Despite the extended-stay hotel segment being at the forefront of development in the U.S. and the influx of new brands in the that segment of the market, extended-stay supply growth is currently at a historical low. “The average annual increase in supply since the late 1990s has been 6 percent,” said Mark Skinner, partner at the Highland Group. “For the last two years, it's been less than 2 percent.”

Skinner notes that the last time this happened was just after the great recession in 2010. “Supply dropped dramatically and it stayed low for four years. And the federal funds rate at that time was 1/10 of what it is today.” Skinner believes supply growth is going to stay “well below” the industry trend for at least another two years.

Skinner suggests looking at past industry performance to see what will happen beyond those two years. The highest annual increase in extended-stay supply—excluding the late 1990s when many brands were first entering the market—occurred in 2009 at 9 percent.

“If that was to happen today, the number of rooms under construction would have to double and they'd all have to open within one year,” Skinner said. “So it's not going to happen in the near term. If history repeats itself, it will gradually increase.”

Over the next four or five years, Skinner predicts acceleration of the supply growth. “Extended-stay demand nationally, on an annual basis, has never gone down except in 2020.” The pandemic changed the extended-stay market and was the impetus for the recent boom, according to Doug Artusio, chairman and CEO of Dellisart and founder of the Extended Stay Lodging Association. Standard properties were running at 40 percent occupancy while often extended-stay properties were running at 70 percent or higher, Artusio continued.

“So [extended-stay] has become, really, the best thing in the market right now, especially when people are looking to invest their dollars. Extended-stay hotels have more than double the gross operating profit percentage on the monies coming in from the top and, on the bottom, two or three times the profitability that a regular hotel might have. So, in general, it's caught the eye and the attention of basically everybody.”

The brands have recognized this potential—thus the influx of new brands in the market—but Artusio wondered how far hotels will be able to push those average daily rates and occupancies to sustain the growth.

The Secret is Out

The sector’s growth trajectory will be “heading north” for some time before the industry gets to a point where supply and demand meet each other, Artusio continued. “There’s a lot of money on the sidelines and a lot of investors that are committing in big ways to these [new] brands. It’s amazing that people are jumping in in a big way, not just putting their toes in. This is now known. The secret is out.”

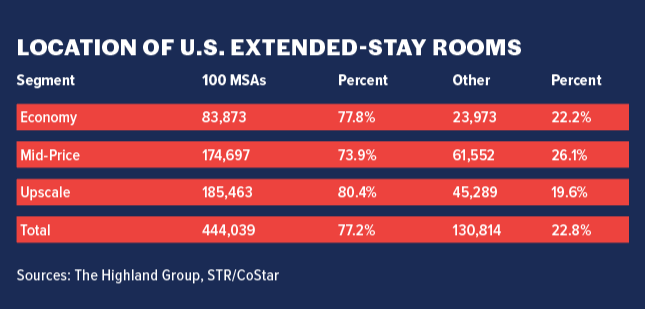

In the largest 100 metropolitan statistical areas in the United States, extended-stay room supply grew 3 percent in 2023 over 2022, according to the Highland Group. This was one of the smallest increases for the past several years. More than 18,000 extended-stay rooms were reported to be under construction at the end of 2022; however, the net change in rooms open by the end of 2023 was less than 13,000, reflecting the lengthening hotel development timeline, disenfranchising hotels that no longer meet brand standards, conversions to apartments and some municipalities acquiring extended-stay hotels for housing. Extended-stay hotel rooms reportedly under construction in the 100 largest MSAs increased 8 percent over the last 12 months. However, they remain low compared to the pre-pandemic period.

Recession-Proof?

A key lesson learned in 2020 and 2021 is that the extended-stay industry may not be recession-proof, but it is at least recession-resistant, said Jan Freitag, national director, hospitality analytics at CoStar Group, noting that these qualities have garnered the segment a lot of attention from hotel brands. “If you have guests that are, indeed, true extended-stay guests, your profit margins are much better than in a limited-service hotel,” he continued. “That got a lot of people excited for the extended-stay market, which then means a lot of owners went to [companies] asking for extended-stay brands.”

What does interest from investors, owners and travelers mean in the long run? “I think, like anything, if you have strong demand and you have supply coming in, that means that the occupancies will flatten out. I don't think there's any magic about that. It's just math,” Freitag said.

Ketan Patel, managing director at JLL Hotels & Hospitality Group, sees developers actively build extended-stay properties. “[The developers] have observed that extended-stay hotels are the most resilient and created the least amount of risk [for] them from a development standpoint,” Patel said.

Even when looking on the long-term horizon, these developers have learned that when they are exiting the market, the extended-stay properties will have the lowest cap rates. As such, “they will get the highest value on those properties,” Patel concluded.

Location and Revenue

The geographic distribution of select-service and extended-stay hotels has shifted with a greater focus on the top 25 markets rather than secondary and tertiary markets, according to a JLL report. From September 2013 to 2023, total hotel room supply in the top 25 markets grew by 67.2 percent, whereas it only grew by 7.1 percent in non-top-25 markets. While the majority of the sector’s hotel room supply is concentrated in its traditional suburban and small-town locations, since 1988, the growth of hotel room supply in urban and resort areas has increased by a substantial 178 percent and 109 percent, respectively.

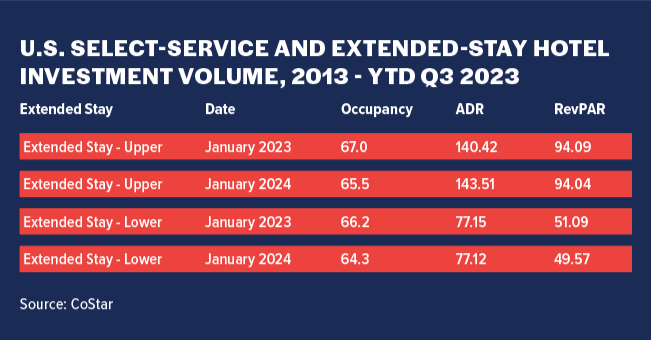

Freitag also noted “a pretty good bifurcation by price point in the upper extended-stay and the lower extended-stay” per STR’s classifications. “It will be interesting to see if there will be a slowing rate,” he said. Growth in revenue per available room last year favored ADR as occupancy declined in two thirds of MSAs but more than 80 markets reported higher extended-stay hotel RevPAR compared to 2022, according to a Highland Group report. Like 2023, some of the markets hardest hit by the pandemic, including New York, Boston and Washington D.C., reported among the strongest gains in revPAR. However, San Jose, Calif.—which recorded a slight RevPAR decline in 2023—and San Francisco were not included and extended-stay hotel RevPAR remained well below its nominal 2019 value in both markets.

Freitag surmises that, due to potential increases in infrastructure spending, brands will capitalize on those people who will be constructing the building of future bridges, roads and tunnels. “The question is: Will the increase in supply be outweighed by the increase in demand?” he continued. “We'll just have to wait and see. But I think the occupancies are going to be fine—they're not going to grow as quickly as they have, but they will be fine.”

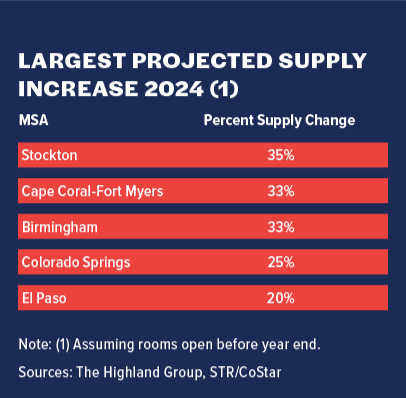

The near-term outlook for extended-stay hotels in the 100 largest markets is very good, according to that Highland report. RevPAR growth in 2023 compared to 2022 was at least 5 percent in more than one third of MSAs and 40 markets achieved larger RevPAR gains than the 4.2 percent national average for all extended-stay hotels. Collectively, supply growth across the 100 MSAs in 2024 should be one of the lowest for several years. Almost one third of MSAs expect supply growth of 5 percent or less and more than 40 MSAs forecast no supply growth during the near term.

To read insights from the brands on target markets and conversions in the extended-stay market, read part two of this story.