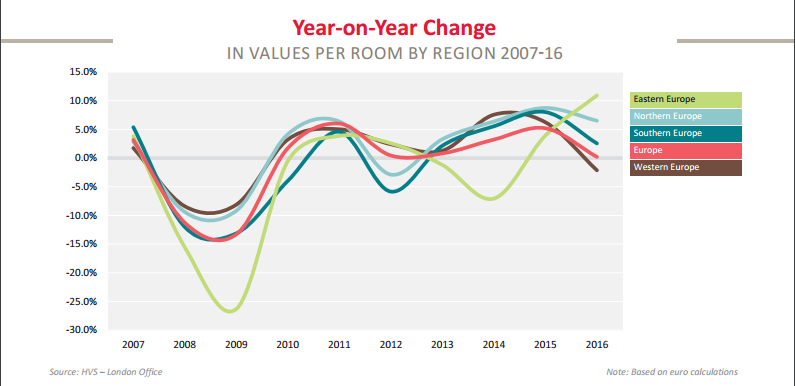

Hotels in Eastern Europe are benefitting from Western Europe's recent struggles, with room values in the region seeing 11 percent average growth.

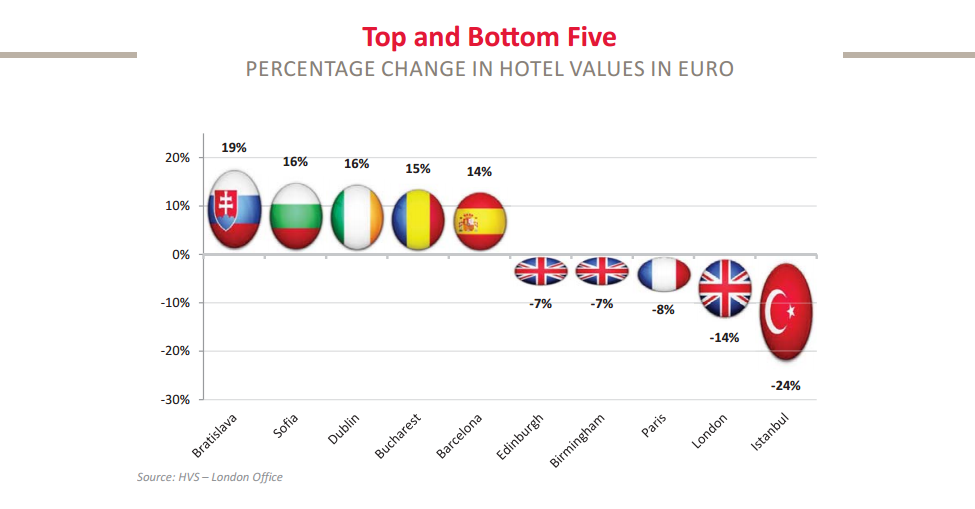

According to HVS' 2017 European Hotel Valuation Index, in a year that saw little change in values across the rest of Europe, hotels in Bratislava topped the list of value rises, up 18.9 percent year-on-year, while hotel room values in Sofia rose 16 percent. Bucharest saw hotel room values up 14.6 percent, while those in both Budapest and Prague were up 9.9 percent.

Why the East is Winning

While many Eastern European markets saw their hotel room values rise from a relatively low base, their new affordability has helped build a strong demand base as holidays in the Eurozone become more expensive, particularly for British citizens.

“Many Eastern European markets are benefitting from the misfortune of Western Europe,” report co-author Nicole Perreten, senior associate, HVS, said in a statement.

Following a strong 2015, Dublin was once again in the top five. Hotel values in the city saw a 15.5 percent rise in 2016 on the back of double-digit RevPAR growth due to limited supply. This let hotels in Dublin grow occupancy levels as well as average rates.

Hotels in Barcelona also experienced a record 2016. Following strong rate growth, values per room rose 13.8 percent. Stricter regulation on new hotel development will further strengthen performance in Barcelona, bolstered by a strong conference program this year and next.

The strengthening rouble and a slow recovery in oil prices has seen Moscow’s hotel values per room rise 16.7 percent in local currency as its economy comes out of recession. Moscow has a strong hotel pipeline with over 6,000 rooms coming on-stream over the next 18 months.

Why the West is struggling

Terrorism, Brexit and an unknown future for the Eurozone have led to a decrease in values per room of around 2.1 percent in Western Europe.

In London, hotels showed a softening of values in local currency following a slow start to 2016 and performance growth only in November and December 2016. The anticipated boom in visitation prompted by a fall in sterling failed to materialise immediately and an influx of new supply limited occupancy growth.

Edinburgh, however, saw sterling values rise 5.3 percent on the back of impressive occupancy levels of over 80 percent in 2016, while Birmingham saw sterling values rise 5.1 percent benefitting from increased leisure tourism.

“Regardless of political emotions coming our way, values in Europe still have some room for growth, as markets such as some of the PIGS countries continue to climb the value ladder to their rightful positions,” added Sophie Perret, director, HVS.

“A subdued pipeline, coupled with decent demand growth, and room for growth value-wise if compared to 10 years ago, all bode well for Europe in 2017, although with moderation.”