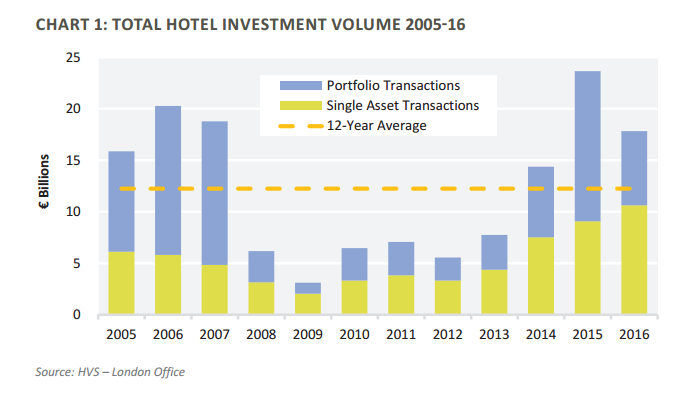

According to HVS’ annual European Hotel Transactions report, deal volume across Europe reached €17.8 billion in 2016—a decline of 25 percent from the previous year’s record numbers.

The decrease in transaction volume was predominantly driven by 2016’s inability to keep pace with the “extremely active” portfolio transactions market in 2015—€7.2 billion in 2016 compared to €14.6 billion in 2015—a decline of more than half. However, total single asset volume (€10.6 billion) reached a new peak, up almost 17 percent year-on-year and 73 percent on the pre-recession peak in 2005.

The majority (83 percent) of total investment volume was acquired by European players, totaling €14.8 billion of acquisitions (up from last year’s 40 percent). The market saw a large fall in North American, Middle Eastern and Asian investors’ investments, by about 88 percent, 70 percent and 61 percent, respectively, and, of the €980 million of Asian inflow, almost 40 percent was invested in London.

“The new normal, in a period of political uncertainty, Brexit and low interest rates seems to be a race for fixed income hotel assets, as a variety of investors reach to hotels as an alternative in the search for yield,” report co-author Peter Szabo, analyst, HVS London, said. “Despite the lack of stock, appetite for hotel assets will likely be strong in 2017 until interest rates turn and pricing levels adjust across the spectrum.”

Key Players

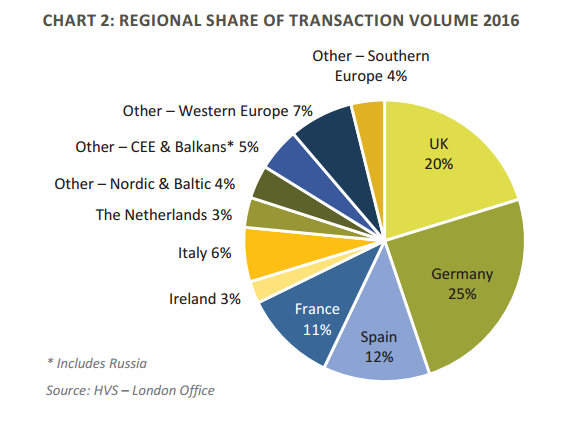

For the first time ever, Germany’s hotels took top place for 2016, knocking the UK down to second with transaction volumes reaching €4.4 billion, including €2.45 billion-worth of portfolio assets, a 30 percent rise on 2015. Single-asset transactions in Germany were valued at €1.95 billion. Notable deals included the sale of the Hyatt Regency Düsseldorf to Algonquin and Aviva France’s Primotel Europe fund and the sale of the Grand Hotel Taschenbergpalais Kempinski in Dresden.

Despite a 70-percent fall in transaction levels, the UK was still the second-best performer in Europe. Of its total volume of €3.6 billion, €2.1 billion were single asset transactions. Portfolio transactions fell 83 percent year-on-year to €1.5 billion (£1.2 billion). This could easily be attributed to the pound losing 10 percent of its value between 2015-16, as well as the long-term Brexit effect. And if the UK as a nation saw a decline, London is doing well as the leading European hotel transaction market, with a total volume of €1.8 billion.

Transaction volume in France, meanwhile, grew in 2016, up from €1.5 billion to €1.9 billion. Single-asset transactions grew by 130 percent year-on-year, although operating performance continues to struggle in Paris and Nice—the sites of notable recent terror attacks that have affected visitor numbers.

In Spain, market fundamentals continued to improve last year, with the country showing a 12 percent increase in transaction activity to €2.1 billion. Ireland and Austria also showed a rise in transaction activity in 2016.