HVS’ latest FHRAI Indian Hotel Survey examines the performance of hotels in several key cities over 2015 and 2016. Here are six major takeaways.

1. The country's numbers are improving

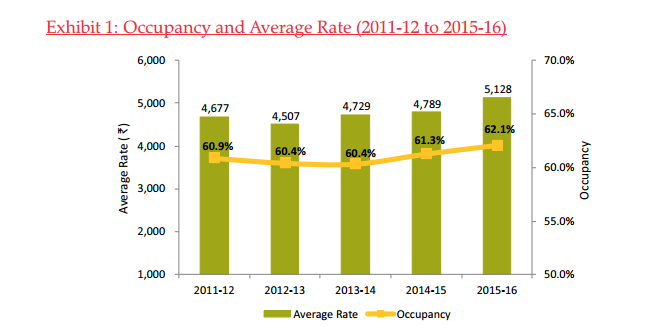

Countrywide, the average daily rate registered in 2015-16 was Rs 5,128 ($USD 76), the highest recorded since 2009-10. Similarly, occupancy continued to improve, recorded at 62.1 percent in the previous fiscal year

2. Bengaluru is hot

Hotels in Bengaluru (formerly Bangalore) saw a surge of 15.3 percent in marketwide RevPAR over the course of 2015 and 2016, surpassing the other major hotel markets in the country. Driven mainly by occupancy growth, the city's hotels also displayed a marginal increase in average rates, ending a four-year downward trend. The fact that the resilient market performance was accompanied by a 6-percent growth in supply bodes well for the city that is expected to add approximately 3,500 rooms in a phased manner over the next five years.

The city, however, continues to face challenges, mainly due to the “paralyzing infrastructure” and lack of a convention center built to international standards. HVS, however, remains “extremely optimistic” about the city’s hotel market performance, with a steady increase in RevPAR anticipated for the next three to five years.

3. Chennai on the rebound

In spite of devastating floods in late 2015, Chennai’s hotel market continued improving. Several new properties opened within the city, including the InterContinental Resort, Fortune Select Grand and Turyaa by Heritance in the last calendar year alone. All the micro-markets in Chennai recorded a growth in occupancy in 2015-16, while average rates declined marginally. More than 1,000 new rooms are expected over the next two years, and a growing MICE scene will boost the city’s appeal for developers.

4. Kolkata is changing

For the first time, hotels in Kolkata (formerly Calcutta) are now divided into two distinct micro-markets—the city hotels, which serve the CBD and south-western industrial corridor, and hotels along the eastern periphery (serving Rajarhat, Salt Lake and the EM Bypass).

In 2015-16, while room night demand had not witnessed noteworthy change, demand from the commercial and extended-stay segments grew proportionate to that of commercial/industrial activity in Kolkata. Leisure demand improved marginally in this market, which HVS attributes to initiatives like new river cruises, which attract foreign tourists to the city.

HVS expects approximately 3,000 rooms to enter the market over the next five years. Due to the micro-market distinction, the impact on existing hotels may be cushioned to some extent; however, it is likely that the city hotels will experience supply pressure.

5. Mumbai is ripe for investment

Mumbai's hotel market reached the highest occupancy recorded over the past four years compared to all major markets across the country. The city also saw the highest ADR, making it the best performing hotel market in terms of RevPAR too.

A closer look at Mumbai's three micro-markets—South, Central and North Mumbai—which have minimal overlap in room-night demand, revealed an increase in occupancy and ADR in each. HVS attributes strong growth in corporate travel, an upswing in MICE demand and the growing extended-stay segment for the improvements.

In the short term, the bulk of the supply is expected to be within the upscale and luxury segments, which should help increase ADR city-wide. In the medium to long term, HVS expects the Mumbai International Airport Limited landside development (which includes several new hotels) to also improve the city’s hospitality scene. Upcoming improvements in infrastructure the Coastal Road, the extension of the Metro and Monorail and a proposed convention center are also poised to assist in hotel performances. Going forward, HVS forecasts steady growth in the city's performance in the coming years.

6. New Delhi is a mixed bag

New Delhi is home to the largest branded hotel market in the country. In spite of supply pressure, the city’s hotels recorded a year-on-year RevPAR growth in 2015-16. Not all areas saw similar numbers, however: The Aerocity hospitality district saw an increase in occupied room nights driven by growth in corporate, transient and MICE demand. The demand previously catered to by the independent sector in the area has been absorbed by the branded mid-market and budget hotels. On the other hand, Central, South and East Delhi hotels saw average rates decline as they fought to compete with Aerocity. This resulted in a drop of 4.6 percent in market-wide ADR which was, however, compensated by a solid 8.2-percent growth in occupancy over the previous year.

HVS expects that the city will add approximately 2,800 rooms over the next five years, with the major part of the supply in the upscale and mid-market positioning. However, demand for room nights does not show signs of slowing down, and given that the existing hotels are moving towards a rate-driven strategy, the market is expected to absorb the new supply successfully over the medium term. Therefore, the outlook for the New Delhi market remains positive.

HVS is pleased to release the 19th edition of FHRAI #Indian #Hotel Industry Survey 2015-16 | DOWNLOAD FULL REPORT: https://t.co/WONzYB11ES pic.twitter.com/tiTFF8yEJ7

— HVS (@HVS_Consulting) February 2, 2017