After a year of new launches and big-name partnerships, Marriott International is pushing ahead with further avenues for growth. During the company’s fourth-quarter and full-year 2023 earnings call with investors, Marriott President and CEO Anthony Capuano highlighted the groundbreaking of the first StudioRes property and the licensing agreement with MGM Resorts International as indicators of the company’s future.

The New York, New York resort in Las Vegas became available on Marriott’s channels in January as part of the MGM agreement, and the company expects the remaining properties to be available by the middle of March. “While it is very early days, we're incredibly pleased with the initial booking,” Capuano said during the call. “We're excited about adding these amazing properties to our portfolio and enhancing our distribution in Las Vegas.”

Capuano also noted that he and CFO Leeny Oberg were in Las Vegas over the weekend for the Super Bowl and left the city “really enthusiastic about what this partnership is going to offer” the company.

The first StudioRes hotel broke ground in Fort Myers, Fla., in January, and the development partners expect to open the hotel “in at most 13 months, with an eye towards trying to get it open in 12 months,” Capuano said. A further 300 potential deals for the brand are under consideration in 150 markets.

The company also is working on a new U.S. transient midscale brand for both new-build and conversions. “Leeny and I tend to climb over each other with enthusiasm to talk about midscale,” Capuano said. “We think there's a tremendous market opportunity from a demand perspective. There is deep appetite from our franchise community. We think the cost of developing midscale will help our partners navigate what is still a challenging financing environment.”

Fourth Quarter 2023 Results

Marriott’s reported operating income totaled $718 million in Q4 compared to 2022 reported operating income of $996 million in the same quarter of 2022. Reported net income totaled $848 million in the 2023 fourth quarter, a 26 percent increase compared to 2022 fourth quarter reported net income of $673 million.

Full-year global revenue per available room rose 15 percent year-over-year. For the last quarter of the year, worldwide RevPAR increased 7.2 percent (a 7.6 percent increase using actual dollars) compared to the 2022 fourth quarter. RevPAR in the U.S. & Canada increased 3.3 percent (using actual dollars), and RevPAR in international markets increased 17.4 percent (an 18.7 percent increase using actual dollars). Capuano noted “particular strength” in Asia Pacific and Europe.

Group revenue increased 7 percent compared to the 2022 fourth quarter, which Capuano credited to “solid rate increases.” Hotel leisure revenue was up 2 percent and business transient revenue grew 3 percent from Q4 2022, with demand from large corporate customers continuing to make gains.

Adjusted operating income in Q4 totaled $992 million, compared to 2022 Q4 adjusted operating income of $926 million. Fourth quarter 2023 adjusted net income totaled $1.055 billion, compared to 2022 fourth quarter adjusted net income of $622 million.

Adjusted earnings before interest, taxes, depreciation and amortization totaled $1.197 billion in the quarter, a 10 percent increase compared to Q4 2022 adjusted EBITDA of $1.090 billion.

Unit Growth

Marriott’s development team signed a record 164,000 organic rooms globally in 2023 and added 558 properties with 81,281 rooms to its worldwide portfolio, including approximately 17,500 rooms associated with the City Express transaction and more than 43,000 other rooms in international markets. One in four organic rooms came from conversions, and 63 properties with 9,430 rooms exited the system during the year. Net rooms grew 4.7 percent from year-end 2022, and at the end of the year, Marriott’s global system totaled nearly 8,800 properties, with more than 1,597,000 rooms.

At the end of the year, the company’s worldwide development pipeline totaled 3,379 properties with roughly 573,000 rooms, including 126 properties with over 21,000 rooms approved for development, but not yet subject to signed contracts. The year-end pipeline included 1,066 properties with more than 232,000 rooms under construction, or 41 percent, including approximately 37,000 rooms from the MGM deal.

Looking Ahead

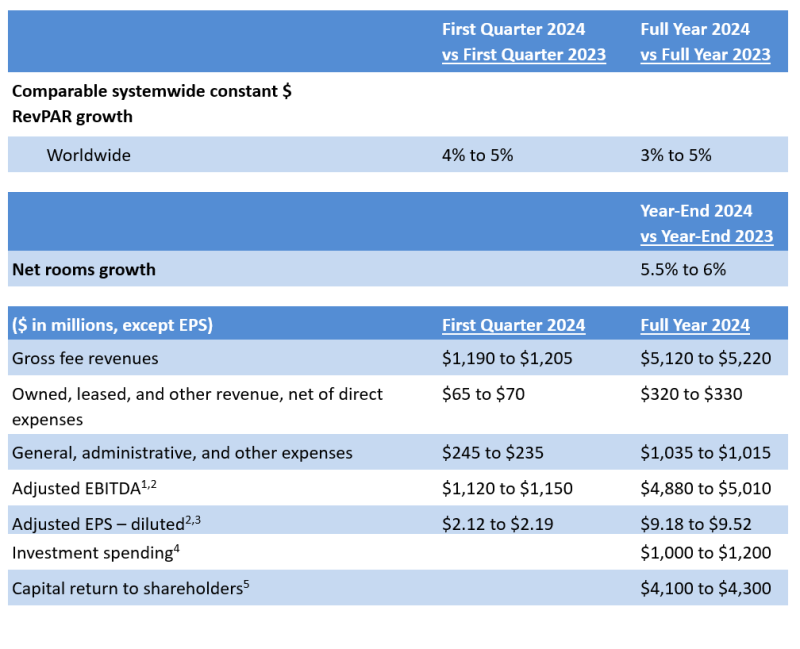

“In 2024, we expect another year of solid growth and significant shareholder returns,” Capuano said. “With normalizing RevPAR growth around the world, we anticipate a worldwide full year RevPAR increase of 3 to 5 percent and net rooms growth of 5.5 to 6 percent. We expect this should yield adjusted EBITDA of approximately $4.9 billion to $5 billion for the year and enable us to return $4.1 billion to $4.3 billion to shareholders after factoring in $500 million to purchase the Sheraton Grand Chicago.”