Franchising carries its own risks and rewards for franchisors and franchisees. Returns must be measured in terms of the direct financial impact and the wider intangible return on investment.

The direct financial measure is by way of franchise fees and system contributions received by the franchisor, and the incremental revenue arising to the franchisee as reduced by franchise fees and payments. The franchisee also gains through cost efficiencies on sales. The quantum of gain and ROI is also dependent upon the asset size and investment requirement to make the asset franchise worthy; of course, the entire investment is not necessarily a franchise burden because the asset may itself need an uplift.

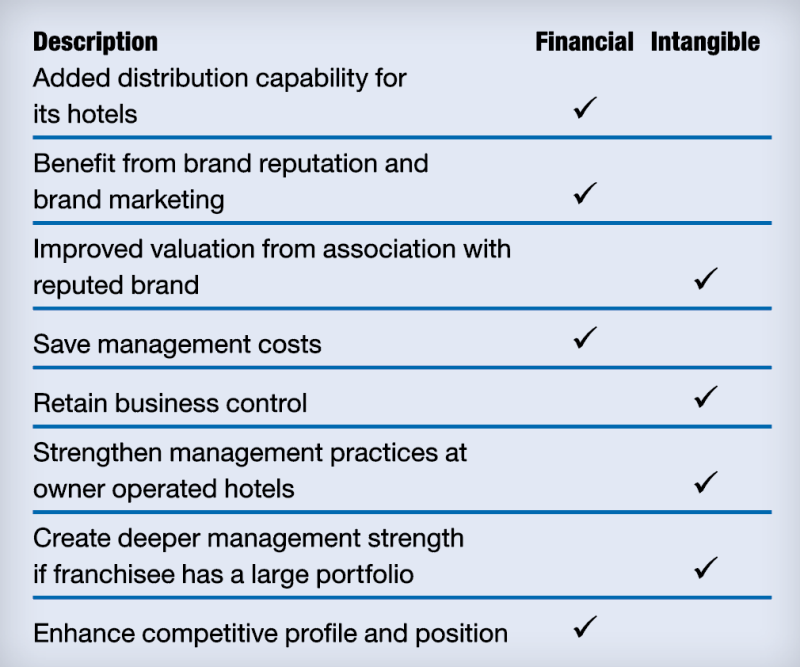

Intangible returns need deeper assessment with benchmarks best determined by the purpose and intent behind the franchise relationship. Franchisees take on a franchise for the following gains:

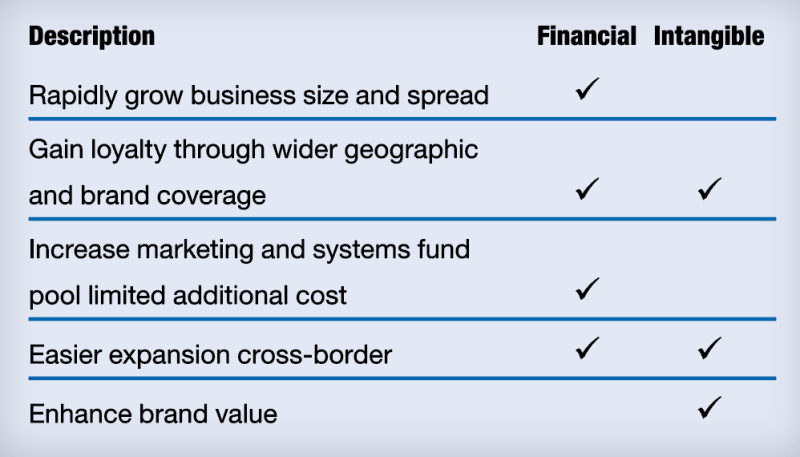

Franchisors seek franchisee relationships for the following gains:

A carefully structured franchise program with graded growth and commitments backed by delivery are essential for realizing the intangible returns. The product and brand must suit the market rather than the franchisor’s preference. Franchising also carries obvious and hidden risks and costs that are often ignored or acknowledged only over time:

- Inconsistent franchisee commitment to standards, as a common failing; where franchisee attitudes are below par, the brand suffers loss of long-term value, particularly if the portfolio of such franchises builds up.

- Imbalance between desired speed for growth through franchising and availability of suitable franchisee targets. Stringent “on-paper” targets can lead to suboptimal selection of franchisees.

- Lack of hotel size. Small inventory may be a key reason why franchising is considered instead of a management contract, but limited earnings can be drained if the franchise needs material supervision. Although a portfolio of small hotels adds geographic presence and a sense of growth, it can buy significant oversight headaches or cause brand dilution through practical inability to exercise oversight. While strict action to terminate noncompliant franchises is commendable, the inherent purpose of portfolio growth is negated if terminations become rampant.

- Rapid growth without adequate franchisor delivery capacity does not help the franchisee. This potential imbalance can particularly occur when franchising becomes a model for quick overseas expansion. Franchisee commitment to standards diminishes when franchisor commitment to its promises is thin, and the return-on-investment model for franchisor and franchisee collapses.

- Use of third-party operators is often a via media, provided the fee issue is resolved—the aggregation of franchise and third-party management fees must compete with the brand owner’s management contract option except where such an option is fundamentally off the table. Besides, it introduces a third set of business objectives in the game.

The deeper value implication of franchisees, and from failure of such relationships, is not adequately thought through while pursuing growth through this model. Success for one brand or geography does not guarantee success in another geography because the underlying market situations, maturity and value objectives can be vastly different. There are numerous instances where the franchise approach has failed to make headway whether due to inappropriateness of product at the given time; inadequate commitment to marketing, distribution and oversight; or due to counter-party risk.

Lack of success hurts the brand value and reputation; the loss on intangibles creates a larger negative ROI than limited financial gain unless the franchised asset or portfolio is large enough to drive gain toward fuller value realization.

Vijay Thacker is managing director of Horwath HTL India.