Days after Marc Anthony and his company Magnus became equity partners in Sam Nazarian’s sbe, sbe has partnered with Wyndham Hotels & Resorts to launch a new conversion-focused “smart lifestyle” brand under the working name Project HQ Hotels & Residences.

Owned by sbe with strategic investment by Anthony and Magnus, Project HQ will be affiliated with Wyndham’s Registry Collection Hotels. According to the partners, the temporary brand name “Project HQ” is meant to convey that the hotels will be the “headquarters” for dining, nightlife and wellness in their communities. The brand also will include a residential element that aims to drive licensing revenue for owners.

Building a Brand

After 22 years in hospitality, Nazarian has learned that “finding a great strategic partner is the best thing that you can really bring to the table,” he said. The brand is sbe’s first since the 2020 sale of its hotel brand and management platform, which included over 100 hotels under the SLS, Delano, Mondrian and Hyde brands, as well as more than 150 restaurants and lounges and more than $4 billion of residential sales.

Project HQ is meant to be “a unique product that resonates both for owners and ultimately for a consumer that really has not been targeted,” Nazarian said, adding that since sbe left the hotel business, it had been focused on its food and beverage business. Looking to “make the biggest disruption” in the industry, the team began developing a brand that would be “approachable” to millennials and Gen Z travelers who have been “priced out” of the lifestyle segment and have largely opted for short-term rentals rather than traditional hotels.

Geoff Ballotti, president & CEO of Wyndham Hotels & Resorts, agreed, noting that the company’s overall guest demographic and makeup is becoming younger. “Appealing to these millennials, these Gen Z travelers … is something that we think is going to work really, really well,” he said.

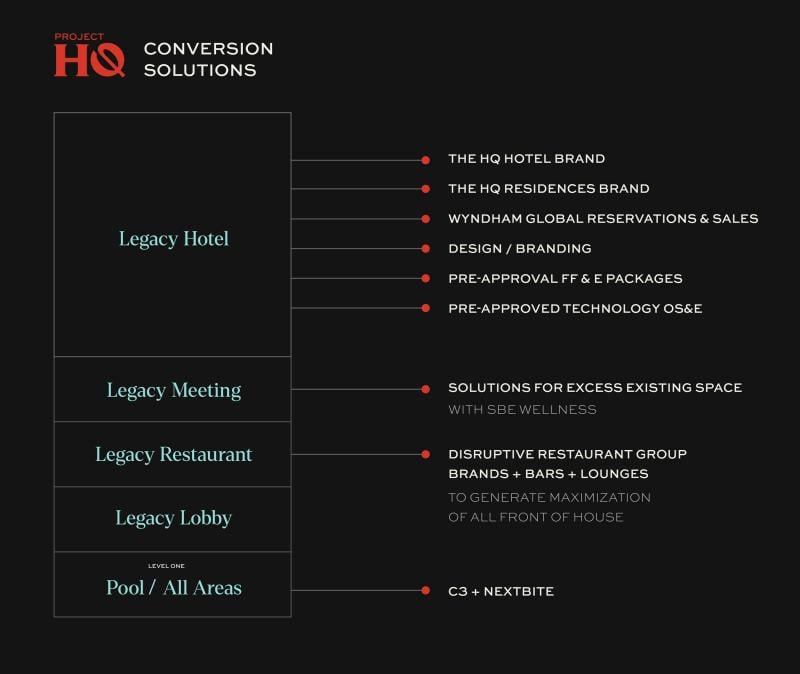

The brand will focus on upscale and upper-upscale conversion properties, Nazarian continued, and will emphasize sbe’s history in food and beverage, entertainment, digital elements and wellness. Nazarian expects the company’s strengths in these categories to attract owners with legacy hotels whose contracts are coming up, especially with sbe as the brand's management company.

Ballotti noted that the conversion market is “overheated,” with half of hotel rooms worldwide still unbranded. In choosing a brand, he continued, developers are looking for “something that's new, that's different, that's fresh, that's going to really put more relevance into their real estate.” From the other side of the table, Nazarian said the partners are seeking owners who have “ambition” and “excitement” but have not found “the right fit” for their asset.

Bringing Experience to the Table

As Project HQ takes shape, sbe will bring its “global influencers and celebrities and culinary talent into this democratized F&B and entertainment environment,” Nazarian said, which he expects will help owners spend less money on those elements. Wyndham, in turn, will bring its 105 million-member Wyndham Rewards loyalty program to the table, along with updated technology initiatives (the company has invested $275 million in technology) and its central reservation system.

Sbe will contribute its wellness programming, such as the med spa with sbe Wellness Clinics, to the hotels. Food and beverage options will include Sam Nazarian’s C3 and Nextbite brands developed with celebrity partners like Sofia Vergara, Dario Cecchini, Masharu Morimoto, Dani García and Wes Avila; the Umami Burger and Soom Soom, among others. The company is also looking to work with Gen Z F&B professionals who know how to build a following from the younger generations. “That's really where we think we're going to get the connectivity to [our target] audience,” Nazarian said. “We've actually invested into that world [and built] relationships and partnerships, and that's really why we think this brand will resonate with that community.” The target customers and owners want creativity and fun in their hotels, he added. “That translates into the brand.”

Other elements available from the partners will include pre-approved furniture, fixture and equipment packages; supply chain support; technology integrations, operating supplies and equipment packages; and unique programming to monetize otherwise underutilized spaces of the hotel. Notably, Project HQ properties will not include the “by Wyndham” tag that most of the company’s other flags have.

Ultimately, Nazarian said, the brand will take shape as its leaders meet with owners and determine what is right for each property. “What we would bring is a portfolio where we can sit with the owners and decide together,” he said. “I've seen a lot of other brands sit with owners and say, ‘Once you sign my management contract, get out of the way. It's our hotel.’ And we think that’s not good business.”

Affordability, Approachability

The brand is meant to be both affordable and approachable for guests, Ballotti said, estimating that the average daily rate will be between $250 to $500 per night. It is also meant to be within reach for owners, and Nazarian estimated that the conversion cost per key will be between $30,000 and $50,000. The partners currently are in talks to open two hotels in Europe, four in the U.S. and two in the Middle East, and are scheduled to meet with more potential owners during the American Lodging and Investment conference in January.

In “short order,” Nazarian said, the company expects to announce three or four debut hotels, some of which sbe will own, and the partners expect hotels in Latin America, the Caribbean and the Asia Pacific markets to follow. A full 80 percent of the properties will convert from existing hotels or even office spaces, Nazarian added, and almost all of the domestic properties will be conversions, while the Middle East is likely to get more new-build hotels.

The company is also looking to gain a foothold in college towns, Nazarian added. “We really think that the intersection of student housing, workforce housing, hospitality and food and beverage becomes very interesting if you do it under a brand, and we've really seen not too many brands touch all four of those components.”

In total, the partners expect to open 50 hotels with approximately 7,500 rooms under the HQ flag by 2030. Half of these properties will be based in the U.S. and half will be international.