U.S. hotel demand and average daily rate on a nominal basis are set to approach full recovery in 2022, according to the upgraded forecast released by STR and Tourism Economics at the 43rd Annual NYU International Hospitality Industry Investment Conference. At the same time, revenue per available room on a nominal basis is projected to be fully recovered in 2023.

“This has been, for sure, the most difficult year to try to forecast,” said STR President Amanda Hite as she presented the new data, noting that a pandemic is a disruption rather than a traditional economic cycle. “It's really hard to get it right.”

The new forecast essentially moves the top-line recovery timeline up by one year to 2023, although Hite noted the improved RevPAR projections are on a nominal basis. On a real basis ADR and RevPAR improvement won’t reach 2019 levels until 2025. The industry has reported “really steady gains” throughout each month over the course of the year, Hite said, noting that RevPAR, on a nominal basis, has gotten back to 2017’s numbers. “On an inflation-adjusted basis, we're currently about 25 percent below our prior peak in RevPAR, which was actually in 2018,” she added.

“Travel activity entered the fall with strong momentum. With improving public health conditions and sustained economic recovery, additional business and group travelers are expected to join leisure travelers, supporting further gains next year,” Aran Ryan, director of lodging analytics at Tourism Economics, said in a statement. “The demand recovery, coupled with successful revenue management, has supported resilient hotel pricing, helping shorten the time it will take to recover 2019 revenue levels.”

STR expects leisure travel to remain strong, and group and business travel is likely to follow suit in 2022. “2022 is going to be a very positive year,” Hite said. “With today's reopening of international travel, we have every piece of the demand segment back now that we need to put the pieces of the puzzle together for a full recovery.”

HVS Looks at the Labor Crisis

Rod G. Clough, president of HVS Americas, said that occupancy is being driven by longer length of stays, from 1.2 nights to 1.7 nights. “As all of the travelers end up coming back and as more and more people get used to this ‘bleisure’ … we'll have to grapple with what does that mean for our hotels and how are we going to handle staffing?” he told attendees.

Hoteliers will need to ponder the staffing issue, and soon, Clough said: “We have to really understand what we're doing from a hiring perspective and we need to do it quickly because the demand is racing back to our hotels.” With workers having more choices about where they want to earn their living, Clough said hoteliers need to encourage those workers to consider careers in hospitality. “We have to make the hotel industry fun again,” he said.

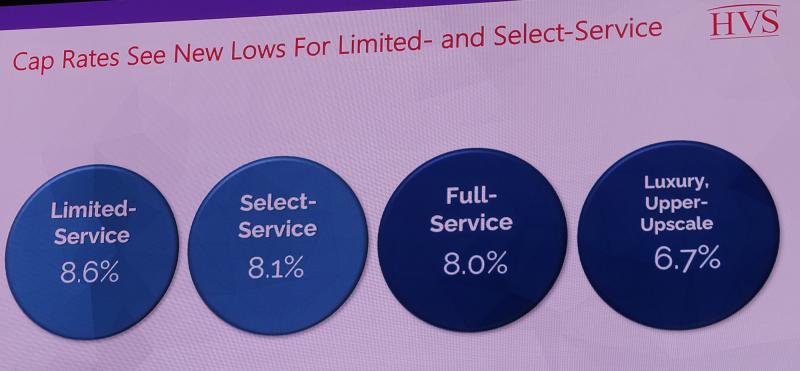

According to HVS’ most recent broker survey, limited-service capitalization rates are about a point and a half below where they normally are, while select-service hotels have cap rates about a point under where they normally are. “Full-service and luxury [hotels are] kind of right where they should be,” Clough said. “So we're seeing record low cap rates right now for those types of assets—not surprisingly.”

Over time, HVS expects those rates to increase, Clough added. “A year ago, the cap rates were pretty similar for limited-service but for select, full and luxury, they were about a point higher," he said. "So that shows you how we're in a much more favorable environment.”