According to CBRE's Q4 2023 U.S. Hotel report, a 1.8 percent year-over-year decrease in hotel demand and a 0.8 percent increase in supply led to a 2.5 percent drop in occupancy in Q4 2023. Occupancy declines were partially offset by a 0.7 percent increase in average daily rates, resulting in a 1.9 percent decrease in revenue per available room during the quarter.

Competition from other lodging sources like short-term rentals and cruise lines, as well as continued strength in outbound international travel, was a headwind to hotel demand in Q4.

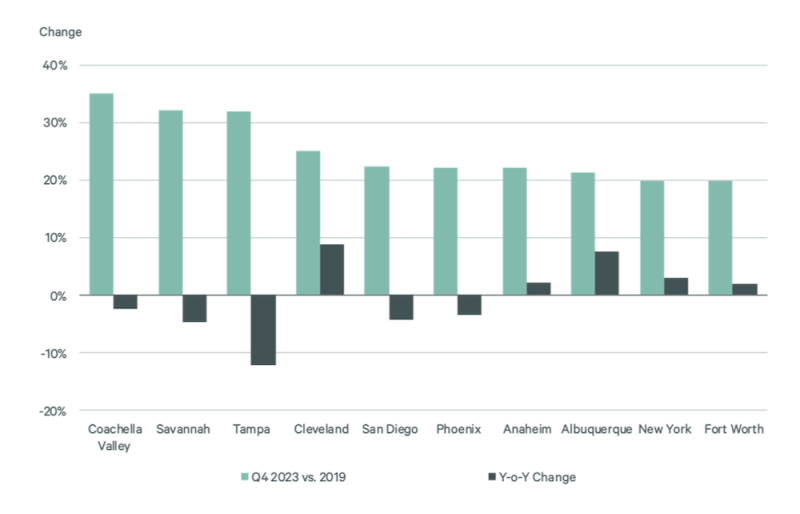

Five western markets were the strongest revPAR performers relative to Q4 2019. On a year-over-year basis, several smaller secondary markets were among the strongest performers.

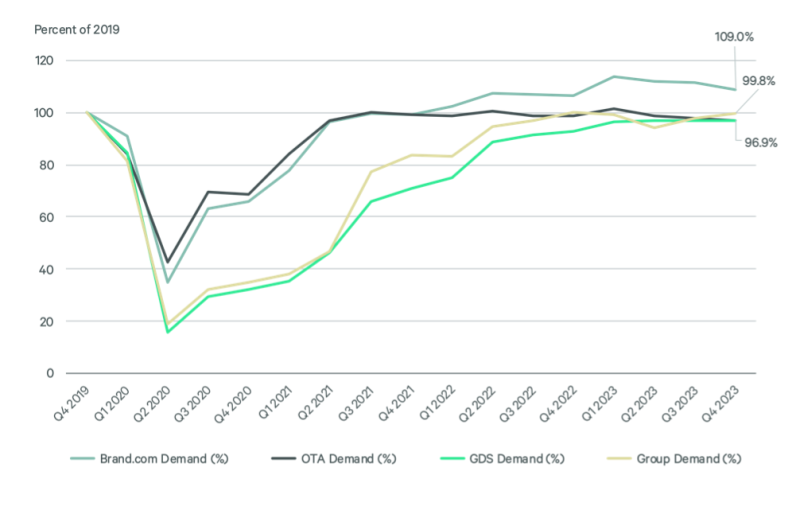

Total room nights sold fell by 1.8 percent year-over-year, driven by decreases in group, online travel agency, property direct and voice bookings. Global distribution system demand grew the most at 4.6 percent.

Real vs. Nominal RevPAR

Nominal revPAR fell by 3.2 percent in December and 1.9 percent in the fourth quarter. On an inflation-adjusted basis, real revPAR dropped 6.3 percent and 5.0 percent in December and Q4, respectively. Real revPAR stood at 92.3 percent of 2019 levels at the end of Q4. The gap between real and nominal revPAR relative to that in 2019 widened by 268 basis points compared with a year ago.

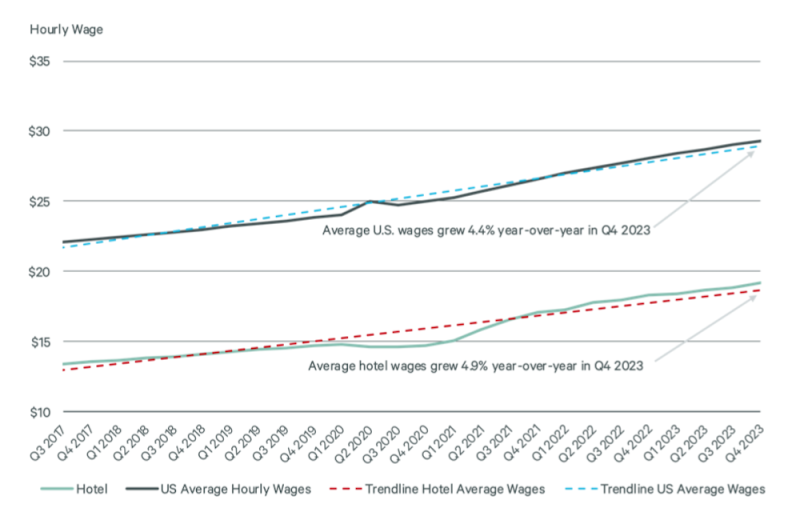

Hotel Wage Growth Outpaced National Average

The average hourly wage for hotel works remained over $10 less than than the national average hourly wage. However year-over-year hotel wage growth of 4.9 percent in Q4 was 57 basis points more than national average wage growth.

Job openings per hotel feel by 28 percent to 18 in Q4 from 25 a year ago. Total hotel employment ended 2023 slightly below 2019 levels.

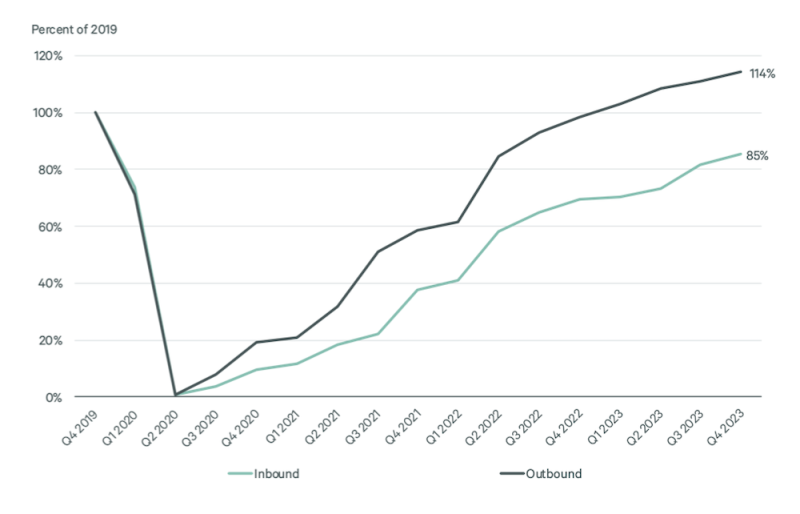

Inbound and Outbound International Travelers

Outbound international passenger counts ended Q4 at 114.3 percent of the 2019 total, continuing to outpace inbound passenger counts at 85.4 percent of 2019 levels. Inbound travel is expected to boost occupancies in 2024 as more international travelers return to gateway cities and destination locales.

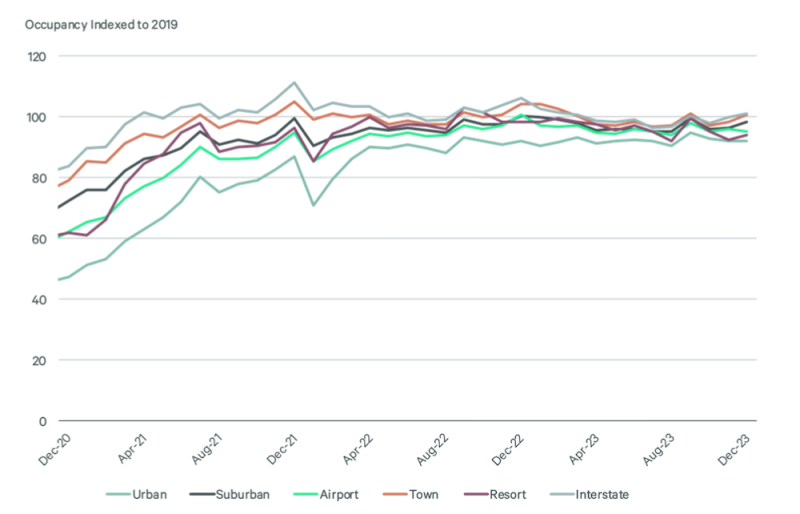

Occupancy Indexed to 2019

The occupancy rate or urban locations increased by 0.8 percent year-over-year in Q4. Occupancy rates of all other location types decreased both year-over-year and relative to 2019 levels. Interstate locations were nearest to their 2019 levels at 99 percent while urban locations lagged at 92 percent.

Room Nights by Channel vs. 2019

Hotel demand dropped 1.8 percent year-over-year in Q4, driven in part by decreases of 2.0 percent in OTA and 6.9 percent property direct bookings. Brand.com continued to increases its share of total bookings, up by 2.2 percentage points over its Q4 2019 level. Property direct's share fell by 2 percentage points.

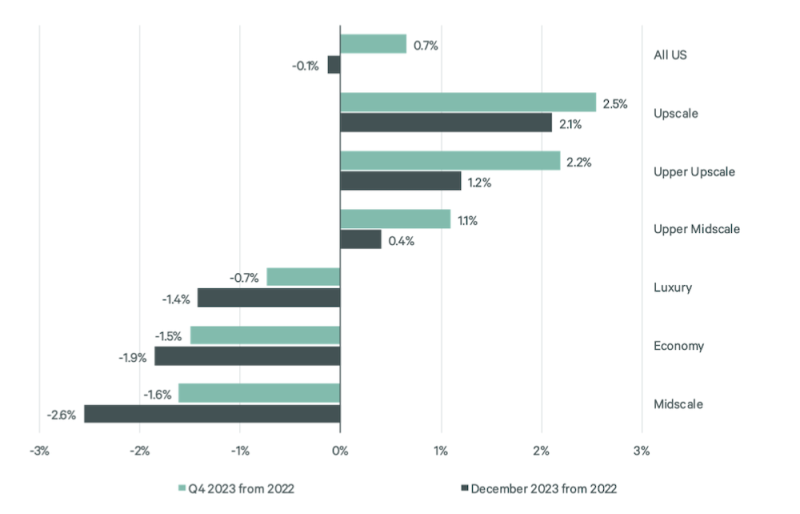

ADR Percent Change vs. 2022 by Chain Scale

While average ADR declined slightly by 0.1 percent in December 2023, ADR increased by 0.7 percent for all of Q4. ADR for upscale, upper-upscale and upper-midscale chains rose 2.5 percent 2.2 percent and 1.1 percent respectively in Q4. The rest of the chain scales decreased, ranging from -1.6 percent for midscale to -0.7 percent for luxury year-over-year.

Top 10 RevPAR Markets

Coachella Valley had the biggest revPAR gain of 35 percent in Q4 vs. Q4 2019, with all top 10 markets recording increases of 20 percent or more over the same period. Half of these markets posted year-over-year declines in revPAR growth, including Coachella Valley, Savannah, Tampa, San Diego and Phoenix.

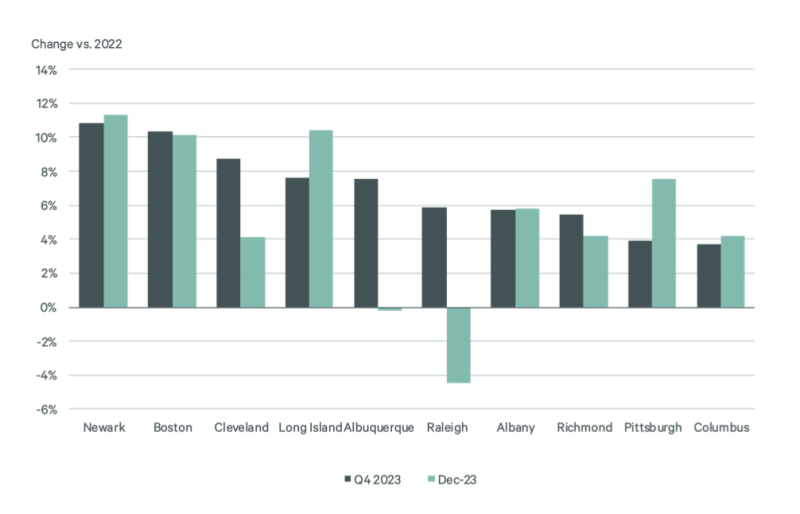

Q4 & December Top 10 RevPAR Markets

Secondary markets like Cleveland, Long Island, Albuquerque, Raleigh, Albany, Richmond, Pittsburgh and Columbus had among the highest year-over-year revPAR gains in Q4. Newark and Boston had the most year-over-year growth in Q4 at 11 percent and 10 percent, respectively.