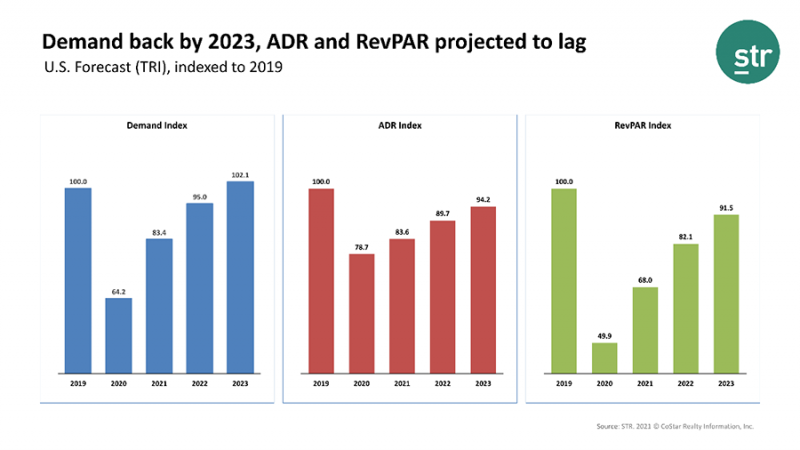

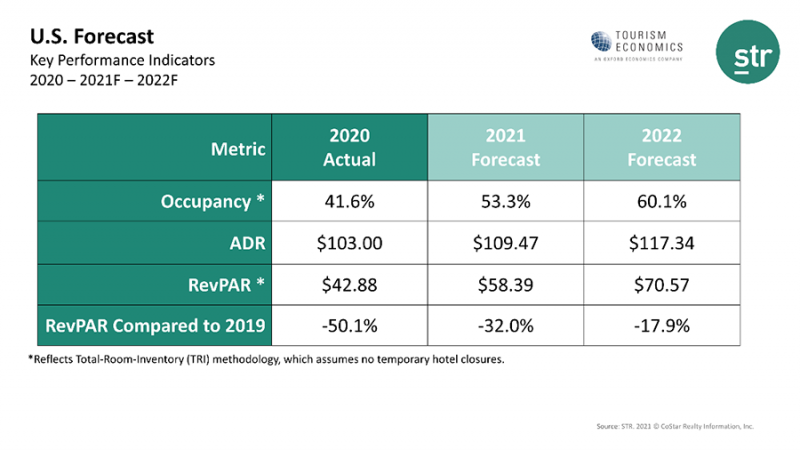

Supported by stronger-than-expected demand during Q1, STR and Tourism Economics released a new upgraded U.S. hotel forecast at the Hunter Hotel Investment Conference. While the companies’ 2021 projections are higher, full recovery of demand remains on the same timeline for 2023, while close-to-complete recovery of revenue per available room is still projected for 2024.

“The next stage of the U.S. travel recovery has commenced,” said Adam Sacks, Tourism Economics president. “An effective vaccine rollout and generous fiscal stimulus will drive the fastest single-year economic expansion in nearly 40 years. Leisure travel demand is gathering strength with substantial recovery in sight for many markets. However, transient business, group and international travel face continued headwinds, and a full recovery will take several years.”

“The expectations for the upcoming summer months have been strong for some time, but the year got off to a better start than anticipated as vaccinations expanded and consumers flush with savings felt ready to jump back into the experiences that were put on hold over the past year,” said Amanda Hite, STR president. “As we saw in late March and early April, leisure continues to be the primary source of demand although improving weekday occupancies indicate that some business travel is back in the marketplace.

"What remains furthest off from meaningful recovery is group business, but there is hope for upward movement in that segment as more events get back on the books. Until that point, big-box hotels and markets heavily reliant on conventions will continue to lag, keeping total industry recovery to 2019 levels in the distance. As we saw in our latest monthly [profit and loss] data release, the industry has only recently reached 50 percent of pre-pandemic [gross operating profit] levels.”