The American Hotel & Lodging Association is continuing its analysis of Airbnb’s impact on major hotel markets, this time with a look at Miami. A new report from the association, which looks into the effect of large-scale commercial home-sharing operations, found that $76 million of Airbnb’s revenue in Miami came from operators who listed multiple units for rent nearly every day of the year.

Like the AH&LA’s reports on Chicago and Phoenix, Troy Flannigan, VP of state and local affairs at the AH&LA, said that the primary concern does not come from property owners periodically rending their homes, but from commercialized operations that operate without permits and ignore local taxes and the safety of their guests.

“Home sharing and home rentals have been going on for decades,” Flannigan said. “We support property owners, but more than any of the other 14 cities included in the AH&LA’s study, Miami has a significant problem with large-scale home-sharing operations.”

The study’s findings are sobering, showing that three-quarters (76 percent) of Airbnb’s revenue in Miami comes from the nearly 30 percent of operators who listed their units for rent for more than 180 days per year, and more than $76 million of Airbnb’s revenue in the city came from operators listing multiple units for rent; at 62 percent, nearly two-thirds of the city’s home-sharing operators, this is the highest percentage of the 14 cities surveyed by the AH&LA.

Airbnb is trying to woo European regulators https://t.co/0E28PPAwtw pic.twitter.com/Y4lmKCMfPN

— Bloomberg (@business) May 25, 2016

Carol Dover, president & CEO of the Florida Restaurant and Lodging Association, said that specific neighborhoods are being directly impacted by the level of home sharing taking place. She cited the city’s zip code of 33139 as a location in South Beach with notably tight restrictions on home sharing that nonetheless has more than 1,400 Airbnb listings.

“Tourism is a critical driver of Miami’s economy, and we have to protect the integrity and unique culture of the city that Miami’s hotels provide,” Dover said. “We welcome competition, but hotels shouldn’t have to compete with commercial landlords exploiting tax loopholes.”

The primary struggle faced by communities looking to oust illegal home sharing operators is enforcement. According to Flannigan, existing laws already spell out the illegality behind many of these operations, but a lack of transparency between Airbnb and local communities makes it difficult to police.

“The law is clear, but we didn’t have the Internet when it was written,” Dover said. “Nobody dreamed that these hotel rooms would exist on a cloud, where communities struggle to find them.”

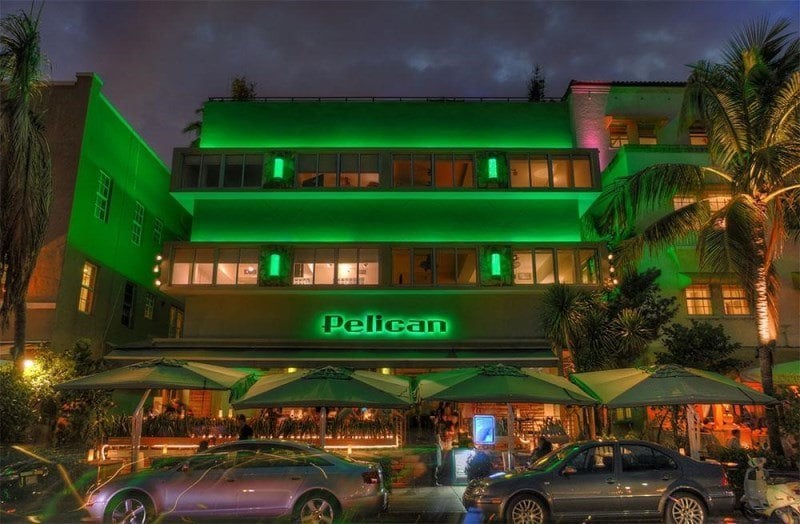

Stefano Frittella, owner of the Pelican Hotel in Miami, put the pressure Airbnb places on his hotel in numbers. “My average daily rates and occupancy have dropped very low as a result of this trend,” Frittella said. “My occupancy is down 22 percent from last year.”

“If Airbnb was serious about stopping landlords from running illegal hotels they could do it overnight,” Flannigan said. “Instead, they are forming partnerships with apartment buildings and landlords, ensuring the practice continues.”