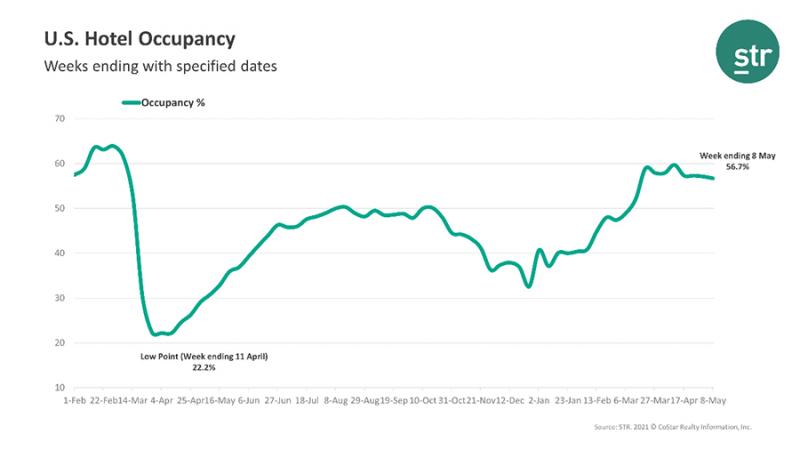

Due to more supply in the marketplace, U.S. hotel occupancy fell slightly from the previous week to an eight-week low, according to STR's latest data. For the week of May 2-8, occupancy was 56.7 percent, average daily rate was $110.19 and revenue per available room was $62.50.

While demand was up week over week, an increase in supply from both reopenings and new properties pulled national occupancy down. Major markets, such as New York City and San Francisco, are showing the most movement with properties coming back online.

Supply Gains

According to STR’s Market Recovery Monitor for the week, supply was up 0.8 percent week over week with more than 284,000 additional rooms available that week than in the previous one. The weekly gain was the most since last summer.

The largest supply gains were in the New Jersey Shore market, where 28,000 rooms came online ahead of the summer season, and in Alaska. Among the top 25 markets, Washington, D.C., led the pack with the addition of 14,000 rooms followed by New York City. Chicago and San Francisco also saw openings during the week.

Looking at the hotel stock by property size, large hotels (with 300 rooms or more) continued to lag with only 93 percent of the rooms available in 2019 opened today. The other size categories were slightly ahead of the stock they had in 2019.

Top Markets

Among the top 25 markets, Miami (72 percent) and Tampa, Fla., (69.8 percent) experienced the highest occupancy levels, while San Francisco/San Mateo (40.9 percent) and Boston (42.3 percent) came in the lowest.

The aggregate occupancy for the top 25 markets (54.3 percent) was lower than all other markets on average, but ADR in the major markets ($119.14) was higher.