Another insider believes that the next downturn in the lodging cycle is upon us. In a note this week, Bank of America Merrill Lynch analysts led by Shaun Kelley cited soft corporate demand, a glut of brick-and-mortar hotels and pressure brought on by online services like Airbnb and online travel agencies as major challenges facing the industry for the foreseeable future.

As a result, Bank of America has downgraded major hotel companies—Hilton Worldwide Holdings, Hyatt Hotels Corp. and Hersha Hospitality Trust—from "buy" to "neutral" and has cut RLJ Lodging Trust from a "buy" to "underperform."

Hotels' revenue per available room dropped 1.1 percent in the first two weeks of May, the report said. If that trend continues for the last two weeks of the month, RevPAR growth from May 2014 to May 2016 would come in at the lowest of any two-year period since the financial crisis, Kelley reported.

If valuations move back toward their historical average, the analysts estimate that the sector could see shares fall as much as 40 percent. "We have been noting for some time that all demand indicators are at peak while hotel supply is rising, internet pricing is dragging on rates, and alternative accommodations—including Airbnb—are a threat," the analysts wrote. "Given this backdrop, it’s increasingly clear that the lodging cycle that began in March 2009 is over."

Let the Good Times Roll?

This sentiment is not universal, however. Executives at commercial real estate services firm CBRE Hotels are bullish that the hospitality industry will remain on the crest of its current wave of success for some time to come. Via a webcast presentation of the company’s Hotel Sector Update and Forecast for first quarter 2016, CBRE Hotels’ senior managing directors Mark Woodworth and Kevin Mallory and EVP Mark Owens prognosticated high levels of industry growth to continue through 2017 and likely beyond.

According to the forecast, average daily rate is expected to continue its upward trajectory, with a long-run average of 3 percent between 2013, when ADR grew 3.8 percent over the previous year, and 2017, when ADR is projected to rise 5.3 percent. CBRE also anticipates that occupancy is just starting to peak; the forecasted year-end 2016 occupancy level is 65.7 percent, 20 basis points greater than 2015’s record occupancy level.

The Airbnb Effect

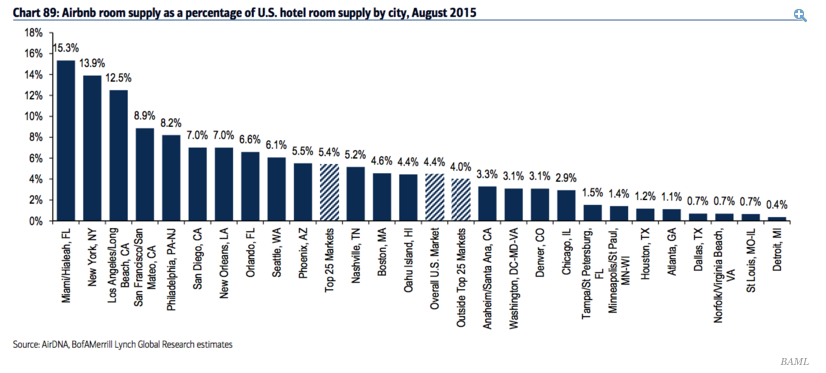

Airbnb’s operations were blamed for a negative impact of $2.1 billion on the lodging industry and the broader economy of New York City over the 12-month period from September 2014 through August 2015, according the Hotel Association of New York City, an industry trade group that represents more than 270 of the city’s hotels. (The report was conducted by HVS Consulting & Valuation and was commissioned by the Hotel Association.)

But not everyone is so pessimistic about the service and its effects on the industry. At the International Hotel Investment Forum earlier this year, Dirk Bakker, director of hotels, EMEA, for Colliers International, said that hoteliers should "embrace" Airbnb. The room-sharing platform is only successful, he said, because tourism is growing and there aren't enough affordable hotel rooms yet in the most popular markets. Much as hoteliers have had to learn to work with OTAs, he said, they must also learn to work with Airbnb. "We're getting a new situation that we need to deal with," he said. "The industry needs to find an answer."

Analysts at Cowen Group expect Airbnb to grow and project roomnights to increase from around 79 million this year to 500 million over the next five years. But in contrast to the warnings from BoAML, the Cowen analysts don't predict such doom for the overall hotel industry because business travelers still favor traditional lodging.

Sources: Bloomberg, Business Insider, Hotel Association of New York City, The Fly