Hotel investment and overall tourism investment throughout Africa are growing. And now, as the newly formed Tripartite Free Trade Area (TFTA) trade bloc, the proposed African free trade agreement, starts to take shape, and help trade from Cairo to the Cape, tourism and tourism investment could benefit even more.

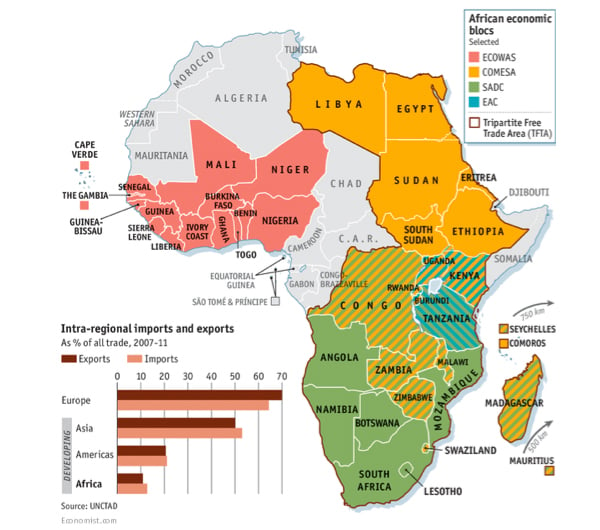

Africa now counts 17 trade blocs for regional trade, including the recently formed 26 country Tripartite Free Trade Area (TFTA), which is intended to combine the East African Community (EAC), the Southern African Development Community (SADC) and the Common Market for Eastern and Southern Africa (COMESA)—a Cairo to the Cape unified trading bloc.

The below map (Figure 1) from The Economist shows the main blocs and the new TFTA. The also included chart from UNCTAD shows that intra-regional trade in Africa, however, is much lower in regions outside Africa. The Economist noted that, “Most African countries produce a narrow range of goods and have export sectors geared toward supplying rich countries. Few have significant manufacturing bases and, unlike in developing Asian countries, there is little trade in inputs or services that might lead to African chains of production.”

The picture for tourism is brighter. According to the World Bank’s 2015 study, "The Unexplored Potential of Trade in Services in Africa," which included a chapter titled “Trade in Tourism Services for Regional Integration in Southern and Eastern Africa,” these trade blocs could reduce some of the constraints and increase opportunities for tourism throughout Africa.

Opportunities

Regional trade blocs are intended to increase trade among countries in the region, which, when implemented, can help improve road and air access, reduce visa restrictions, increase the cross-border movement of people and goods, harmonize national policies and standards, coordinate trade and investment promotion, as well as coordinate safety and security—all of which help increase the volume and benefits of EAC regional tourism.

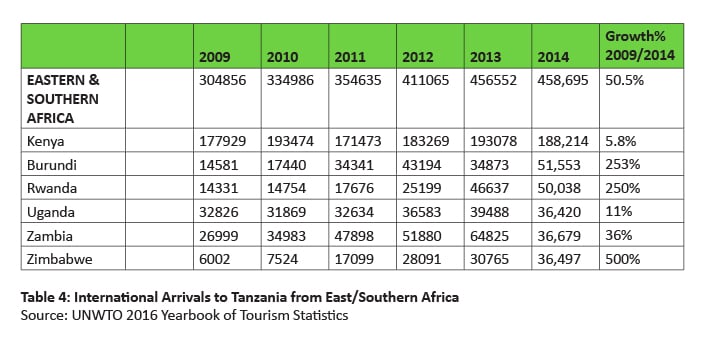

For tourism, all of the above potential improvements could build on and accelerate the trend toward increased intra-regional travel. For one country in particular, Tanzania, more than 40 percent of the country’s international arrivals were from East Africa with Kenya accounting for the biggest share.

Similar trends can be seen for many of the other countries in the region. As intra-regional trade has become easier between these countries – thanks to coordination via the trade blocs – travel and tourism have increased, which is also, of course, beginning to attract more investment.

Visas

Single regional visa and visa-on-arrival schemes in EAC and SADC country blocs have been initiated and are expected to help boost arrivals within each region. In fact, according to the UNWTO, by easing visa requirements and thus reducing international travel costs, Tanzania and other countries in the EAC and beyond could see more growth in jobs and GDP.

UNWTO/WTTC research has shown that improving visa processes could generate an extra US$206 billion in tourism receipts and create as many as 5.1 million additional jobs in G20 countries. Developing countries, such as in the ASEAN region, could realize US$12 billion in international tourism receipts by the end of 2016. They also note that visas, which are expensive or difficult to obtain, can be a disincentive for tour operators and independent travelers to include the country in their itineraries—thus opportunities lost. Overall, East Africa is on track to realize these benefits; it is the second most open sub-region globally according to UNWTO.

Transportation

Through The Infrastructure Consortium for Africa, countries are also cooperating regionally on improved ground transport (roads and rail), which includes initiatives for improved eastern and central transport corridors. The Consortium is linked to the Northern Corridor Integration Projects, which link Uganda, Rwanda, Burundi and South Sudan with the Port of Mombasa, Kenya, and also serve Northern Tanzania. Tanzania, Rwanda and Burundi have also signed an MOU for the development of a regional rail network, which is partially supported by the World Bank’s Intermodal and Rail Development Project. Improved ground transport will reduce travel time between countries and thus further encourage tour operators to offer multi-country itineraries, which in turn will also encourage the development of more tourism facilities and activities in the region.

Regional cooperation and integration through the above infrastructure programs and aviation liberalization could reinforce coordination in other areas that impact tourism, such as safety and security standards and programs, adoption of international hotel classification standards, and marketing East African tourism. The latter is being attempted through the East Africa Tourism Platform, a private sector led initiative that aspires to coordinate tourism marketing among the tourism boards of Tanzania, Uganda, Rwanda, Kenya and Burundi. All of which can increase tourism access, demand and competitiveness.

Constraints to Regional Integration

While the regional integration trade blocs are certainly a step in the right direction, now each country has to tackle the challenging steps of implementation. The World Bank emphasized in "The Unexplored Potential of Trade in Services in Africa," that “many initiatives still require adoption and enforcement on a national level, such as the EAC standardized classification criteria...Due to issues of national sovereignty, political economy, and prioritization, it has been difficult to translate regional policy and coordinative initiatives into reality at the national level.” Some of these challenges are due to funding and capacity constraints that limit the effectiveness of the EAC program management, especially in regional promotion.

Strategic Interventions

The East African Community Treaty requires member states to develop a regional strategy for tourism promotion to “ensure equitable distribution of benefits” from sustainable tourism and wildlife resources. To achieve this, the treaty identified the following strategic interventions for action:

- Market and promote East Africa as a single tourist destination, which has been partially occurring since 2006 via the East African Tourism and Wildlife Coordination Agency (EATWCA) at international tourism fairs.

- Operationalize the East African Tourism and Wildlife Conservation Agency, which was created as an implementing agency for EAC tourism activities, including the implementation of a 2007 ECA tourism marketing plan and strategy.

- Implement the (voluntary) standardized criteria for classification of hotels, restaurants, and other tourist facilities

- Harmonize policies and legislation on wildlife conservation and management

- Adopt a regional approach to the protection of wildlife resources from illegal use and practice

- Adopt a regional approach for participation in regional and international treaties/agreements on wildlife conservation and management

- Enhance capacity building in the tourism and wildlife sector, in part, through three Centers of Excellence in tourism education and workforce development that ECA has identified.

In addition to these strategic interventions, the World Bank recommended in "The Unexplored Potential of Trade in Services in Africa" the following actions:

- Improve the business environment and attract investment (see below)

- Implement EAC-wide codes as conduct (as recommended in the Treaty)

- Improve crisis management

- Advocate for regional integration

- Coordinate among EAC countries the sharing of statistics and research

- Increase bilateral air service agreements, pan-African code shares and knowledge transfers in operations and management.

- Base regional tourism initiatives on a specific product, route, circuit, or theme.

All of these actions make sense and, if implemented, the entire region, from Cairo to the Cape, could be a thriving trade and tourism zone that attracts investment and visitors from around the world. There is lots of work needed to achieve implementation, but as the old saying goes, it is best to look at the glass as half full rather than half empty. While the glass is not quite half full yet, it is filling up with potential opportunities and beginning to attract investment.

| Scott Wayne is the president of SW Associates, a Washington, D.C.-based sustainable tourism consultancy, focused on strategic planning and investment for destinations on every continent. For further information: www.sw-associates.net and [email protected] |