HVS’ 2017 European Hotel Lending Survey found some positive trends in hotel financing across all European markets.

“The widespread availability of bank financing for hotels is partly due to stronger hotel market fundamentals and partly to a more resilient banking sector across most of Europe,” London-based analyst Peter Szabo wrote in the report. “Paired with historically low interest rates, this trend has resulted in increased transaction volumes with many deals seeing the use of all available debt.

“Despite Western Europe reaching a possible tipping point in the cycle and lenders becoming more prudent, our survey of European hotel lenders indicates a healthy appetite for hotel investments in Europe. With debt being generally available for all project types at historically low interest rates in most regions, borrowers with well-founded business plans should be able to secure financing for their hotel investments.”

Here are some of the key takeaways from the survey.

1. Senior debt is available for all project types

Banks are willing to issue senior debt for a range of needs, including existing property acquisitions, refinancing, renovations and expansions. In the case of new hotel constructions, however, Western European lenders are "much more cautious," with only 50 percent of lenders willing to consider these projects.

2. Lenders prefer full-service properties at the higher end of the chain-scale segment

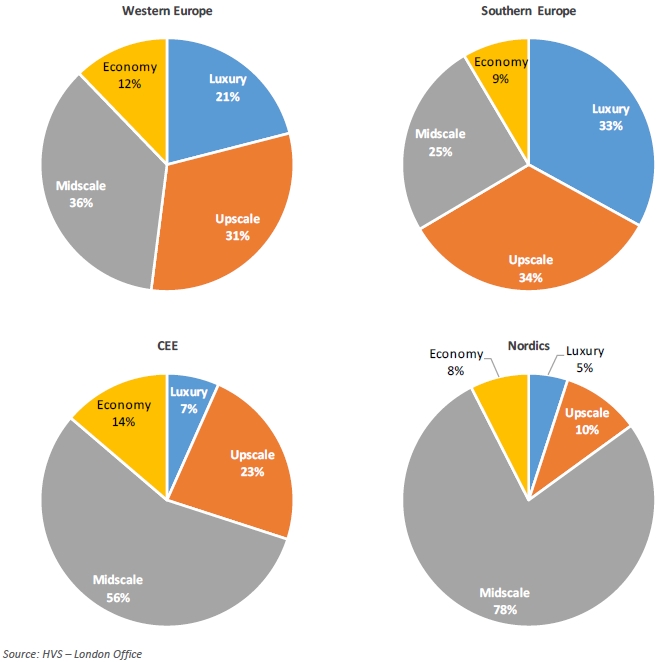

Overall, upscale and midscale hotels are the most favored type of hotels to receive loans, followed by the luxury segment. Economy properties have received the least amount of financing.

3. The largest loans are originated by major Western European banks

Western European banks have the ability to issue the largest loans. As smaller regional banks cannot finance projects above €250 million, banks in the west often step in and provide syndicated funding for the largest projects.

4. Lending parameters in Western Europe are least stringent

Fixed interest rates showed less favorable terms for secondary markets, with interest rates in primary cities being at or below 3 percent. Interest rates for leased hotels in primary cities across different regions are surprisingly close, with very little regional variation except for the CEE.

5. As bank lending tightens in the future, the shadow banking sector will fill the gap

With close to 60 percent of bank lenders agreeing that lending from the shadow banking sector will increase their activity in the future, investors and developers are getting more creative in filling the gap in lending.