London- and New York-based credit rating agency Fitch Ratings has revised its 2023 global lodging sector outlook to Neutral from Deteriorating based on improved near-term economic growth prospects, demand visibility in the U.S. and Europe and a stronger rebound in Asia-Pacific aided by the reopening of China and restoration of flight capacity.

Leisure travel demand and employment have been resilient both in the U.S. and Europe, while savings accumulated during the pandemic are likely to keep supporting sector performance in 2023. China’s reopening also supports the outlook revision as the agency previously assumed the country’s ‘zero COVID’ policy would continue in 2023.

The first-quarter increase in room revenue was strong globally, partly due to the low comparison base of 2022, which was still affected by pandemic restrictions. In the U.S. and Europe, Fitch expects sector performance to stabilize for the rest of 2023 as occupancies are already close to pre-pandemic levels and further steep price increases are unlikely.

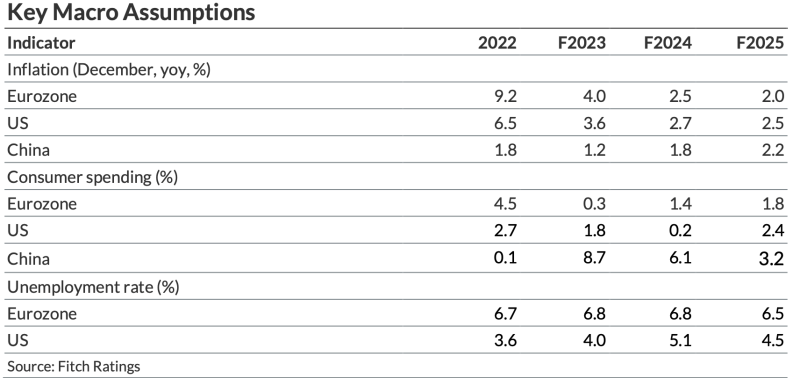

As a result, Fitch expects hotel operators in the U.S. and Europe to increase revenue and profits in 2023 compared to 2022, even if demand wanes after the summer season. Although real disposable incomes have declined and consumer sentiment remains weak, a dramatic fall in demand seems unlikely. The agency expects full-year performance will be supported by strong results in the first half of the year, offsetting a potentially more subdued second half.

A recovery in business travel, which has lagged that of leisure and only began in the fourth quarter of 2022, also supports sector growth in 2023 and will cushion any weakening in leisure travel demand.

A higher interest rate environment may decelerate hotel system expansion as the funding of new hotels becomes more expensive. However, this is only likely to weigh on industry growth from 2024-2025, due to construction lead times.