Data show that Hong Kong is one of the most expensive places in the world to live, in many instances ranking it No. 1. Suffice it to say, the bulk of the expense comes from an exorbitantly priced real estate and rental market—buoyed by low supply and a high concentration of expats.

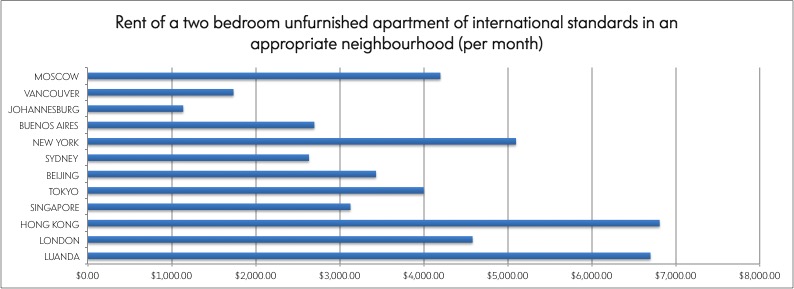

Consider this: In Hong Kong, it costs somewhere in the neighborhood of $1 million USD to buy 20.60 square meters of property. A two-bedroom apartment in a fair neighborhood by international standards costs close to $7,000 USD per month. For comparison's sake, take New York, where a two-bedroom, on average, will run around $4,800 per month.

Well, one compassionate Hong Konger has had enough of the prohibitive pricing and is petitioning the government to alleviate the situation. His solution: put hotel rooms up for sale or rent.

Indeed, William Cheng Kai-ming, who is the chairman of Magnificent Hotel Investments, a hotel owner and operator, is a proponent of the allowance and is actively asking the government to tweak policies that disallow the practice, as reported by the South Morning China Post.

Cheng discussed with SMCP the recent spate of buying tiny flats, which "saw prices of up to HK$25,000 per square foot," and "has helped to put a spotlight on the city’s stock of under-utilized hotel rooms."

“It is really outrageous. A tiny flat of 200 square feet or smaller will cost one’s life saving,” Cheng told SMCP.

Whether this is a magnanimous gesture or a financial one is anyone's guess. According to its website, Magnificent Hotel Investments has a seven-hotel portfolio, consisting of more than 2,000 rooms, the majority of which are branded Best Western hotels. According to the Hong Kong Tourism Board, the overall average hotel occupancy rate in the city, in 2015, was a robust 86 percent.

According to SMCP, shares in the Hong Kong-listed company have fallen 19.4 percent in the past year.

Still, Cheng went on to say that there are "tens of thousands" of unoccupied hotel rooms on urban areas—a claim that seemingly flies in the face of the data provided by the local tourism board.

“These hotel rooms are ready for occupation. More importantly, they are furnished and comply with high standards of fire safety which can provide a safe living environment,” he said.

But, he added that hotels away from the major tourism beltways, in places like Tsing Yi, Kwun Tong and Cheung Sha Wan, "were suffering from low occupancy rates amid a dramatic change in the tourism market."

The regulation, however, is this, and not unlike other international municipalities: hotels are prohibited from re-selling or renting out rooms for more than 30 days.

"Hong Kong is the only city in the world, I believe, which prohibits hotel owners from selling hotel rooms through a strata title structure," Cheng said. Strata title is a form of ownership devised for multi-level apartment blocks and horizontal subdivisions with shared areas. This form of title gives individual unit holders title over the space they occupy while the land and common property are controlled by the management corporation.

Elsewhere, for example, many hotels are constructed in a format such that there is a residential component and a hotel component that allows the property's owner to sell the residential units even before the property opens.

Cheng told SMCP that "it is significantly more expensive to build hotels than residential buildings because of stringent building codes." Hotels must, for example, meet a high standard for fire safety and have rapid-escape corridors. In recognition of these additional costs, the government is reportedly more lax when it comes to site use, allowing a plot ratio of up to 15 times, versus only eight times for residential projects. The is means that developers can yield higher gross floor area for hotels than for residential projects.

Cheng concluded that there was little risk an amendment would dramatically impact developer behavior: "The end effect would be more or less neutral in terms of profitability," he said.

A New Airbnb

In another twist, according to e27, Metro Residences, likened as Airbnb for business travelers, is expanding from Singapore to Hong Kong after raising $1 million in seed money.

Metro Residences is a web-based platform that offers serviced apartments for a minimum of 30 days. These residential units belong to investment property owners who earn the rental income.

“No two countries are alike, but it is no secret that Hong Kong and Singapore are very similar. Taking Singapore as a reference point, I think it is possible for [our] Hong Kong [business] to do very well,” Founding Partner James Chua told e27.