Choice Hotels International used its third-quarter 2023 earnings call with investors to push for continued progress on its proposed acquisition of Wyndham Hotels & Resorts, despite Wyndham’s rejection of the bid and explanation for the decision.

“We decided to make our offer public after six months of private negotiations that resulted in little progress,” President and CEO Patrick Pacious said as the call began. “Our goal is to resume a constructive dialogue with Wyndham’s board to make this combination a reality. We are confident that a combination with Wyndham represents compelling value for both companies, shareholders, franchisees, associates and guests.”

The proposal, Pacious continued, provides “significant financial and strategic benefits” to both companies. “Wyndham shareholders would receive a substantial premium and immediate value for their shares, and both sets of shareholders would have the opportunity to participate in the significant value creation that we believe a combined company would unlock.” Pacious argued that the combined companies’ asset-light fee-for-service model would “generate stronger free cash flow and profitability and have the financial strength to accelerate growth, quickly deliver and enhance returns to our combined shareholders.” For franchisees, he said the union would “nearly double” the resources available to $1.2 billion of spend on marketing and reservation activities, drive more direct revenue to hotels through an “even stronger” rewards program and lower properties’ operating costs.

Pacious highlighted last year’s acquisition of Radisson Hotel Group Americas as an indicator of what Choice could provide for Wyndham, noting that the integration of the Radisson hotels is “nearly completed” and the additions have “already realized synergies 5 percent above our original plan, and ahead of schedule.” Choice, he added, is “driving stronger performance for the Radisson America's brands with bookings on our digital platform increasing by over 20 percent.”

Scott Oaksmith, Choice’s new CFO, said the company was “well positioned” for further growth. “Our strong capital structure positions us well to increase investment to further expand the scale of our business to drive franchisee and shareholder value. It can also effectively support the acquisition and successful integration of Wyndham.”

Throughout the call, Pacious emphasized that Choice’s leadership is eager to continue discussions with Wyndham. “Every issue that's been identified can be solved by coming back to the table and negotiating,” he added. “We, as a company, have been very patient in our growth strategies, but when we look at what the opportunity here sitting in front of us is today, the time to execute this transaction is now.”

Third-Quarter Results

Choice’s total revenues were $425.6 million for third quarter 2023, a third-quarter record and a 3 percent increase compared to the same period of 2022. Net income was $92 million for the quarter. As a result of one-time items, including Radisson Hotels Americas integration costs, gains from the sale of the Cambria Hotel Nashville owned asset and “extraordinary” franchisee termination fees as well as the timing of net reimbursable expenses, net income was 11 percent and 2 percent lower, respectively, for third quarter 2023 compared to the same period of 2022.

Domestic revenue per available room decreased 80 basis points and increased 140 basis points for the three and nine-month periods ended September 30, respectively, compared to the same periods last year. The company's third quarter average daily rate increased 1.3 percent compared to the same period of 2022 while occupancy reached 62 percent.

Adjusted earnings before interest, taxes, depreciation and amortization grew to $155.9 million, a third-quarter record and a 12 percent increase compared to the same period in 2022.

Pipeline and Unit Growth

Choice’s global rooms pipeline, as of Sept. 30, increased 6 percent to more than 99,000 rooms from June 30. The global rooms pipeline for conversion rooms increased 11 percent year over year and 27 percent quarter over quarter.

The expanded international pipeline nearly doubled by rooms count year over year, inclusive of more than 30 properties representing approximately 6,000 rooms associated with the company's alliance with a Mexican hotel operator.

Choice executed an average of more than four hotel openings per week, for a total of 159 hotel openings year-to-date through September 30, a 24 percent increase compared to the same period in 2022. For the first nine months of 2023, the company grew hotel openings across all segments, increasing openings in the upscale segment by 50 percent, the extended stay segment by 38 percent, the midscale segment by 14 percent and the economy segment by 27 percent compared to the same period last year.

Of the total domestic franchise agreements awarded in the nine months ended Sept. 30, 84 percent were for the company's upscale, extended stay, and midscale brands, and 72 percent were for conversion hotels. Of the domestic franchise agreements awarded for conversion hotels in the first three quarters, 67 percent have already opened or are expected to open by Dec. 31. “We expect nearly 70 additional domestic conversion projects to open by year's end,” Pacious said during the call.

The domestic upscale and extended-stay portfolio grew 11 percent and 13 percent, respectively, since Sept. 30, 2022, driven by an increase in the number of Cambria Hotels, Ascend Hotel Collection, WoodSpring Suites, MainStay Suites and Suburban Studios units. The extended-stay domestic pipeline increased 12 percent to more than 47,000 rooms in 360 hotels since Sept. 30, 2022. The domestic pipeline reached nearly 86,000 rooms as of the end of Q3.

Oaksmith highlighted the infrastructure bill and and the reshoring of American jobs as driving forces behind extended-stay growth. “There's a huge amount of new business coming in—50 to 100 million room nights over the next decade—that really are going to feed the extended-stay profile,” he said. “We're well-positioned to capture that demand.”

Pacious noted “a lot of conversions from transient hotels to extended-stay hotels,” and room for an upscale extended-stay brand. “That's a whitespace in our portfolio that could be filled with a future brand launch or potential acquisition,” he said.

The company's total domestic system size was over 6,200 hotels and 490,000 rooms as of Sept. 30.

The total number of international upscale hotels, as of Sept. 30, increased 13 percent year over year. The company's total international system size approached 1,200 hotels as of Sept. 30.

Next Steps

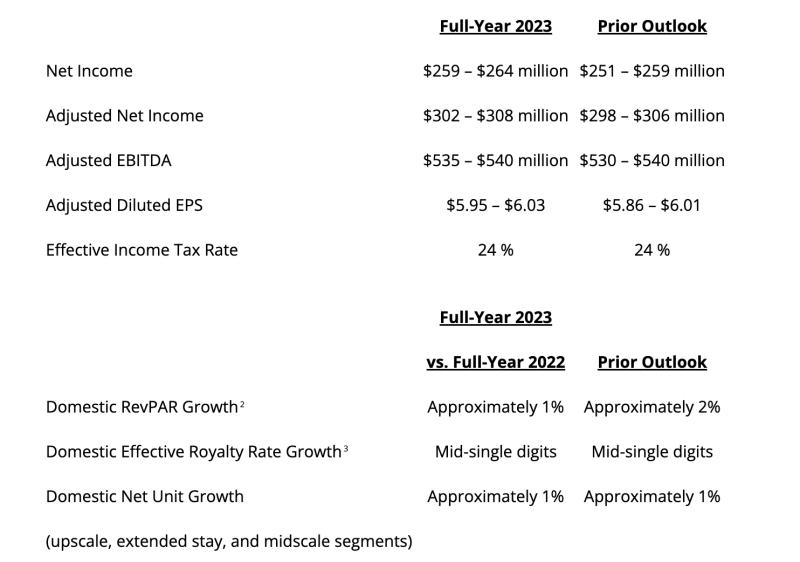

In line with the solid numbers, Choice raised the midpoint of the company’s full-year guidance to $537.5 million, representing a 12.3 percent increase in its adjusted EBITDA for the full year and approximately 44 percent growth compared to the full-year 2019. “From a full-year perspective, when assuming a like-for-like portfolio, our organic adjusted EBITDA—excluding Radisson Americas—is expected to grow an impressive 8.4 percent over the prior year,” Oaksmith said.