Africa's hotel pipeline is getting stronger and stronger, according to new figures from the annual W Hospitality Group Hotel Chain Development Pipeline Survey.

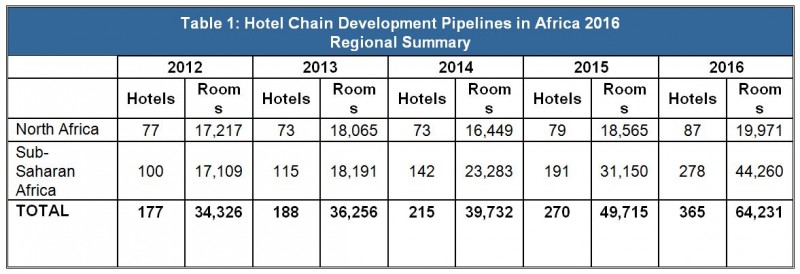

The number of planned hotel rooms in Africa has increased to 64,000 in 365 properties, up almost 30 percent on the previous year, the report claims, crediting strong growth in sub-Saharan Africa. This region is up 42.1 percent over 2015, and is significantly outpacing North Africa, which achieved only a modest 7.5 percent pipeline increase this year.

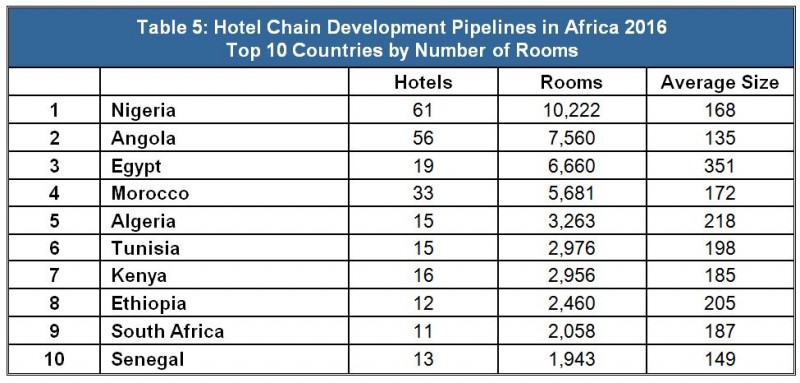

Notably, Angola, which has never before been listed among the top 10 countries for development, pushed Egypt out of second place, largely due to a major deal there signed between AccorHotels and AAA Activos LDA for the management of 50 hotels with around 6,200 rooms. All are under construction and many are ready to open. In September, GoldenPeaks Capital Holdings, a UK-based investment firm, signed a contract to spend $1.2 billion toward the construction of 170 hotels in Angola, which reportedly also has one of the most expensive hotel room rates in all of Africa.

Nigeria remains the country with the most rooms in the pipeline, up 20 percent over 2015. Together with Angola, the two countries account for 17,782 rooms between them, almost 30 percent of the total pipeline and 40 percent of the signed rooms in sub-Saharan Africa.

“The evidence from our survey is clear," Trevor Ward, W Hospitality Group managing director, said in a statement. "Investors remain confident about the future of the hospitality industry on the continent. Even when pummelled daily by low commodity prices, exchange rate problems, political challenges and poor infrastructure, Africa remains resilient.”

The IMF forecast for economic growth in sub-Saharan Africa is for an increase of 4 percent this year and 4.7 percent in 2017, up from 3.5 percent in 2015. Overall this is down on the 5-6 percent increase seen over the past decade, but is still double or more the forecast for the world’s advanced economies, such as Europe, the U.S. and Japan.

Detailed Analysis

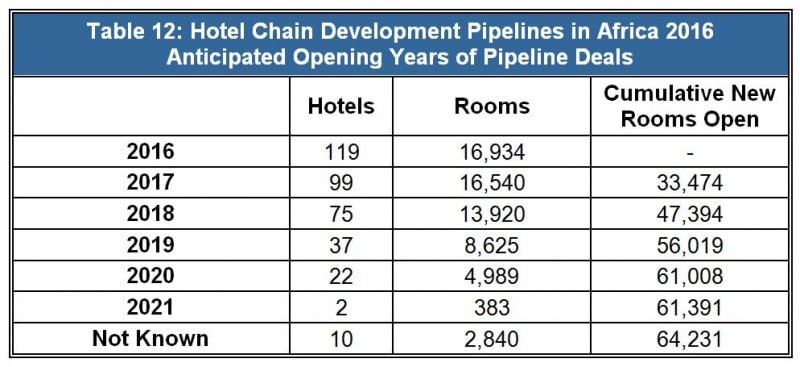

W Hospitality Group's eighth annual pipeline survey lists 36 hotel chains and 86 brands opening more than 64,000 rooms in 365 hotels.

This is a distinct improvement over the inaugural survey in 2009. That year saw 19 international and regional hotel chains contributing, with a pipeline of 144 hotels and just under 30,000 rooms.

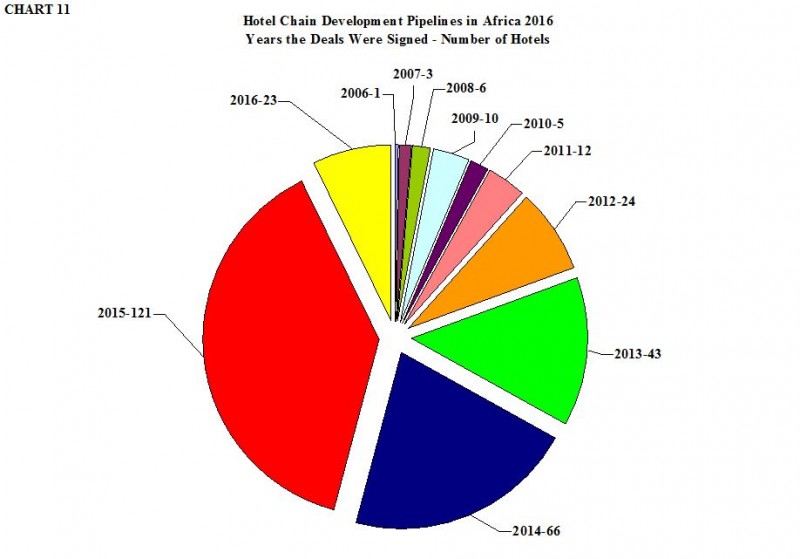

Still, not every outlook was positive, and Ward noted the number of hotel deals that have been signed but have so far not opened. These delays can be attributed to "a variety of reasons," but can be mainly credited to an overall lack of finance. “Between 2006 and 2013, 104 deals with 21,377 rooms, over 30 percent of the total, were signed and should now be open, or at least well under construction,” Ward said.

Across the continent, the north-south divide on hotel development continues. In 2011, the number of pipeline rooms in the five countries of North Africa was about 25 percent higher than that in sub-Saharan Africa. Today, it is less than half.

“There are two reasons why development activity in North Africa is now somewhat subdued," Ward said. "Firstly, the markets there are more mature and have already seen much development, so there are fewer opportunities for new hotels. Secondly, there is the political turmoil--in Libya, which has seen a 40 percent drop in the pipeline, and also Egypt, parts of which are experiencing drastic reductions in the number of tourists.”

These numbers also match predictions made by JLL at the end of last year. At the time, the consultancy firm predicted that Africa's hotel sector could safely expect an investment increase of $2.7 billion by 2018. Sub-Saharan Africa expects an average growth of 9,000 new rooms per year, with supply expected to grow to 4 percent annually by 2017. This compares to a relative slow-down in the north, where 5,000 new rooms are anticipated between 2015 and 2017.

The continent's tourism industry is expected to increase 5.7 percent yearly between now and 2030, significantly higher than the 3.6 percent anticipated globally. This, and more diversified economies, is attracting global hotel brands, whose presence accounts for 22 percent of total rooms. Such hotels are mostly operated via franchises and management contracts with very few leases, according to JLL.

Charts courtesy of Bench Events.