While incentive travel took a severe hit during the pandemic, the segment’s future looks brighter, according to nearly two-thirds of respondents in a recent survey of more than 700 incentive industry professionals.

"Open for Business: Incentive Expectations and Reality in the Hospitality Industry" is a new study jointly produced by the Incentive Research Foundation and Questex, the parent company of Hotel Management. The study examines renewed demand for incentive travel and how issues such as staffing shortages, service levels and cost increases are affecting the planning and execution of incentive travel programs.

Among the respondents, 63 percent anticipate “significant” growth for the sector. Nearly two-thirds said incentive travel is trending up for 2022 and beyond, with 13 percent saying incentive travel will increase 50 percent over the next 18 months.

Hoteliers Speak Out

Among the hoteliers who responded to the survey, only 5 percent said incentive travel is very important to their profitability. Another 46 percent said incentive travel is a high priority or important. This, however, tended to vary by hotel size with larger properties citing increased importance of incentive programs.

While hotels expect leisure travel to represent 30 percent of their business over the next 18 months, incentive travel is a close second at 27 percent. Larger properties have a higher reliance on leisure travel, and they are expecting a strong demand into the future. Incentive travel for properties of all sizes is expected to continue without slowdown, with smaller properties expecting more of an uptake, possibly due to limited availability within larger hotels.

Staffing Solutions

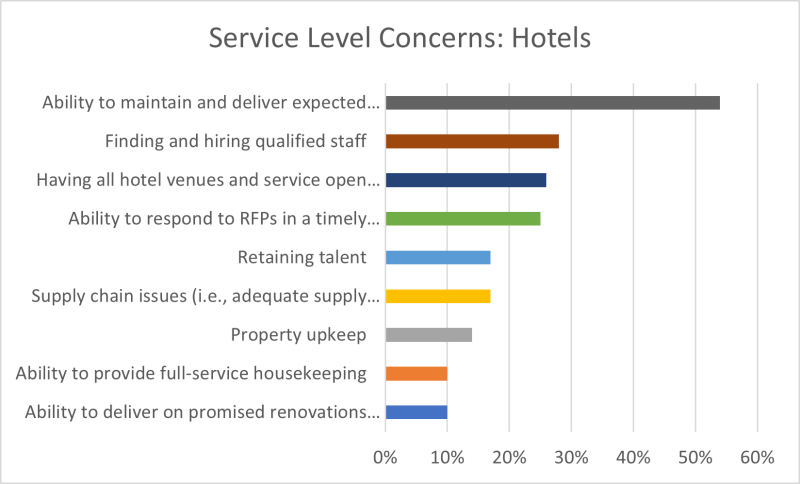

Many hoteliers said their full facilities—including restaurant outlets, spas, gyms and outdoor facilities—are up and running. But less than half report being staffed to pre-pandemic levels, which has led to the service-level challenges many are experiencing. Only 49 percent of properties have achieved pre-COVID staffing levels, while another 38 percent are working to staff up over the next six months.

Among the staffing challenges facing hotels, respondents cited increased variability due to COVID surges and other unforeseeable factors (58 percent), time to train and upskill staff (54 percent) and not enough qualified applicants (52 percent). The report noted that COVID surges creating unpredictability is more acute for hotels perhaps due to the sheer scale of their hiring needs.

Despite these staffing challenges, most hoteliers reported solid service capabilities. A full 84 percent offer daily housekeeping services, with only 6 percent saying they offer it on request only. At the same time, 95 percent of hotels report having all food and beverage outlets available (inclusive of roomservice). Of the 5 percent that remain, 86 percent report they will have some or all outlets available in the next 18 months.

To evoke a pre-COVID experience, hoteliers are prioritizing restaurants, rates, housekeeping services and roomservice. Transportation services, partnerships with local tourism and concierge services—all less likely to be impacted by the pandemic—were all lower on the priority list.

The survey was conducted from April 27 to June 17 with a total of 710 respondents—280 of whom were hoteliers and 84 percent of whom were from the U.S.