News that China's Anbang Insurance Group had put in an unsolicited bid as one-third part of a consortium to acquire Starwood Hotels & Resorts, mere weeks before Starwood's deal with Marriott was set to close, while a bombshell, isn't all that surprising.

In fact, a timeline of events makes it clear and outlines how it is now easier for Chinese insurance groups, including Anbang, which made a splash in 2014 with the purchase of the iconic Waldorf Astoria in New York, and Sunshine Insurance Group, which acquired the Baccarat Hotel, also in Manhattan, not too long after, to invest overseas.

What is Anbang Insurance? – The Short Answer

In October 2012, the China Insurance Regulatory Commission (CIRC), an agency of China authorized by the State Council to regulate the Chinese insurance products and services market, issued new rules allowing insurers invest up to 15 percent of total assets overseas. Prior to the change, the percentage stood at 5 percent.

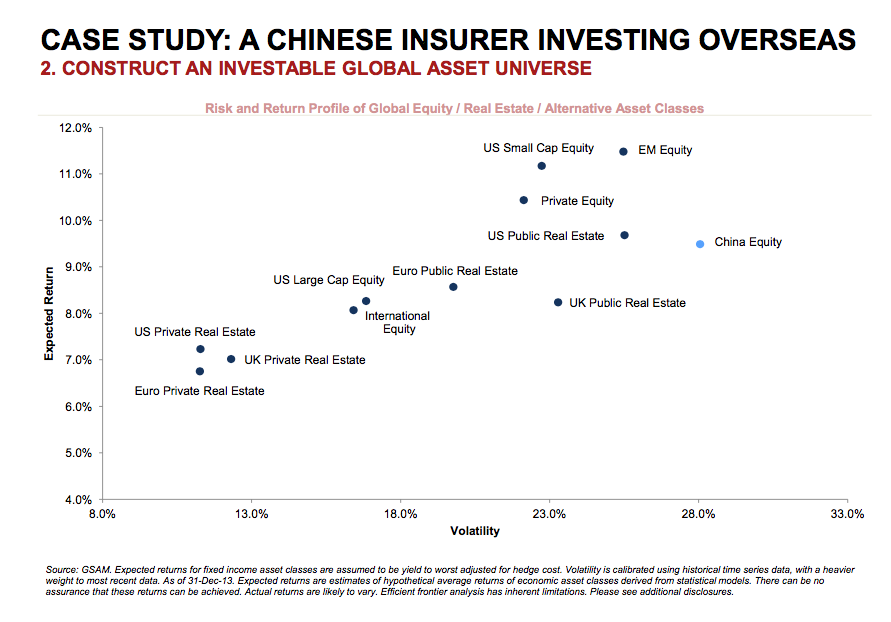

A recent case study presented by Russell Gao, a Goldman Sachs VP, demonstrated that Chinese insurers investing overseas "can bring significant benefits from potentially higher investment returns and from greater risk."

Buying Bonanza

Already, then, China was poised to continue cross-border investment into the U.S. That's when the U.S. sweetened the pot even more.

In December 2015, President Barack Obama signed into law a measure easing a 35-year-old tax on foreign investment in U.S. real estate—the move serving as further enticement for overseas buyers to purchase property in the U.S. The provision waived the tax imposed on such investors under the 1980 Foreign Investment in Real Property Tax Act, known as FIRPTA. In addition, funds can now buy up to 10 percent of a U.S. publicly traded REIT without falling under FIRPTA. The limit had been 5 percent.

“FIRPTA has historically made direct investment in U.S. property a non-starter for trillions of dollars worth of foreign pensions,” James Corl, a managing director at private equity firm Siguler Guff & Co., told Bloomberg. “This tax-law modification is a game changer.”

"The current volatility in China has underscored for Chinese investors the importance of diversifying their investments into the U.S. and elsewhere," Sam Chandan, a professor at the Wharton School of the University of Pennsylvania, told CNBC. "It does, however, raise the possibility of a policy intervention on behalf of the Chinese government that will limit capital outflow and roll back some of the liberalization at least temporarily." Some of this has already begun to take shape.

More to Come

Still, capital continues to flow out of China. The U.S., in particular, is viewed as a safe haven for Chinese companies and investors to place money—and there is no safer, less-volatile asset class than real estate.

That's just why Anbang, as a precursor to its bid for Starwood, announced it had come to terms with Blackstone Group to acquire REIT Strategic Hotels & Resorts for $6.5 billion. Talk about a flip: The agreement with Anbang comes just about three months after Blackstone completed its acquisition Strategic for around $4 billion.

Blackstone to sell Strategic Hotels & Resorts to Anbang

Strategic Hotels' portfolio is comprised of 16 properties with 7,532 rooms as well as meeting and banquet space. Among the properties are Ritz-Carlton locations in California, the Fairmont Scottsdale in Arizona, and the Four Seasons Resort in Jackson Hole, Wyoming.

There doesn't appear to be a slowdown in cross-border investment from China any time soon. The confluence of a safe market (the U.S.) mixed with a tenuous, slowing economy (China) is an impetus for Chinese companies to see diversification.

Meanwhile, Chinese capital is ruining Marriott's best-laid plans. According to a Baird equity note this morning, "the Anbang-led consortium's non-binding $76/share bid for Starwood's hotel business represents a 13.0-percent premium to the implied value of Marriott's proposal; if this bid becomes binding (the consortium has diligence rights through March 17), we would view the consortium's bid, which represents 13.7x 2016E EBITDA (inclusive of the termination fee), as superior to Marriott's mostly stock consideration."

But will it be accepted? The Baird note supposes that Marriott will not likely increase its bid until consortium's bid is binding. Marriott's waiver allowing Starwood to engage in discussions with and provide diligence materials to the consortium expires at the end of the day on March 17, which affords limited time to review financials and submit a binding offer.

Still, Starwood's board remains a backer of the Marriott deal. Starwood has stated that it sees long-term value in Marriott's stock and expects a combined platform will create additional value.

If Starwood does end up accepting a binding bid from the consortium, Marriott would be due a $400-million termination fee.

"These are turbulent economic times, and yet we see Chinese companies acting with confidence and continuing to make major moves in Europe and North America," Michael DeFranco, chairman of the global mergers and acquisitions practice at law firm Baker & McKenzie, told the Los Angeles Times.

According to commercial real estate services firm CBRE, Chinese outbound capital flows into global commercial real estate markets have now exceeded $10 billion in a year for the first time ever as of 2015. And, according to JLL, Chinese investors had $1.9 billion in U.S. real estate acquisitions during the second quarter of 2015.