At the International Hotel Investment Forum (IHIF), flooring in March, in Berlin, Robin Rossmann, managing director of STR, will take part in a unique panel entitled: Hotel Investment Today. The quick-fire session will be include short talks on the hospitality industry. In Rossmann's case, he will offer a concise report on industry metrics.

Here, Rossmann gives a preview of some of what he'll be speaking about at IHIF: the good, the bad and the ugly.

Overview

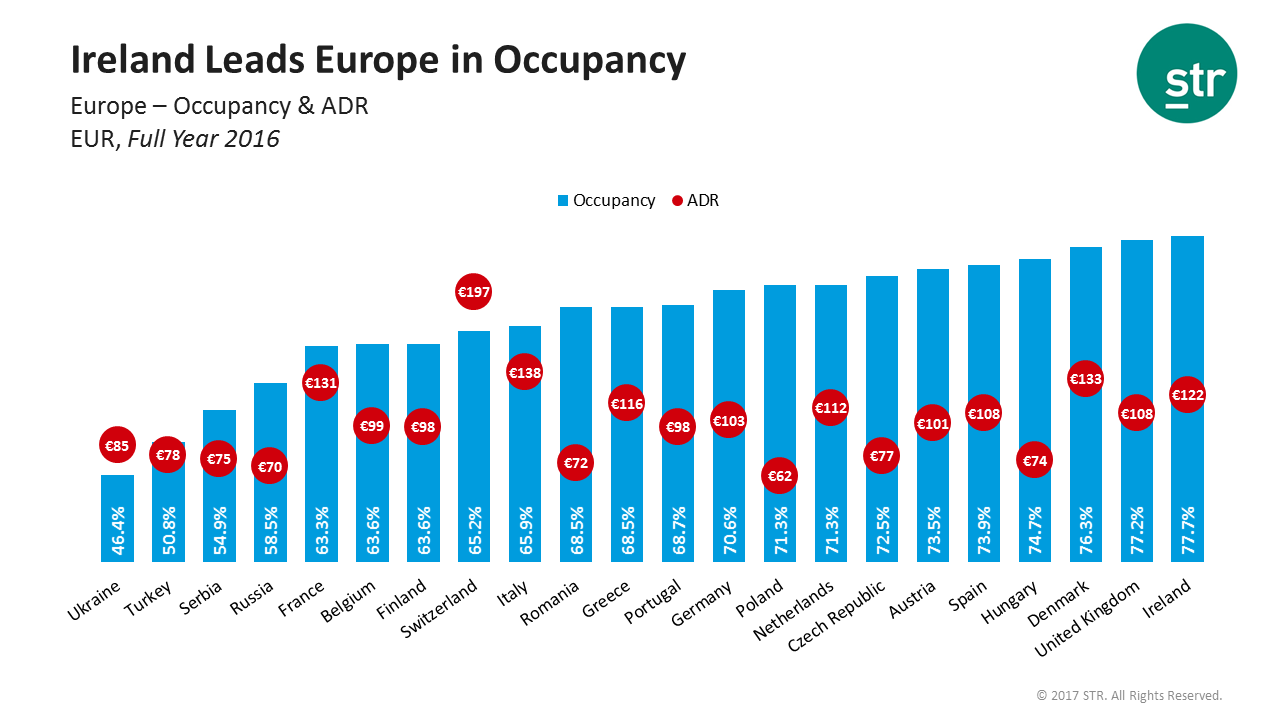

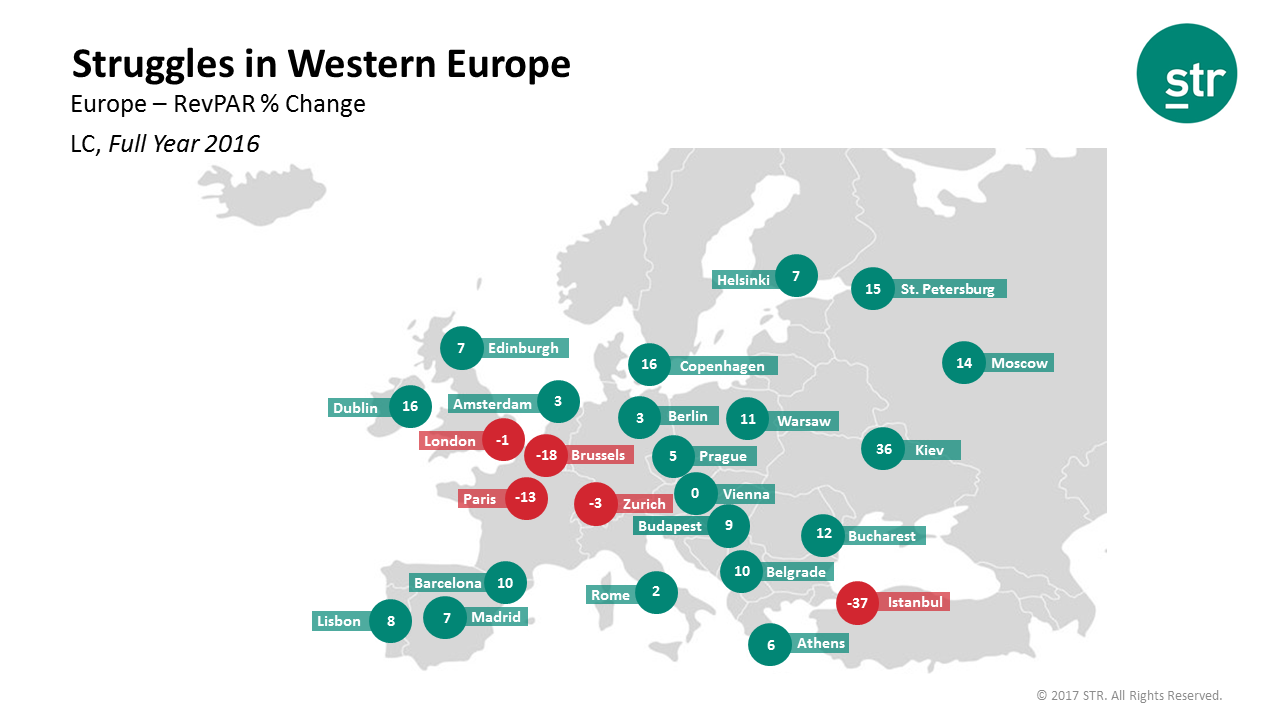

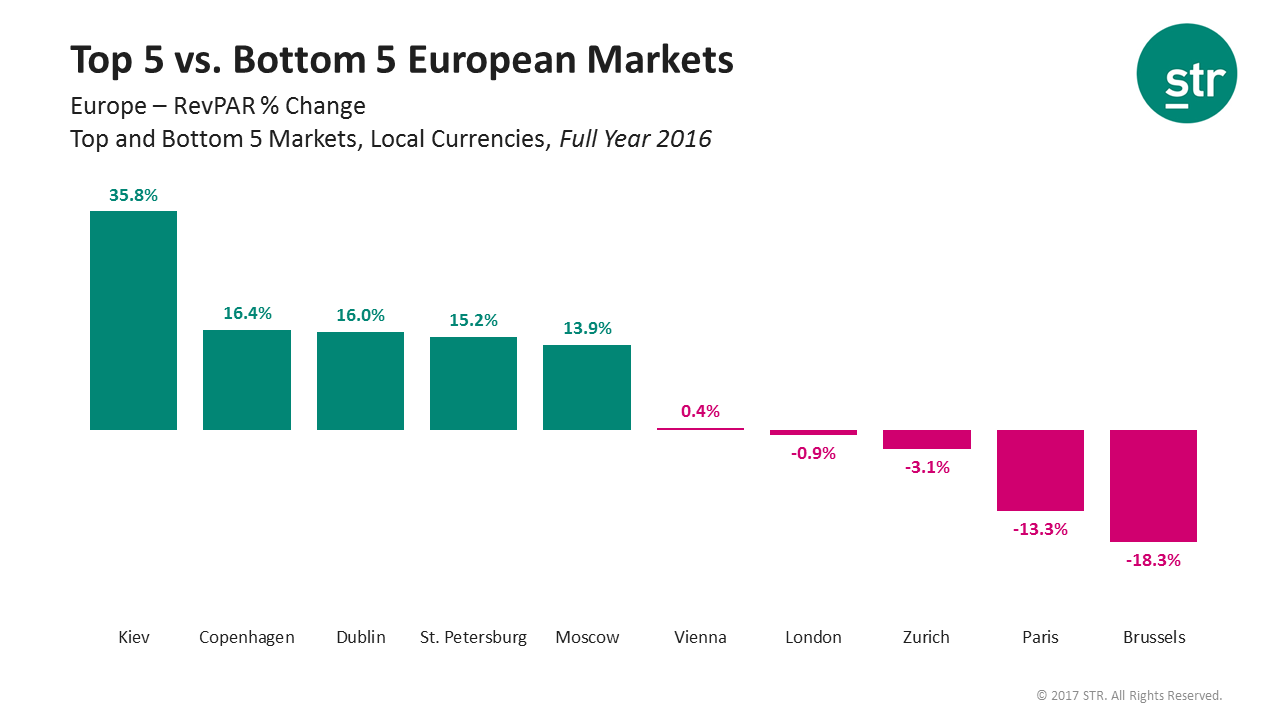

Europe, not unlike other parts of the world, had its ups and downs in 2016. This certainly was the case on the hospitality front. While some European hotel markets struggled, others posted substantial performance growth. For major European cities, Dublin was at the forefront, with a 16.6-percent increase in revenue per available room (RevPAR). Meanwhile, Paris and Brussels continue to struggle, both weighed down by the impact of terror attacks and recording double digit RevPAR declines.

In terms of supply, the UK remains the development hotspot of Europe, with 43,000 new rooms set to come online over the next year. London alone has more than 15,000 rooms in the pipeline, which is higher than any other European country except for Germany and Russia.

Market Insights: London, Berlin, Madrid, Paris, Brussels, Istanbul, Rome

London hotels struggled throughout most of 2016. This was due to a significant uptick in supply growth and mild aftershock from the November 2015 terror attacks in Paris that trickled into the first few months of the year. Performance, however, began to pick up toward the end of the year, and December marked the city’s highest year-over-year RevPAR growth since the 2012 Olympics. The sterling devaluation following the Brexit vote has made the UK a more affordable destination for many leisure visitors, namely from the U.S.; nonetheless, we’re expecting 2017 to be a tough year due to continued supply growth.

Berlin posted its 7th consecutive year of occupancy growth, despite significant increases in supply throughout the same time period. We have not seen any immediate impacts of the attack in December, but, of course, we’ll be keeping an eye on how the market performs in the first few months of 2017. Overall, demand has been strong in the city, with a lot of business driven by events and corporate business.

Hotels in Madrid posted a near 7-percent growth in RevPAR, aided by strong domestic demand and 3.2-percent GDP growth for Spain in 2016. The market has also benefitted from shifted international demand from other European destinations and Northern Africa destinations, as Madrid and Barcelona have, of recent, been considered relatively safe destinations.

Following the major attacks in Paris, in 2015, as well as the July 2016 attacks in Nice, hotels in the French capital have struggled, with a near 15-percent year-over-year drop in RevPAR. Even the summer UEFA tournament did not have much of an impact on performance.

Brussels also had a significant 18-percent RevPAR decline due to terror attacks and an extended lock-down. As STR reported earlier this year, it historically takes hotel markets about three months to stabilize following an attack; however, Paris has recorded 13 consecutive months with RevPAR declines and Brussels has recorded 8 months with RevPAR declines, so ongoing security concerns have heavily impacted performance. December 2016 was the first month showing positive RevPAR growth for both these cities and we expect performance to stabilize in 2017 if there are no further attacks.

Istanbul has recorded a 39-percent decline in RevPAR, struggling from the ongoing attacks in the market as well as domestic and international political issues. In Istanbul’s case, it remains to be seen when the market will be deemed as a safe destination again, and how long afterwards it will take for hotel performance to bounce back.

Rome posted a 2-percent growth in RevPAR in 2016, mainly driven by rate growth. Overall, the city has had latent demand growth, but there is not a substantial amount of supply development in the market, which should give occupancy and average daily rate a chance to grow.

Robin Rossmann leads STR’s operations across the Europe, Middle East, Africa, Asia Pacific and Central and South America regions. Prior to STR, Robin was a senior director in Deloitte’s Global Hospitality Advisory Team in London.