There's no question that London is consistently hot for hotel development—but the city is big, and not all neighborhoods are equally in demand. Courtesy of Colliers International’s latest London Hotel Index, which analyzes seven performance indicators of 14 London Boroughs, here are the top areas of the UK's capital city for hotel development.

Top Boroughs

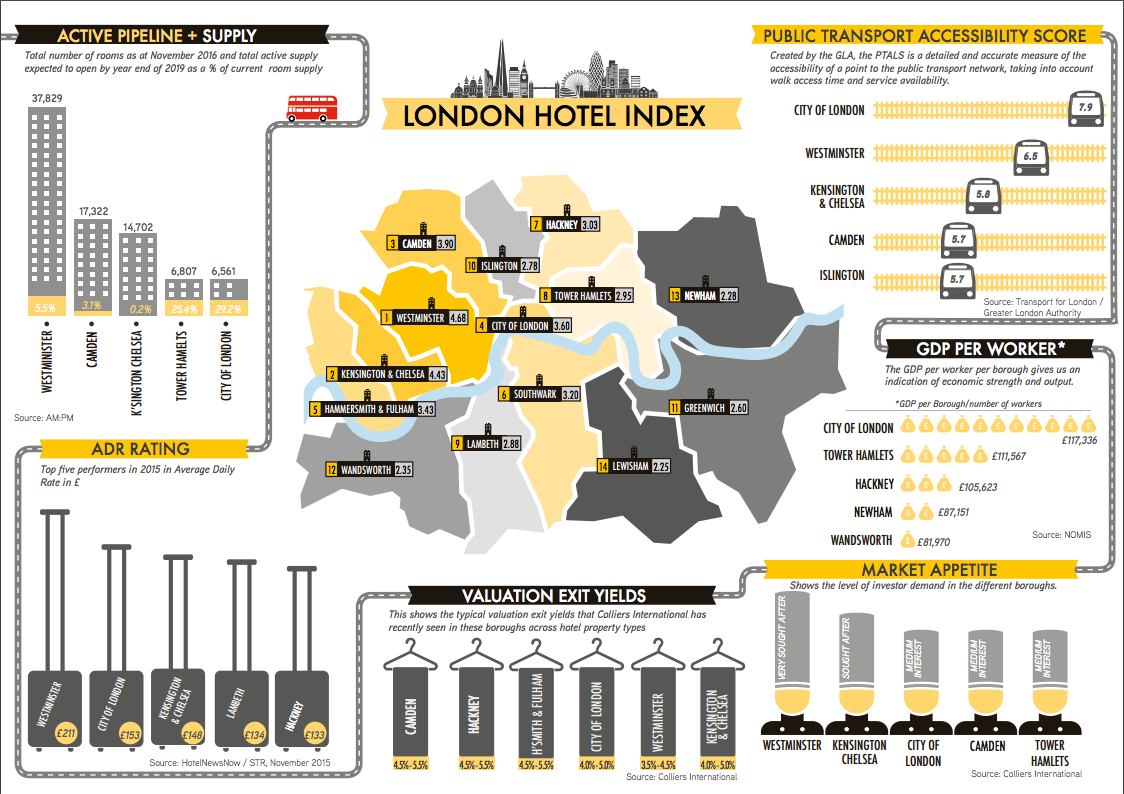

The City of Westminster “unsurprisingly” reached the top of the index mainly due to its strong ADR and transportation links in combination with high investor interest with most of London’s Trophy assets located in the Borough. Westminster has the most hotel guestrooms of London's neighborhoods at 37,000.

Kensington and Chelsea ranked second due to strong investment and valuation parameters with a relatively low active pipeline.

Camden reached third place in the index, largely due to low active pipeline and strong valuation yields. The City of London ranked fourth, being “punished” by medium buyer demand and Hackney ranked seventh—mainly due to an expected increase in supply in rooms of 50.4 percent of current supply.

On the other hand, Greenwhich, Wandsworth and Newham rank the lowest in the index due to low average daily rates, lower buyer demand and poor

Notably, Westminster, The City of London and Kensington & Chelsea recorded the highest ADR at £211, £153 and £148, respectively.

London's Pipeline

The Royal Borough of Kensington and Chelsea has nearly reached full capacity for hotel development. The borough currently has 14,702 hotel rooms in 183 hotels, and research shows that supply growth is a near-stagnant 0.2 percent, with only 30 new guestrooms slated to open before 2019.

“It’s been near impossible for hotel investors and developers to find the space to create new hotels in Kensington and Chelsea,” Colin Hall, head of London hotels agency at Colliers International, said in a statement. “The residential market has remained extremely strong over the past few years, keeping prices high and supply low, and the grand period houses that make up much of the property stock in the area is difficult to convert.”

While central and west London have suffered from a lack of new supply, Hall continued, rising regeneration opportunities in the east has tempted hoteliers to seek out new investment areas, particularly The City of London and Shoreditch. The City of London has confirmed plans for more than 1,900 new hotel rooms slated to open by 2019 (bringing the borough’s guestroom total to 8,476), while Tower Hamlets has more than 1,700 new rooms in the pipeline.

Hackney—which includes Shoreditch and Old Street within its borough—currently has only 2,200 hotel rooms open, but it has the most active development pipeline as a percentage of current supply up until 2019 (50 percent growth), almost double the development pipeline available in The City (29 percent). Hackney and Hammersmith & Fulham have also seen further yield compression in recent years.

“The popularity increase in the east of London has not gone unnoticed by hotel investors,” Hall said. “We’ve recently seen both Citizen M and The Courthouse Hotel open their doors in Shoreditch, and many other well known brands are looking to establish themselves here as well.”