As the end of second quarter approaches, it’s increasingly apparent that the hotel lending landscape has become more complex in 2016. In fact, EY’s “Global Hospitality Insights: Top 10 Thoughts for 2016” is proving an apt assessment of the current lending environment, particularly as it pertains to commercial mortgage-backed securities. CMBSes started to trend downward in the final quarter of last year due to widening spreads and increased regulation, despite having been the largest source of debt for the U.S. hotel sector recently, comprising 39 percent of originations in 2015, according to EY.

Nevertheless, EY forecasted global hospitality investment to “remain favorable in 2016, buoyed by the continued expansion of equity, debt and emerging financing platforms.”

Strong Interest

According to Herb Warmbrodt, president of Warmbrodt Hotel Investments, the number of buyers interested in investing in hospitality remains ample, from his perspective. “Now the issue is becoming the disconnect between the ask and the bid,” he said. “Metrics are showing slower growth, particularly in [revenue per available room]… and so there is the concern on the investment side that we’re pushing to a peak.”

He went on to say that sellers are not necessarily factoring in the changing metrics as they hope to sell on lower cap rates while lenders are pushing up rates and thus, adversely affecting the cap rates at which properties sell.

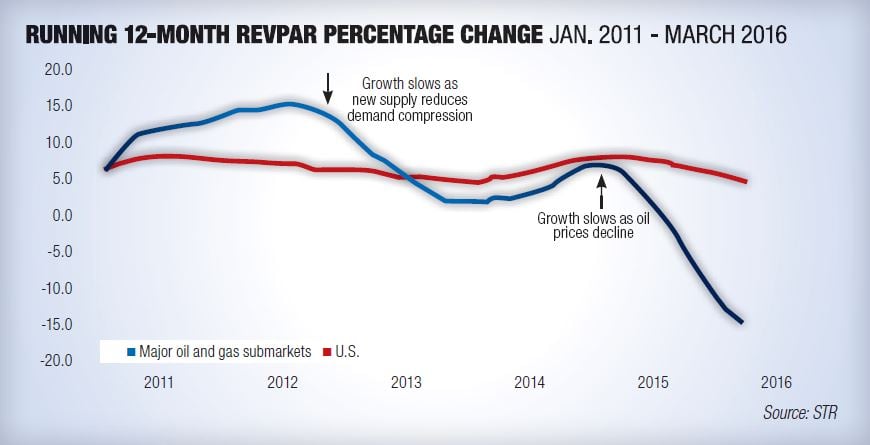

Warmbrodt has also noticed a growing number of buyers seeking distressed opportunities in certain energy markets, where a steady pipeline of supply is outpacing a slowing demand caused by low oil prices. Through the first quarter of this year, the 20 submarkets that STR identifies as having the vast majority of hotel rooms and that are primarily driven by the oil and gas industry reported an 8.8-percent decline in demand and a 3.7 percent increase in supply.

“We work with a number of people who would like to play in this space on a distressed basis and typically when lenders reach out to us, they’ve already taken over the project or put a receiver in place to take over the management,” Warmbrodt said. “We’re going to see more of that over the course of the next 12 to 18 months without a doubt.”

Asian Capital

EY’s report also cites continued capital flowing from Asia where investors are “attracted by high property yields and safe investment environments abroad.” Asian cross-border hotel transactions reached $11 billion by the end of last November, a 24-percent year-over-year increase. China’s cross-border hotel investment volume also increased from $240.5 million in 2011 to $4.9 billion last November, much of which was driven by Anbang Insurance Group’s $1.95-billion acquisition of New York’s Waldorf Astoria Hotel, which was announced in October 2014, and Sunshine Insurance Group’s $230-million acquisition of the Baccarat Hotel, also in New York, in early 2015.

According to Fitch Ratings, “Historically, this type of activity, rich property valuations paid by less-established (often international) market participants, has corresponded with U.S. CRE (commercial real estate) cycle peaks. This cycle could be shaping up to follow a similar path.”

Future Climate

While the general consensus among hotel investment professionals and hoteliers is that another recession is not expected this year, hoteliers are nonetheless devising strategies to safeguard their brands against future economic turmoil. Jamie Sabatier, president and COO of Destination Hotels, said that the scale created through the management company’s merger with Commune Hotels earlier this year is providing both businesses with a competitive edge from which owners are already seeing gains.

“There is some RevPAR deceleration taking place in the market and so I don’t think anyone can be reliant simply on market growth,” Sabatier said. “We’re creating upside through what we bring to the table from an operating standpoint.”

He adds that on the profit-and-loss side, the two companies are leveraging their combined scale to buy more effectively and so have already lowered distribution costs. “The merger plays well into the current market climate because over the next few years, the winners are going to be those who can drive market-share gains and strong profit margins.”

Expanded Offerings

In February, Choice Hotels announced Vacation Rentals by Choice Hotels, which will offer properties in 11 leisure markets across the U.S. “There’s been a major shift and mega trend in terms of where the consumer is now considering in terms of their travel choices and vacation rentals are now a $25-billion market,” said Stephen P. Joyce, CEO of Choice Hotels.

The brand is intended to compete with Airbnb, but Joyce pointed out that Choice will also be working with management companies, not independent property owners, in order to ensure consistent check-in and check-out experiences. Vacation Rentals by Choice will also be integrated with the Choice Privileges rewards program.

In March, Choice Hotels also announced a new strategic venture with CapStar Hotel Company to drive a new conversion strategy for Cambria Hotels & Suites, Choice’s flagship brand in the upscale segment. The strategy is focused on top urban markets and leverages adaptive reuse properties. Already more than 30 new locations are in the pipeline.

“On the investment side, we’re putting our dollars in Cambria and in urban markets,” Joyce said. “The bulk of the investing is primary and mezzanine lending, but we’re also doing equity as that’s what the partners we’re working with want to do and we’re also doing forgivable key money. We’re underwriting at high teens, low twenties in terms of return.”

Joyce said that Choice is investing between $80 million and $100 million into the brand’s urban market expansion because it’s lacked a presence in major gateway markets despite the demand.

Different Approach

At Philadelphia-based AMResorts, which manages all-inclusive resorts across Mexico, the Caribbean and Latin America and which benefits from the distribution channels of parent company Apple Leisure Group, economic cycles have virtually no impact on the company’s contract signings. Conversions and rebrandings are typically the product of a down market when owners are concerned about occupancy levels while the company signs more contracts for new builds in a bull market, when investors and real estate developers are out in full force. More than 60 percent of the new deals that Apple Leisure Group has signed over the past two years have been for new builds.

“Regardless if the economy is in good shape or not, we do well because [the vertical integration of] our business is complementary and as a hotel management company we grow regardless,” said Javier Coll, EVP and chief strategy officer for Apple Leisure Group.