April showers may have dampened hotel investment for the month, but it wasn't a washout.

According to fresh data from Real Capital Analytics, an analytics firm focused on the capital investment markets for commercial real estate, the U.S. hotel sector posted a 4-percent year-over-year decline in investment activity, in April, on sales of $2.4 billion.

But there's a bright spot. While April was a decline, this monthly pace marks the hotel sector as the strongest for the month; others posted double-digit declines.

These positives come from 29-percent YOY growth in portfolio and entity-level transactions.

- Single asset deals were off 8 percent YOY in April on sales of $2 billion. While volume is off, the trend is improving with single-asset volume off 63 percent YOY back in Febru-ary. That fall was due to single-asset sales in the full-service hotel sector, which has posted declining YOY volume in each month of 2016. Deal volume was down 25 percent YOY for single-asset sales in the limited-service sector in April, but for 2016 year-to-date is still 12 percent ahead of the pace from the same period in 2015.

- Portfolio and entity-level sales were up 29 percent YOY in April, but with volume of $400 million, this movement is a story of a small number growing quickly. The pace of these megadeals for the first four months of 2016 is well behind that seen a year earlier; sales of $1.4 billion versus $6.9 billion.

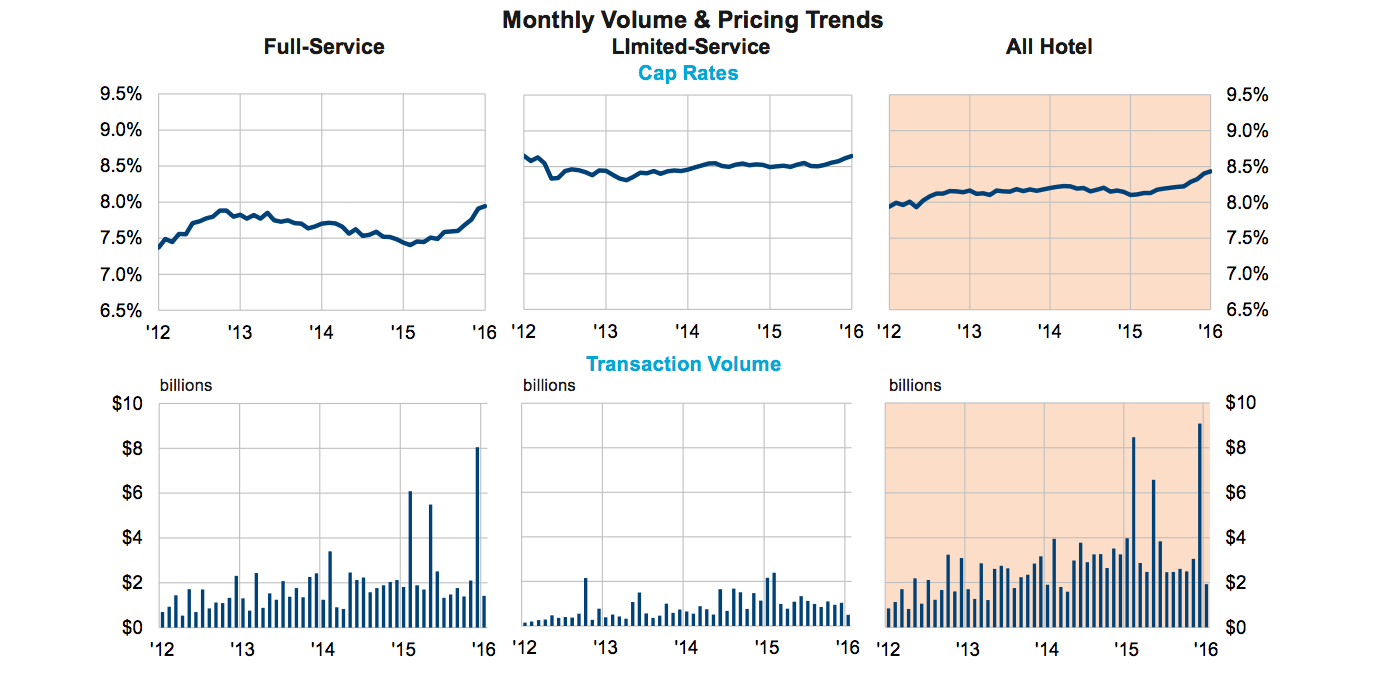

- Cap rates have crept steadily upward over the last year hitting 8.5 percent in April. This creep totaled 40 bps over the year with most of the movement in the full-service segment; up 60 bps to hit 8.0 percent in April.