All signs are positive for the return of travel. Airports, hotels, restaurants and entertainment venues are busy but corporate travel is still lagging. So why is corporate travel not catching up?

Return to Office

According to Kastle’s Back to Work Barometer, which surveyed more than 2,600 buildings in more than 138 cities, office occupancy is only at 39.5 percent of 2019 levels. At the same time, leisure activities such as family vacation, sporting events and social groups are thriving.

Shifting Work Trends

Work trends have shifted post pandemic:

- Companies have realized some employees can work effectively from home due to greater adoption of technology.

- Companies have experienced a cost savings from downsized office leases and less travel amid increasing fuel prices and other rising travel expenses.

- Many companies have renewed their commitment to sustainability with a plan for reducing greenhouse gas emissions. For example, Deloitte has committed to being net-zero by 2030. which includes a goal of reducing their business travel emissions by 50 percent per FTE from 2019 levels.

- Employees are looking for a better work/life balance. Offering work-from-home options and less travel can help employee retention and attract the best talent.

- Work from home and less travel offers companies that are risk adverse more security.

- Remote work has accelerated “bleisure” travel.

Corporate Travel Prediction

The shift in work trends post-pandemic will hinder corporate travel from ever returning to 2019 levels as a percentage of total occupancy; however, many companies still need to travel. These companies generally have in person sales needs, training, and consulting. Both Hilton and American Airlines reported in their recent 4Q 2021 earnings calls that corporate travel has been slower to rebound with small and medium companies traveling much more than larger national accounts.

Delta Airlines said that large companies, mostly Fortune 500, are about 65 percent of 2019 volume while small and medium accounts are about 5 to 10 percent higher. Small to medium companies, including startups, have more in-person needs that require travel.

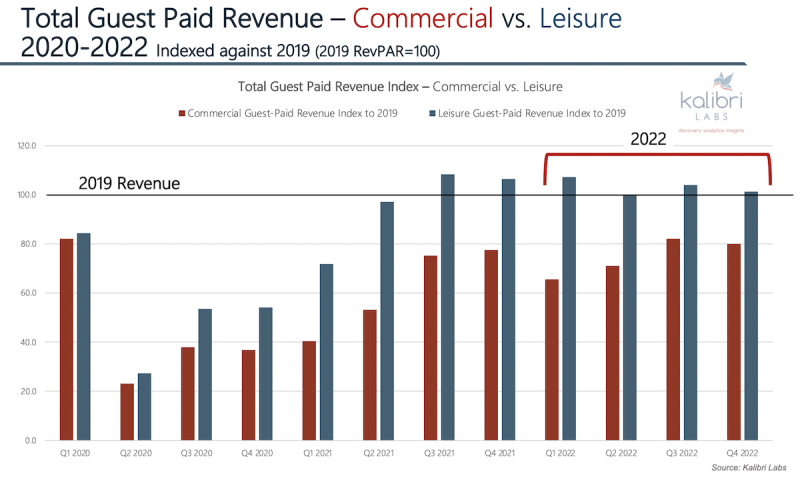

In the above graph, Kalibri Labs shows the relationship and forecast for commercial and leisure travel.

- At its post-COVID peak in 2021, corporate travel indexed at 80 percent of 2019 levels while leisure travel exceeded 2019 levels.

- Kalibri Lab’s forecasts corporate travel to be at about 80 percent of 2019 by the 3rd quarter of 2022.

Steps Toward Recovery

So how do hotel operators recover from the corporate shortfall?

- Evaluate the risk to the overall revenue strategy assuming corporate demand in your market only returns to 85 percent to 90 percent of 2019 levels.

- Large and national corporate accounts will have the greatest reduction of travel post pandemic so redeploy sales and marketing with a focus on small and medium corporate accounts.

- Smaller account penetration requires a more “boots on the ground” sales efforts vs. national sales deployment. Invest in sales training including training on sales solicitation post-pandemic including in person and virtual solicitation.

- Invest in tools.

It’s exciting that travel is once again thriving but travel today doesn’t look like it did pre-pandemic. Travel has changed and many of the changes are permanent. Successful hotel operators will get ahead of these changes to minimize the impact to their business in the future and deploy appropriate strategies.

Sarah Bartlett is SVP of revenue and distribution at hotelAVE.