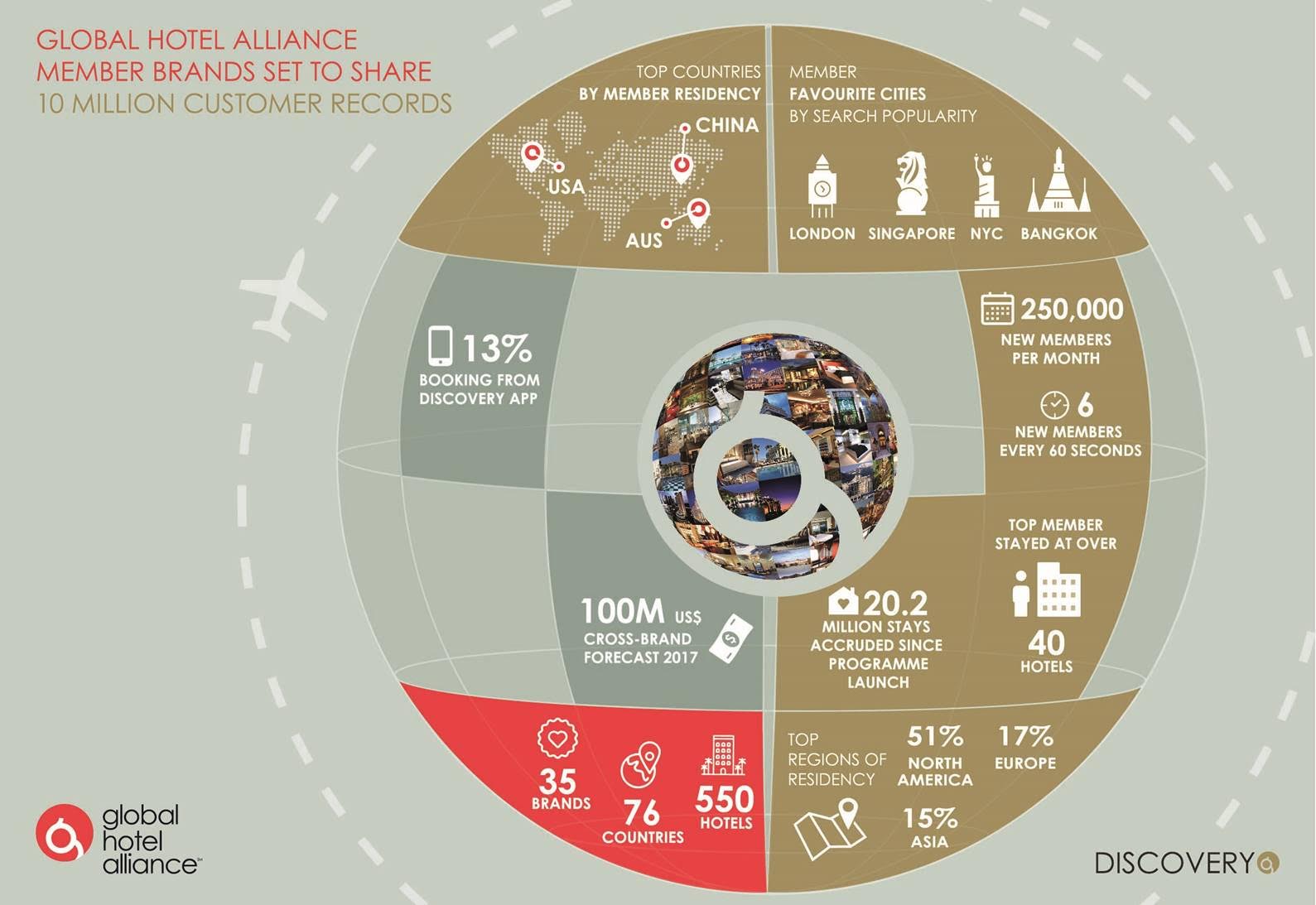

Global Hotel Alliance released a string of data and research about its multibrand, shared loyalty platform Discovery, as it prepares to welcome its 10 millionth member this month. GHA was created to help its 35 member brands to compete more effectively in the face of consolidation among major hotel companies and the growing marketing power of online travel agencies.

The Discovery loyalty program is growing by 250,000 new members each month. Discovery's marketing efforts encourage repeat stays in the same hotel or brand, which are forecast to hit $1 billion in 2017, and also incentivize “cross-brand” stays, with this incremental revenue stream forecast to exceed $100 million this year.

According to Chris Hartley, CEO of GHA, many participating hotels are getting several points in incremental occupancy at a much lower cost of sale through this shared approach to data ownership.

“We’re seeing cross-brand revenue grow consistently at 25-30 percent a year, as our database surges and our marketing and data science gets more sophisticated," Hartley said in a statement. "For some hotels, especially in key gateway cities, that can represent thousands of incremental roomnights, or as much as 5 percent in additional occupancy.”

Discovery's 10 million members are incentivized to try different brands through unique Local Experience rewards. Outrigger Resorts joined GHA in October 2016, and overnight was able to expose its Honolulu properties as well as those in Asia Pacific and the Indian Ocean to 4.5 million U.S.-based customers and millions more globally.

“That’s instant incremental business at a very low cost of sale,” Sean Dee, Outrigger’s EVP and chief marketing officer, said in a statement. “In just a few months we’ve already seen over 4,000 roomnights from Discovery members enrolled by other brands; but on top of that we’ve now gained a sophisticated CRM platform to further strengthen our own loyal customer base, with zero capital investment requirement.”

Kempinski Hotels, one of GHA’s founder members and shareholders, is currently opening the first luxury hotel in Cuba, and it will be able to target that same U.S. customer base, which will ensure instant visibility with an expectant audience.“Even as Kempinski opens its first hotel in the Americas, we already have access to millions of customers on our doorstep, most of whom have never set foot in Cuba, but have been longing for the opportunity to visit," Xavier Destribats, Kempinski’s COO of The Americas and managing director of the Kempinski in Havana, said in a statement.

GHA also launched its own Discovery app in 2016. “We’ve already received several million dollars of bookings on the app,” Folker Heim, GHA’s head of loyalty, said in a statement. “But the most interesting thing is that 55 percent of those bookings are customers trying new brands. And interestingly the No. 1 booking source is not the U.S., but China.”

With the company's China customer base approaching 700,000, GHA is opening a dedicated Chinese membership service center, and last month it added a Chinese language website. According to the company's CEO, GHA isn't stopping there.

“Our next big investment will be in data science and artificial intelligence,” Hartley said in a statement. “There’s no point in having a database of 10 million customers and sending them all the same content. While our marketing team can naturally spot trends, you need sophisticated algorithms to really figure out what drives behavior and choice.

"Recently we noticed, for example, that Norwegians are the biggest customers into Berlin for weekends in the spring [GHA has 225,000 members in Norway, which is 5 percent of their population], but data science will enable us to spot thousands of these trends, and then make sure we’re serving relevant content to those customers, that will drive bookings.”

GHA is also able to use extensive research with its Discovery customer base to hone not just its marketing efforts, but also its development strategy. “France and Italy are our members’ most popular destinations, but we have very few hotels in those markets, so naturally we’re talking to potential member brands with a strong presence there, demonstrating that we can create instant demand for their hotels,” Hartley said.