The Dallas hotel market, a dynamic and evolving landscape, stands at a crossroads in 2024. Post-COVID, the Dallas hotel industry faces the challenge of adapting to normalized travel patterns.

“In 2022, we had that surge in travel from ‘revenge’ travelers,” said Colin Sherman, director of hospitality analytics at CoStar Group. “There was a lot of pent-up money from savings and people just wanting to get out there. Dallas recovered a little bit faster because restrictions were lowered sooner.”

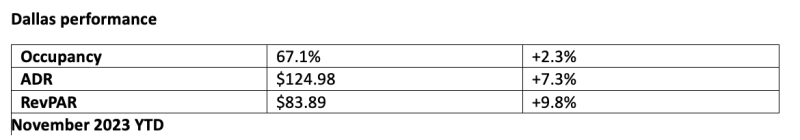

However, in 2023, he said the market saw a softening in occupancy and demand. And although Dallas is well-positioned to benefit from group and convention business, Sherman said travel patterns are adjusting to normal. That means growth in the major key performance indicators may soften, but that’s only because they’re coming off such a shaky base due to pandemic fluctuations.

Development and Lending Challenges

Meanwhile, high interest rates and tight lending are impacting new hotel projects.

“Today, it is difficult to develop new hotels in an environment where yields have been impacted by escalating construction costs, a historic rise in interest rates, and tighter capital markets,” said John Schellhase, director of investments at Peachtree Group. “Many hotels have deferred capex and have diminished funds available to complete renovations. In addition, they have more limited access the credit markets, given the historic rise in interest rates and challenges in the regional banking sector.”

In short, Schellhase said, it is more challenging to be the “bright new shiny” hotel on the block.

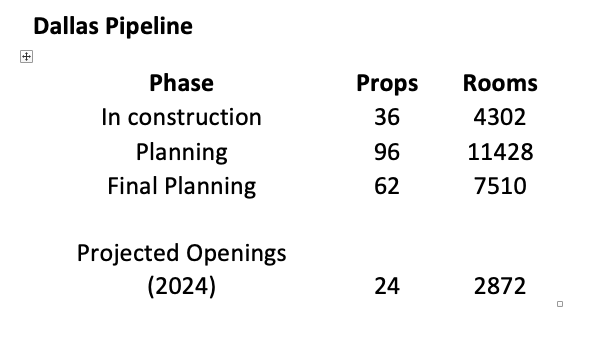

As for new supply, Sherman said the Dallas market has about 6,000 hotel rooms in the final planning stage. However, he said those rooms could sit for longer in that stage before moving to under construction because lending is tight. “We’re not going to see as many hotels move to under construction until lending confidence comes back,” he added.

Sherman said the Dallas market can support that amount of new supply. “That’s where demand is, so that’s where supply needs to be,” he said. “Absorption of those rooms seems to pencil out with projected demand growth.”

Opportunities and Growth Drivers

As a strategic location, Dallas is well-positioned for business travel and conventions. “Business travel hasn't reached peaks, but it’s very close,” Sherman said. “Within the historic percentages of business travel, it’s even closer and can expect to recover this year fully.”

The completion of the Kay Bailey Hutchison Convention Center Dallas renovation will help, he added. “You’re seeing a lot of group travel of 10 room blocks or more a night. Dallas is an easy market to get to. As return-to-office continues, Dallas is going to benefit highly as for groups and conventions meetings,” Sherman said.

Schellhase said that Dallas also enjoys strong fundamentals that take advantage of Sunbelt migration. Dallas is home to the second largest airport hub in the United States, a low cost of living and no state income tax. “These factors, among many, have led to Dallas RevPAR growing year over year around 10 percent,” he said.

One area that excites Schellhase and his team is the Uptown area because it has shown RevPAR growth greater than that of overall Dallas market.

“Uptown has many exciting things going for it, including the $500 million Goldman Sachs campus that will bring 5,000 employees to the area. This will bring many new professionals,” Schellhase said.