Choice Hotels International President and CEO Patrick Pacious promoted his company’s proposed acquisition of Wyndham Hotels & Resorts during the company’s fourth-quarter and full-year earnings call with investors: “At its core, our proposed combination with Wyndham is driven by the natural fit of the two companies coming together to accelerate value creation for all stakeholders,” he said.

Pacious pointed to the company’s 2022 incorporation of Radisson Hotels Group Americas hotels as an example of a positive merger. “In 2023, we meaningfully enhanced the performance of the existing Radisson America's hotels, which is the first step in any successful integration,” he said. “Specifically, upon the integration of the digital channels through year-end, we drove over a 20 percent increase in domestic bookings for the Radisson Americas brands year over year, with particularly strong results for the Country Inn & Suites brand, which grew by over 30 percent.” As Radisson properties increasingly leverage Choice’s hotel profitability tools, Choice’s team expects the solutions to “drive savings of up to 20 percent on the franchisee level.” For the full year, revenue per available room in Radisson’s upscale brands grew 9 percent year over year, outperforming the STR upscale segment by approximately two percentage points.

“We believe we have proven our ability to unlock incremental value through the combination that neither would have accomplished on its own,” Pacious said of the Radisson acquisition. “We are confident in our ability to replicate this great achievement with the Wyndham combination.”

Choice, Pacious continued, “historically trades at an attractive level,” which represents “compelling consideration” for Wyndham shareholders. “The value we consistently generate for our shareholders is due in part to our strong growth profile and prudent balance sheet management. The combination of Choice’s and Wyndham's asset-light businesses is expected to generate significant cash flow available to rapidly reduce leverage while still investing for growth.”

The company is “continuing to progress” on the regulatory process as expected, Pacious said, and the team is “confident” that it is “well-positioned” for regulatory approval and can complete the transaction in a customary time frame. Over the past six plus months, he continued, “it has become clear that Wyndham’s Board [of Directors] is deeply entrenched and unwilling to take the actions that are in the best interest of their shareholders.” To that end, Choice recently nominated a slate of independent directors for election at Wyndham's 2024 annual meeting. “If elected, these nominees are committed to their fiduciary duties and will act in the best interest of Wyndham's shareholders—which we believe is to move with urgency to maximize the value that can be created through a combined company.”

Choice’s franchisees have supported its acquisition efforts “since the beginning,” he added. “Wyndham has mischaracterized franchisee sentiment [as well as] who actually represents the franchisees: Our franchisees are represented by their own franchisee association and advisory council, and they elect the leaders of these groups to represent them.” Choice, he explained, is “in the process” of aligning with the franchisee association on its plan of action—“which would ensure that franchisees' needs are continuously prioritized as part of the proposed combination.”

Full-Year Performance

Record total revenues grew 10 percent to $1.5 billion for full-year 2023 compared to the same period of 2022. Net income was $258.5 million for full-year 2023. As a result of one-time items, including Radisson Hotels Americas' integration costs, due diligence and transaction pursuit costs in 2023, gains from the sale of the Cambria Hotel Nashville owned asset and the “extraordinary” franchisee termination fees in 2022, and the timing of net reimbursable expenses, net income was 22 percent lower for full-year 2023 compared to the same period of 2022.

Adjusted earnings before interest, taxes, depreciation, and amortization for full-year 2023 reached a company record of $540.5 million, a 13 percent increase compared to 2022, and exceeded the top end of the company's full-year 2023 guidance.

Fourth Quarter

The company achieved $85 million of annual recurring synergies through the successful completion of the integration of Radisson Hotels Americas, exceeding the prior target by 6 percent. Fourth-quarter 2023 total revenues were $358.4 million, a 1 percent decline compared to the same period of 2022.

Net income was $29 million for fourth quarter 2023. As a result of one-time items, including Radisson Hotels Americas integration costs, due diligence and transaction pursuit costs in 2023, and the timing of net reimbursable expenses, net income was 48 percent lower for fourth quarter 2023 compared to the same period of 2022.

Adjusted EBITDA for fourth quarter 2023 increased 11 percent to $125 million from the same period of 2022.

Domestic RevPAR increased 10 basis points and decreased 390 basis points for the 12-month and three-month periods ended Dec. 31, respectively, compared to the same periods of 2022. Domestic RevPAR increased 12.7 percent and 13.1 percent for the 12-month and three-month periods ended Dec. 31, respectively, compared to the same periods of 2019.

Unit Growth

Choice, Pacious said, has been “able to move projects quickly through the pipeline.” Out of the domestic franchise agreements the company executed for conversion hotels in 2023, the company opened 135 within the same year. “We have increased our hotel mix of higher revenue-generating hotels by eight percentage points, and they now comprise two percent of our total domestic portfolio,” he added.

The growth of the company's domestic upscale, extended-stay and midscale brands accelerated from Sept. 30, and exceeded the unit growth guidance for the full-year 2023, with the Choice legacy portfolio increasing 1.8 percent for hotels and 2.4 percent for rooms since Dec. 31, 2022.

The global pipeline as of Dec. 31 increased 6 percent to more than 105,000 rooms from Sept. 30. The global pipeline for conversion rooms increased by 16 percent from Sept. 30 and 34 percent from Dec. 31, 2022.

The company's hotel mix of the domestic upscale, extended-stay and midscale portfolio increased by 8 percentage points since December 31, 2017, and represented 82 percent of the company's total domestic portfolio as of Dec. 31.

The company's domestic upscale, extended-stay, and midscale portfolio increased by 1.4 percent for hotels and 1.6 percent for rooms since Dec. 31, 2022. Domestic upscale and extended-stay rooms portfolio grew by 6.3 percent and 14.9 percent, respectively, since Dec. 31, 2022, driven by an increase in the number of Cambria Hotels, Ascend Hotel Collection, WoodSpring Suites, MainStay Suites and Suburban Studios units. The company's total domestic system size increased to more than 6,300 hotels and nearly 497,000 rooms as of Dec. 31.

The company opened an average of eight hotels per week in the fourth quarter 2023, contributing to a total of 263 hotel openings for full-year 2023, a 13 percent increase compared to the same period of 2022.

Of the total domestic franchise agreements awarded in full-year 2023, 83 percent were for the company's upscale, extended-stay and midscale brands, and 72 percent were for conversion hotels. Of the domestic franchise agreements awarded for conversion hotels in 2023, 135 opened in the same year.

Domestic rooms pipeline as of Dec. 31 increased by 3 percent since Sept. 30, highlighted by a 6 percent increase for conversion hotels.

The international portfolio, as of Dec. 31, expanded by 2.6 percent in the number of units and by 2.0 percent in the number of rooms from Dec. 31, 2022. Specifically, the company extended its master franchise agreement with Strawberry (formerly Nordic Choice Hotels), secured a distribution partnership with a leading Spanish hotel chain, Sercotel, signed an agreement with Zenitude Hotel-Residences that is expected to double the company's unit footprint in France, and acquired the franchise rights for City Edge Apartment Hotels in Australia. As of Dec. 31, the international units pipeline increased by 33 percent from Sept. 30, and the company more than doubled the number of international hotels in the pipeline since Dec. 31, 2022.

Outlook

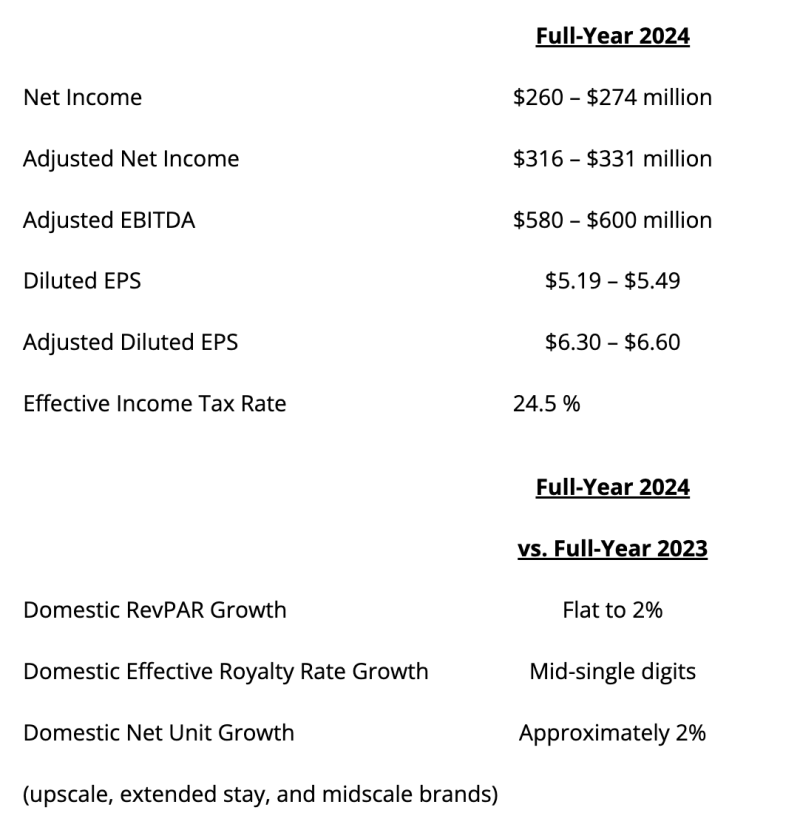

The company provided full-year 2024 net income guidance of $260 million and $274 million. Adjusted EBITDA for full-year 2024 is expected to range between $580 million to $600 million.