A new forecast released by PwC US found strong industry performance took place during Q4 2016, including positive trends in demand and average daily rate. This was boosted by a post-election surge in consumer and business sentiment resulting in improved economic conditions, which PwC expects to result in continued revenue-per-available-room growth in 2017.

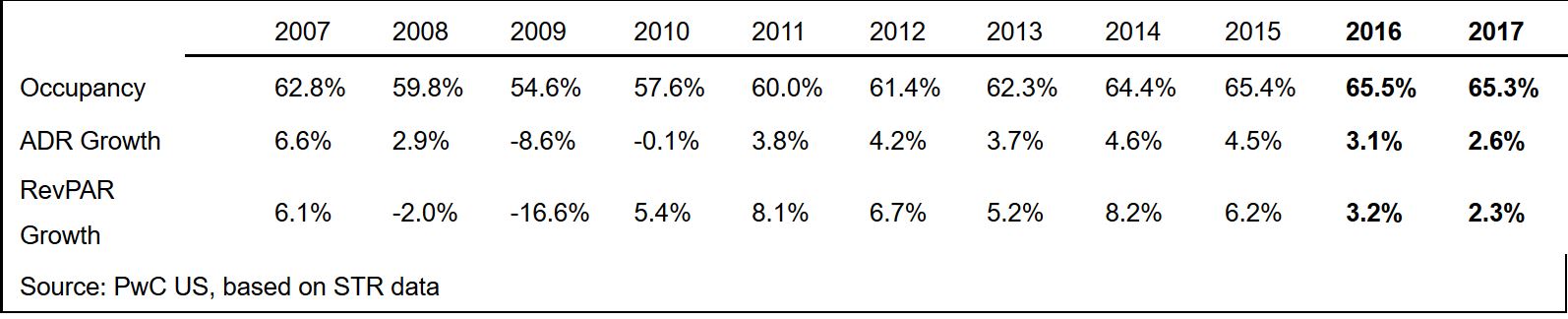

The forecast is calling for increased room supply to marginally outpace growth in demand for this year, resulting in an occupancy decline to 65.3 percent. This will be aided by an expected increase in corporate transient demand and improvements in ADR to drive RevPAR up 2.3 percent.

PwC draws its latest numbers from IHS Markit, which expects real gross domestic product to increase 2.3 percent in 2017 based on a fourth-quarter-over-fourth-quarter measurement. This is roughly 50 basis points higher than a forecast released in November by PwC, and is influenced by improving economic conditions traced to improving business and consumer confidence, positive financial markets and potential policy decisions focused on tax cuts and altered trade regulations.

“Based on a strong fourth quarter, we are encouraged by the trends we are seeing as we head into 2017,” Scott D. Berman, principal and U.S. industry leader, hospitality & leisure, PwC, said in the report. “However, we remain cautiously optimistic, as higher-than-previously anticipated increase in demand is still expected to be offset by increasing supply through the year.”

The updated estimates from PwC are based on a quarterly econometric analysis of the U.S. lodging sector, using an updated forecast released by IHS Markit and historical statistics supplied by STR and other data providers.