While reporting Hyatt Hotels Corp.’s second quarter 2023 financial results to investors, President and CEO Mark Hoplamazian said he was “very pleased” with the company’s performance. “Overall results in the second quarter continue to be very strong, as we anticipated,” he said on an earnings call. “Compared to the second quarter of 2019, leisure transient revenue increased by 26 percent in the second quarter.” This increase also marked a 200 basis point improvement from the growth that the company reported in Q1 this year compared to the first quarter of 2019—“a clear sign that leisure guests continue to prioritize travel,” Hoplamazian said.

The company’s comparable systemwide revenue per available room increased 15 percent in the quarter compared to 2022, while comparable owned and leased hotels RevPAR increased 10.1 percent. Comparable owned and leased hotels operating margins were 26.2 percent in the second quarter.

Adjusted earnings before interest, taxes, depreciation or amortization was $273 million in the second quarter of 2023 compared to $255 million in the second quarter of 2022. Net income was $68 million compared to $206 million in the second quarter of 2022. Adjusted net income was $88 million in the second quarter of 2023 compared to $51 million in the second quarter of 2022. Net income in the second quarter of 2022 included $251 million of gains from the sales of real estate.

Operational Update

In the second quarter of 2023, comparable systemwide RevPAR was up 15 percent compared to the second quarter of 2022, and up 8 percent compared to the second quarter of 2019 for the same set of comparable properties. In the second quarter of 2023, average rate growth remained strong, up 5 percent on a constant currency basis, while occupancy improved 660 basis points, as compared to the same period in 2022. Comparable net package RevPAR for Hyatt’s ALG properties increased 8 percent in the second quarter of 2023, compared to the same period in 2022.

A record level of total management, franchise, license, and other fees of $248 million were generated in the second quarter of 2023, up 21 percent compared to the second quarter of 2022. Fee revenue growth was driven by continued strong global top-line performance and flow-through in addition to the contribution from net rooms growth.

Openings and Development

Hyatt reported 6.9 percent net rooms growth during the second quarter over the trailing 12 month period. “Notably, conversion opportunities remained a significant contributor to our net rooms growth this quarter,” Hoplamazian said during the call.

During the second quarter, 24 new hotels (or 5,927 rooms) joined Hyatt's system. Notable openings in the quarter included Andaz Nanjing Hexi, Grand Hyatt La Manga Club Golf & Spa, Hyatt Regency Mexico City Insurgentes, Impression Isla Mujeres by Secrets, and The Pell, part of JdV by Hyatt.

As of June 30, the company had a pipeline of executed management or franchise contracts for approximately 585 hotels (approximately 119,000 rooms), representing approximately 40 percent of the existing portfolio.

The upper-midscale Hyatt Studios brand, first announced in April, has been “well received” by Hyatt’s ownership community, Hoplamazian said. “Letters of interest for over 100 hotels have begun converting to signed contracts, and we expect the first property to open in the second half of 2024.”

On June 2, Hyatt completed the acquisition of Smith Global Limited (Mr & Mrs Smith) and paid cash of £58 million (approximately $72 million, or $50 million net of cash acquired, using exchange rates as of the acquisition date). The acquisition adds more than 1,500 boutique and luxury properties in more than 20 new countries to World of Hyatt.

Hyatt also is making progress on the two previously announced assets marketed for sale. “We expect to be under contract for one asset and select a buyer for the other asset soon,” Hoplamazian said during the call. The company still plans to realize $2 billion of gross proceeds from the sale of real estate, net of acquisitions, by the end of 2024 as part of its expanded asset-disposition commitment announced in August 2021. As of June 30, the company has realized $721 million of proceeds from the net disposition of real estate as part of this commitment.

Looking Ahead

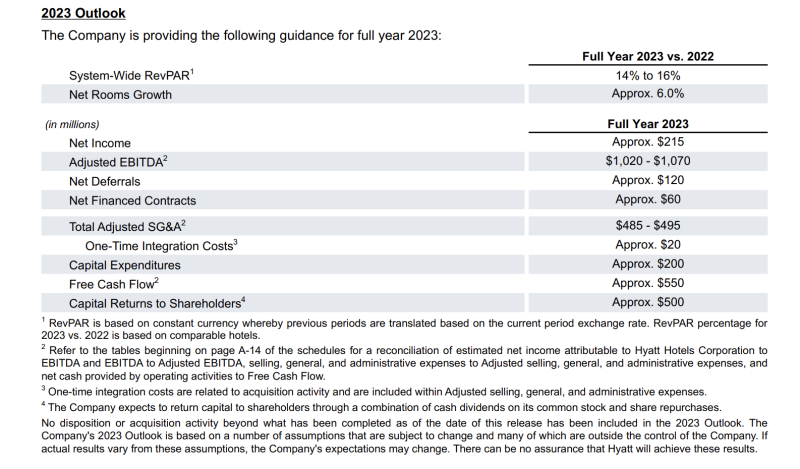

CFO Joan Bottarini told investors the company was updating its full-year 2023 systemwide RevPAR growth expectations to a range of 14 percent to 16 percent compared to 2022 on a constant currency basis, driven by the recovery in Asia Pacific and improving demand in group and business transient. “We continue to anticipate RevPAR growth will be in the mid to high single digits in the back half of the year,” she added.

The company also is reaffirming its expectations of net rooms growth of approximately 6 percent for the full year of 2023 and is updating net income to approximately $215 million. “We feel really good about the rest of the year, given the sustained leisure travel demand that we're seeing, and the group business,” she told the investors.