Hotel fundamentals improved across the board year over year in the first quarter of 2023, according to the latest report from CBRE. Supply growth was essentially flat, while the sector recorded increases of 5.5 percent in demand, 5.4 percent in occupancy, 15.5 percent in revenue per available room and 9.6 percent in average daily rate.

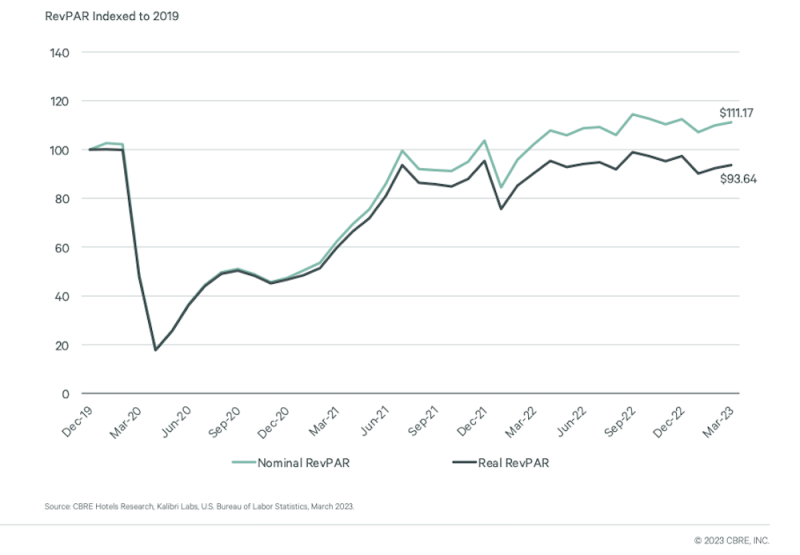

An 8.9 percent increase in nominal RevPAR coupled with 5 percent inflation resulted in real RevPAR increasing by 3.7 percent year-over-year in March. The spread between the real and nominal RevPAR indices has widened by 235 basis points from Q4 2022 to Q1 2023.

Hotel wage growth of 5.7 percent in March outpaced the national average of 5.1 percent and was down from 7 percent at the end of Q4. CBRE expects wage growth will further moderate this year. Average hourly hotel wages lagged the national average by nearly $10. Job openings per hotel average 23 in Q1, down from 27 a year ago. Total hotel employment in Q1 was just 1.8 percent below the 2019 level.

Travel Trends

Inbound foreign traveler expenditures were nearly 20 percent below 2019 levels in February. Inbound spending should increase in the coming quarters with the return of Asian travelers. Outbound foreign traveler expenditures (goods and services) exceeded 2019 levels in January and February by nearly $22 billion, an increase of 11 percent.

Southern markets remained the strongest RevPAR performers relative to 2019. On a year-over-year basis in Q1, RevPAR grew the most in San Francisco, New York and Washington, D.C., which lagged in 2022.

Savannah, Ga., posted the biggest RevPAR gain in Q1 vs. Q1 2019 (31 percent) with all top 10 markets recording increases of nearly 20 percent or more over the same period. Six of the top 10 were in the Southeast. Phoenix, Albuquerque, Coachella Valley and Salt Lake City rounded out the list.

Occupancy rates for all location types except for “town” were below 2019 levels in Q1. The “town” occupancy rate was a full percentage point above its 2019 level, while urban locations lagged at 91 percent.

Total bookings increased nearly 6 percent year over year, driven by increases of 28 percent in corporate bookings and 18 percent in group reservations. Property direct bookings fell by 4 percent. Brand.com continued to take share from other channels, increasing to 22 percent Q1 from 19 percent in Q1 2019.