NEW YORK — STR and Tourism Economics have upgraded the recovery timeline for U.S. hotel revenue per available room. On a nominal basis, RevPAR is now expected to surpass 2019 levels in 2022, due to a +$11 adjustment in 2022 average daily rate. Occupancy for the year is projected to come in under the prepandemic comparable, while ADR and RevPAR are forecasted at $14 and $6 higher than 2019, respectively. Previous versions of the forecast projected nominal RevPAR recovery in 2023.

The updated forecast was released during this week's NYU International Hospitality Industry Investment Conference.

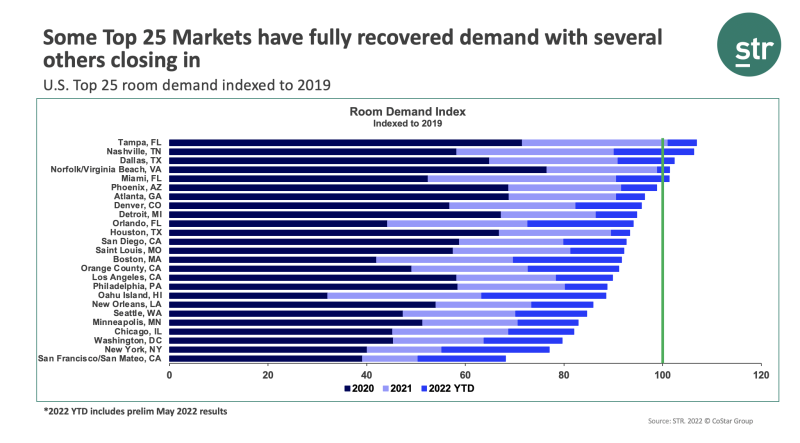

When adjusted for inflation, STR does not expect full recovery of ADR and RevPAR until 2024. Central business districts and the company’s top 25 markets are not expected to reach full RevPAR recovery until after 2024. Of those markets, Tampa, Fla., and Nashville are leading the way in terms of performance to 2019 levels for room demand.

“On the occupancy side, we have seen pretty regular almost every week gains and occupancy since Presidents’ Day weekend, and average daily rate is the shining superstar that I'm sure we're all talking about,” STR President Amanda Hite said during the "Statistically Speaking" panel. Year to date, average daily rate is running about $13 above 2019 performance levels, while demand has been running right around 95 percent of 2019 room levels since the middle of summer last year, she added, noting a “little blip” in January due to the omicron COVID surge.

In a statement released along with the updated forecast, Hite recognized that this latest forecast acknowledges the risk of a “light recession” with no anticipation of mass layoffs and household finances in a strong position to mitigate recession impacts. “The traveling public is less affected by recession, and right now, we are forecasting demand to reach historic levels in 2023 as business travel recovery has ramped up and joined the incredible demand from the leisure sector.”

At the same time, while the top-line metrics are set to reach full recovery on a nominal basis, Hite acknowledged that profitability has only started hitting 2019 levels recently. “Concerns persist around the cost of labor and services, and hotels in some major markets are still well behind in the recovery timeline. Our forecast revision next quarter will reflect any visible impact from recent Fed decisions on interest rates.”

Increased Discipline

Speaking with Hotel Management after the session, Hite noted increased discipline around the bottom line. “When we went through the pandemic, every operator had to go sit down and say, ‘Do I close my hotel or do I keep it open? What is my cash flow? How much money can I lose for how long before I have to make a different decision?’ And so there is an understanding of the bottom line in a different way than maybe we had before the pandemic.”

The outlook for hotel performance remains positive, according to Aran Ryan, director of lodging analytics at Tourism Economics: “Even as the economy faces headwinds of higher interest rates, volatile financial markets, and inflation, lodging demand and room rates are being buoyed by strong household finances and the return of business travel.”

Risk remains, but there are mitigating factors in play, said Tourism Economics President Adam Sacks.

“With the Federal Reserve rapidly tightening monetary policy to tame inflation, there is a risk that financial conditions, which remain very accommodative, start to tighten in a disorderly manner. This would risk abruptly slowing the flow of credit and weigh on corporate and business confidence, which would further restrain economic growth," he said. "Should a U.S. recession occur, it is anticipated to be less severe than the Great Financial Crisis, due to lower current overhang of financial imbalances. Elevated savings buffers among consumers, particularly those of higher income households, would also help mitigate the impact of a downturn to sectors such as lodging."