Serviced apartments are becoming increasingly mainstream in the hotel industry as long-established brands cater to changing demands from growing demographics and try to keep up with the “sharing economy.” Last year, Hyatt was a major part of a group that invested $40 million in U.K-based home rental start-up Onefinestay. In April, French hotel company AccorHotels purchased the company for an estimated $168.45 million, waging the latest battle in the hotel industry's ongoing war against Airbnb.

“The serviced apartment industry is seeing a burst of creativity with new brands being introduced or traditional brands reinvented,” Arlett Hoff, director at HVS London, wrote in her new report, The Serviced Apartment Sector in Europe.

The sector has seen another 12 months of positive growth in demand across Europe. Performance figures indicate a positive trend across Europe and the U.K., with London’s revenue-per-available-room growth having stagnated compared to last year but commanding the highest RevPAR levels in absolute terms.

On the supply side, a continuous focus on development, particularly driven by major national and international brands in the sector, will result in increased brand penetration in the sector—an important prerequisite for larger, consistent inventory to fuel the transaction market in the medium term, Hoff said.

The report also highlights the number of new brands recently launched in the serviced apartment sector, including The Prem Group’s Premier Suites and Premier Suites Plus; Zoku, the new brand of Hotels Ahead; and Ascott’s The Crest Collection of luxury residences. In addition BridgeStreet has added aparthotel brand Mode to its repertoire and Apple Apartments has introduced the Exclusive brand.

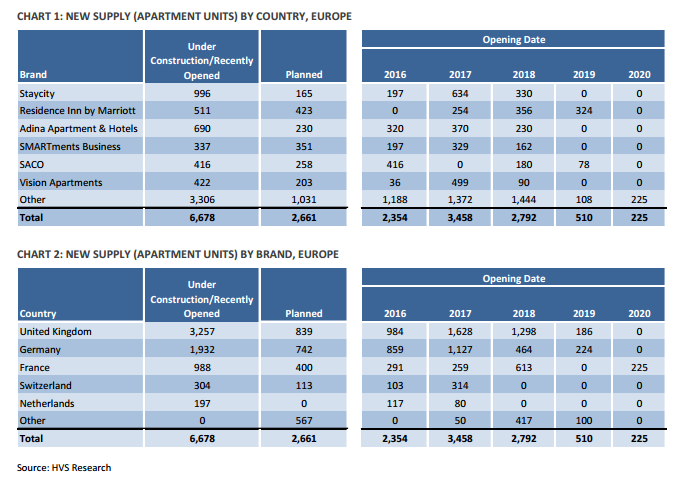

Staycity Aparthotels is the most active in terms of new openings, along with Residence Inn, Adina, Smartments, SACO and Vision Apartments.

Focused Growth

Growth has been particularly focused on Western Europe, led by the U.K., Germany and France. Around 45 percent of the new supply is based in the U.K., and 30 percent in Germany.

Germany’s development hotspots are “well diversified” across primary and secondary cities like Frankfurt, Hamburg, Berlin, Munich and Leipzig. In the UK, London accounted for only 30 percent of development. “This is undoubtedly due to the increasingly high barriers to entry competition for sites in the capital,” the report said.

It remains to be seen how the current Brexit situation will impact demand, supply and performance of the sector in the near future, Hoff said in the report.