advantage in this environment because their cost of debt picks up, and while asset values may not fall, it means their targeted equity returns have to compress. Cost of debt is less meaningful to lower leveraged players like sovereign wealth and REITs," Meliker said.

Fed hikes key interest rate for the second time in 3 months. Here's how the Fed's interest rate hike affects you: https://t.co/r0x8DnCgHt pic.twitter.com/pVRqPbbDGo

— ABC News (@ABC) March 15, 2017

Global Contagion

A lift in U.S. interest rates has an effect globally. When rates rise, the dollar strengthens, making it more expensive for foreign companies to buy property in the U.S. However, as Meliker pointed out, foreign players often want added exposure in the U.S., "where their investments are benefitting from the rising dollar."

The biggest winners are those who are not overly debt ridden, Meliker said. "Lowly levered domestic players are the biggest winners in this environment, but it definitely does not derail lowly levered foreign investors, though there are added headwinds."

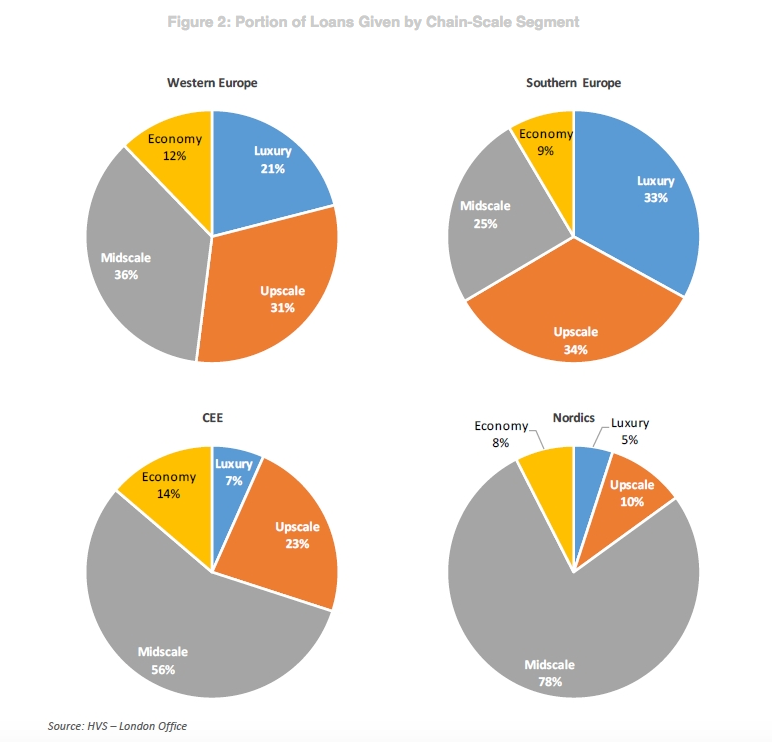

There is much less resistance in Europe, according to some. The recent European Hotel Lending Survey, published by HVS Hodges Ward Elliott, noted that debt for hotels has become more widely available, particularly debt funding for acquisitions, refinancing, renovations and expansions, more so than for ground-up development, with only 50 percent of lenders willing to consider these projects.

Other survey highlights include: 1. Lenders prefer full-service properties at the higher end of the chain-scale segment; 2. The largest loans are originated by major Western European banks; 3. Lending parameters in Western Europe are least stringent; and 4. As bank lending tightens in the future, the shadow banking sector will fill the gap.

The upshot said HVS: "With debt being generally available for all project types at historically low interest rates in most regions, borrowers with well-founded business plans should be able to secure financing for their hotel investments."