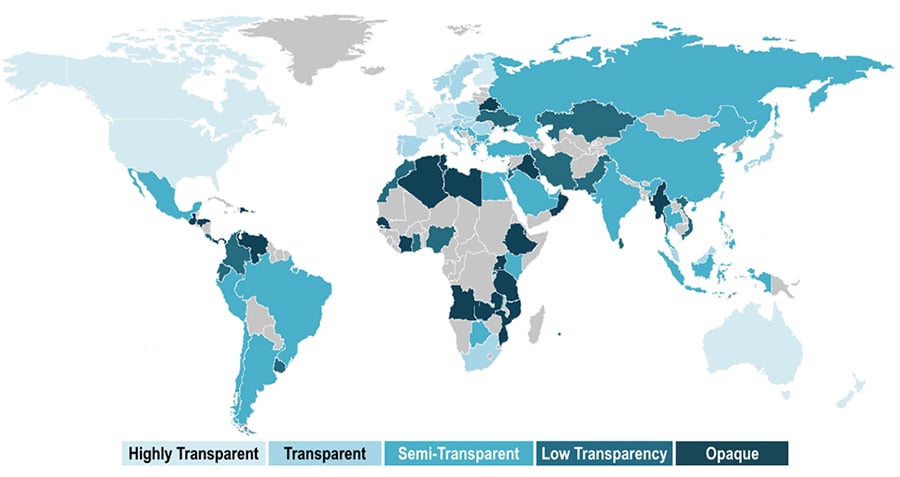

JLL’s ninth Global Real Estate Transparency Index has some intriguing insights on which countries provide the most favorable operating environments for investors, developers and corporate occupiers. Excerpts from the full report, which can be found in full here, follow.

Transparency Under Scrutiny

Earlier this year, the Panama Papers raised awareness of the need for greater real estate transparency and put the fight against corruption decisively on the international political agenda. As capital allocations to real estate grow, investors are demanding further improvements in transparency, even among the world’s most transparent real estate markets.

Technology is allowing a more granular assessment of real estate market patterns. Databases tracking buildings, investment transactions, tenants, leases and values continue to expand, providing more frequently updated and real-time information than ever before.

The Highly Transparent Markets

The world’s 10 most transparent markets account for 75 percent of global direct investment into commercial real estate and are home to nearly half of the world’s 2,000 largest public companies.

The United Kingdom, Australia, Canada and the United States hold the top positions, and are taking real estate transparency to a new level; making improvements that go beyond other transparent markets, particularly in the granularity, quality, frequency and geographical spread of performance measurement, valuations and market fundamentals data, which now also extend to niche property sectors.

Germany has joined the Highly Transparent group for the first time, in part due to growth in its listed sector, while France has consolidated its position among the top tier.

The Transparent Markets

A further 20 countries have been identified as Transparent and 14 of these are in Europe. Poland is now close to joining the ‘Highly Transparent’ group with operating conditions similar to those in its Western European neighbors.

Asia Pacific has been the most consistently improving region in recent years and is well represented in the Transparent tier. Singapore and Hong Kong remain tied for top spot in Asia, although, once again, they have fallen just short of the Highly Transparent category. Several high-income Asian countries have made solid gains: Taiwan elevated itself into the Transparent category for the first time, while Japan has moved up seven positions.

The Semi-Transparent Markets

The most rapid progress in real estate transparency is found in the 37 markets that make up the Semi-Transparent category. This group offers the substantive opportunity to tap into dynamic markets that are undergoing major structural change.

At the top of this category, Mexico and China’s Alpha cities are on the cusp of moving into the Transparent category. Meanwhile, India’s key cities are benefiting from proactive measures to increase transparency in the real estate sector. South Korea has also progressed but, given its economic maturity and real estate investment levels, is an outlier in the Semi-Transparent category.

Regulatory reforms are essential for further progress and many governments appear to be taking steps forward, with recent examples including Dubai and India. However, the survey reveals that among the Semi-Transparent group there is a notable disconnect between the existence of regulations and actual enforcement—particularly in land use planning, contracts and building codes.

Within the next decade we project that annual direct investment into commercial real estate assets will hit in excess of US$1 trillion across the globe. With that in mind, JLL makes the case for what it calls “Hyper-Transparency,” to which those currently in the top tier may not yet qualify.

The Future of Real Estate Transparency

While the survey indicates that the global real estate sector is becoming more transparent, there are too many examples of opaque and corrupt practices, poor corporate governance and failures in regulatory enforcement. Investors and tenants will bypass countries unable to address these shortcomings, gravitating instead to more transparent markets.

To that end, nations will need to take serious initiatives, like stopping money laundering through property, tackling corruption, leveraging technology to promote transparency and promoting regulatory reforms—particularly in Semi-Transparent markets, where there is the greatest disconnect between regulations and actual enforcement.