Taylor Swift’s The Eras Tour of U.S. stadiums boosted guestroom revenue at U.S. hotels by an estimated $208 million, according to a recent blog post by M. Brian Riley, a senior research analyst with STR's Product Analytics & Insights division.

The tour stopped in 20 cities across the country from March to August, typically with two to three performances per stop and always with at least one weekend performance.

Riley's analysis used the average of matched days in shouldering weeks as a performance baseline. Additional adjustments were made for three markets to account for the reduced performance levels typical of the Fourth of July holiday.

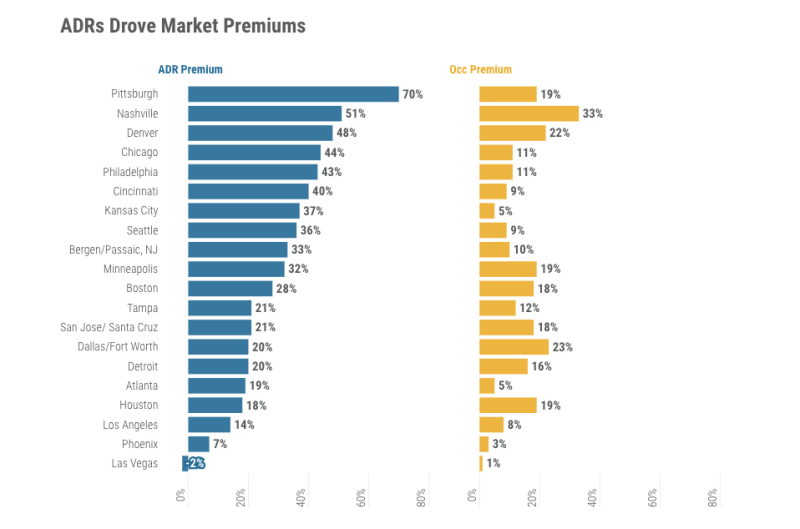

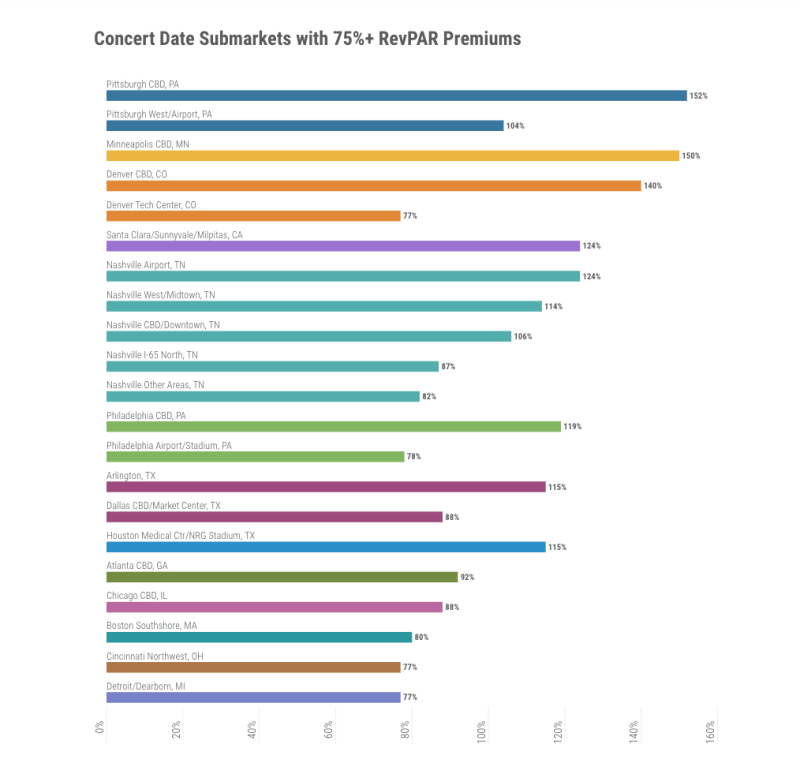

In early May, Nashville reported the country's largest increase in average daily rate (+27.9 percent to $227.79) and the second-highest jump in revenue per available room (+33.2 percent to $174.20) for the first week of the month, which STR credited to the tour. For the final week of the month, New York City registered the highest occupancy level (85.7 percent) when the tour stopped in East Rutherford, N.J., five miles west of the city. When the national portion of the tour ended in Los Angeles in early August, the city reported the largest year-over-year growth in occupancy (+13.5 percent to 82.6 percent), ADR (+8.4 percent to $222.98) and RevPAR (+23 percent to $184.16) of all of STR's top markets for the week. Two markets—Pittsburgh and Nashville—doubled their RevPAR from shoulder weeks, while eight markets overall reported RevPAR premiums of 50 percent or higher.

Riley noted that the overall $208 million estimated impact is "conservative," as it accounts only for the 53 concert nights. "What can’t be measured on top of that impact are extended fan stays, extra lift stemming from show advance/breakdown crews, the broad range of other economic activities beyond concert-night room revenues, or added impact on other hotel revenue streams, like P&L, parking, etc.," Riley wrote in the blog.

In June, Daniel Altman, chief economist at employment firm Instawork, reported “spikes” in demand for temporary labor during tour stops, as much as 1,000 percent on concert days relative to non-concert days, particularly in urban stadiums close to city centers. Stadiums farther away from business hubs reported less of an impact, suggesting businesses close to the stadiums—including hotels—benefitted from increased demand when Swift was in town.

Going Global

The tour is now going international before returning to the U.S. in late 2024, and according to STR's ForwardStar forecasting platform, cities with scheduled tour stops are already seeing booking increases. As of mid-August, the busiest date in Melbourne, Australia, for the next year is Feb. 17, which will be the second Eras performance in the city.

The tour will be in the U.K. next summer, and Liverpool and Cardiff are already reporting booking levels above 50 percent nearly a year in advance. In late August, U.K.-based budget hotel chain Travelodge reported that all of its hotels in Edinburgh, Liverpool and Cardiff were sold out for the days around the concerts in June 2024, and many hotels near Wembley Stadium, where Swift is scheduled to perform in June and August, were also sold out on those dates.

“The unprecedented demand for tickets to Taylor Swift’s U.K. tour will certainly translate into increased demand for hotels, as well as driving more visits to pubs, bars and restaurants in cities when the tour comes to town,” Kate Nicholls, the chief executive of UK Hospitality, told The Guardian. “The levels of interest in her tour shows just how important our music and nightlife scene is to the UK tourism and hospitality industry.”