As the world begins to regain some sense of normalcy, opportunities for hotel investors are emerging. And while some major markets are still struggling, Miami is showing strong potential. Miami’s appeal as a beach destination with upscale leisure resorts and nightlife continues to attract domestic and international visitors, making it a solid demand-generating market.

“There is very limited hospitality supply being built in Miami, so yields should continue to be strong over an investor’s hold period,” said Andrew Dickey, managing director, JLL Hotels & Hospitality Group.

Miami has 40 hotels with 7,480 rooms in the pipeline, according to data from STR. Of those, only five hotels with 1,178 rooms are under construction, with the rest in the planning and final planning stages.

There are other opportunities for investors in Miami, according to Dickey. For one, he said that despite the cost of debt today, investors can buy at a higher capitalization rate and refinance when the cost of debt stabilizes.

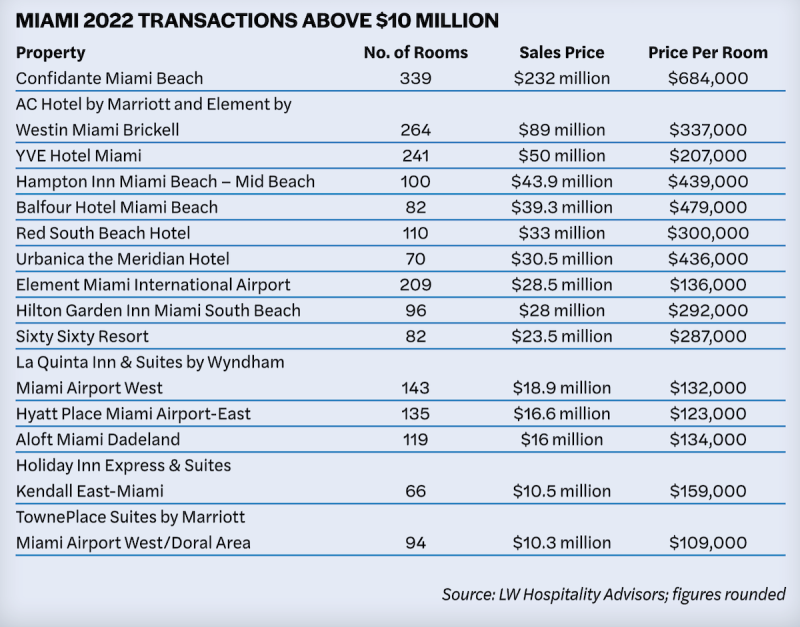

Meanwhile, deals in Miami aren’t dead. One of the most notable transactions in Miami last year was the 339-room Confidante Miami Beach. The soon-to-be Andaz hotel was purchased by Sunstone Hotel Investors for about $684,000 per room (total price tag of $232 million).

“The market continues to go further upscale and most of the renovation products in markets like Miami Beach are going into the ultra-luxury segment, which the market has not truly had until recently, so this will further support the overall revenue per available room growth in the market,” Dickey added.

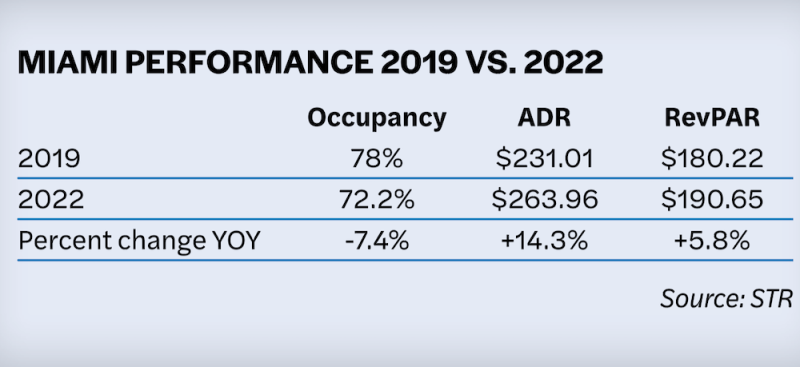

Daryl Cronk, director of hospitality analytics, South, CoStar Group, said Miami continues to be one of the strongest-performing large markets in the United States. “[Revenue per available room] in 2022 was 24 percent higher than the pre-pandemic baseline from 2019, the second-largest increase over 2019 among STR’s top 25 markets—trailing only Tampa’s 25-percent increase,” he said. “The strong recovery in RevPAR has been driven by rate growth, particularly among the higher-end leisure resorts.”

Although occupancy in Miami had decreased 7.4 percent at the end of 2022 versus the same time period in 2019, average daily rate has increased by double digits. RevPAR also has seen nearly 6 percent growth.

What’s more, Miami holds strong for demand, especially from international arrivals. It’s the second major market behind New York City, according to JLL. However, international arrivals to Miami have not fully recovered to 2019 levels. In 2022, Miami saw a nearly 23-percent decrease from visitors overseas.

Challenges Ahead

Despite some of the opportunities, experts said there are still some challenges ahead for Miami’s hotel industry.

“There is a lot of uncertainty surrounding the economic outlook, and some economists are forecasting a recession later this year,” Cronk said. “Inflation and high interest rates could lead some increasingly price-sensitive travelers to consider lower-price destinations, and the strong U.S. dollar is a concern for U.S. destinations that traditionally welcome large numbers of international visitors.”

On the capital markets front, Dickey said the cost of debt and insurance were the biggest challenges at the end of 2022, and that trend will continue into this year. But for now, he said, “RevPAR performance continues to be strong in Miami, and the booking pace reports looks solid for the first half of the year.”

Cronk said Miami is expected to continue to benefit from ongoing recoveries in the group segment and among international travel. However, he noted that economic headwinds are expected to eat away at the pricing power that has led to Miami’s strong ADR growth.

“The uncertain economic outlook presents a challenge to Miami and the travel industry overall,” Cronk said. “But the appeal of Miami’s beaches, dining and nightlife remain a powerful draw for the destination.”